United States Electronic Health Records (EHR) Market Size, Share, and COVID-19 Impact Analysis, By Product (Web-based and On-premise), By End-User (Physician Offices, Hospitals, and Others), and United States Electronic Health Records (EHR) Market Insights Forecasts to 2033

Industry: HealthcareUnited States Electronic Health Records (EHR) Market Insights Forecasts to 2033

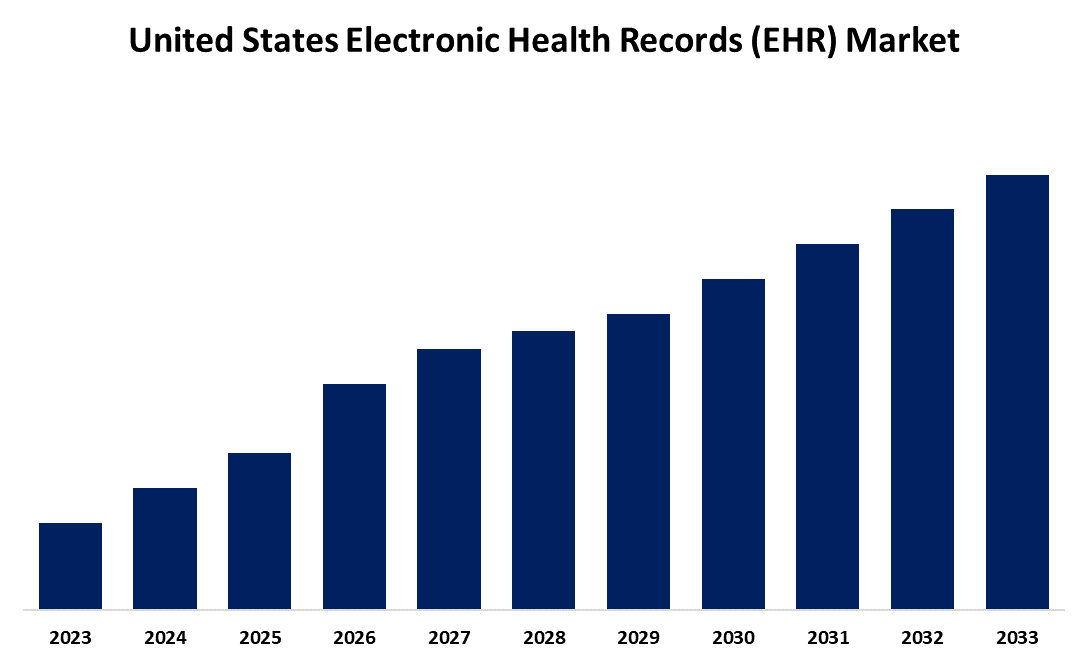

- The Market Size is Growing at a CAGR of 3.4% from 2023 to 2033

- The US Electronic Health Records (EHR) Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The US Electronic Health Records (EHR) Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 3.4% from 2023 to 2033.

Market Overview

Electronic health records are the real-time comprehensive digital version of patients' paper charts. The data includes medical history, diagnosis, medications, treatment plans, immunization dates, allergies, radiology images, and laboratory test results. EHRs have become a fundamental part of modern healthcare because they enhance the quality of care, patient safety, and efficient healthcare delivery. The country has provided healthcare facilities that are quite advanced, and EHR solutions have been widely adopted by healthcare providers in the U.S. The main positive factor playing a key role in making electronic health records useful in the effective management of patients' data is the incorporation of AI in software. This helps reduce administrative and regulatory burdens and focus on more important tasks at hand; this is the key driver for the electronic health record market in the United States. This growth is attributable to government initiatives encouraging healthcare IT usage, technologically advanced healthcare services, and the increasing demand to centralize and streamline healthcare data that improves overall patient outcomes and reduces healthcare costs.

Report Coverage

This research report categorizes the market for the United States electronic health records (EHR) based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States electronic health records (EHR) market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States electronic health records (EHR) market.

United States Electronic Health Records (EHR) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.4% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-User |

| Companies covered:: | Epic Systems Corporation, Veradigm LLC, Oracle, eClinicalWorks, Athenahealth, NextGen Healthcare, Medical Information Technology, Inc., Kareo, Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Several key factors drive the United States electronic health records (EHR) market. Increasing demand for improved patient care and safety, coupled with the push for interoperability among healthcare systems, enhances EHR adoption. Regulatory incentives, such as the Medicare and Medicaid EHR Incentive Programs, encourage healthcare providers to implement these systems. Moreover, the growing emphasis on data analytics and population health management fosters the integration of advanced technologies. The rising prevalence of chronic diseases necessitates efficient patient management, further propelling the EHR market. Overall, these factors collectively contribute to the market's robust growth.

Restraining Factors

Key restraining factors in the U.S. EHR market include high implementation costs, interoperability challenges, data privacy concerns, and resistance from healthcare providers due to complex workflows and inadequate training.

Market Segment

The U.S. electronic health records (EHR) market share is classified into product and end-user.

- The web-based segment is expected to hold the largest market share through the forecast period.

The US electronic health records (EHR) market is by product into web-based and on-premise. Among these, the web-based segment is expected to hold the largest market share through the forecast period. This is attributed to benefits like increased scalability, enhanced efficiency, and reduced costs among others are the causes behind the increasing adoption by healthcare providers and facilities regarding web-based solutions.

- The hospitals segment is expected to hold the largest market share through the forecast period.

The US electronic health records (EHR) market is segmented by end-users into physician offices, hospitals, and others. Among these, the hospitals segment is expected to hold the largest market share through the forecast period. This is attributed to the rising number of hospitals in the country combined with the increased focus of hospitals to expand their infrastructure and services is mainly strengthening the growth of this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States electronic health records (EHR) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Epic Systems Corporation

- Veradigm LLC

- Oracle

- eClinicalWorks

- Athenahealth

- NextGen Healthcare

- Medical Information Technology, Inc.

- Kareo, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2024, Medical Information Technology Inc. released its newly designed Patient and Consumer Health Portal, a cloud-based enhancement to improve accessibility and ease of deployment.

- In June 2024, NextGen Healthcare expanded the capabilities of NextGen Ambient Assist for mid-sized and large practices and introduced NextGen Office Ambient Assist, a tailored solution for small practices.

- In May 2024, eClinicalWorks announced the integration of Sunoh.ai for dermatology clinics in the U.S. The integration aims to improve the clinical documentation of patient information and streamline the overall workflow.

- In April 2024, Athenahealth collaborated with the American Council of the Blind to expand digital accessibility for Athenahealth patients.

- In March 2024, Veradigm LLC acquired ScienceIO, a leading AI platform and foundation model provider for healthcare facilities. The acquisition is aimed at enhancing healthcare data, patient privacy, and data integrity.

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States electronic health records (EHR) market based on the below-mentioned segments:

United States Electronic Health Records (EHR) Market, By Product

- Web-based

- On-premise

United States Electronic Health Records (EHR) Market, By End-User

- Physician Offices

- Hospitals

- Others

Need help to buy this report?