United States Electrosurgical Generators Market Size, Share, and COVID-19 Impact Analysis, By Product (Radiofrequency Electrosurgery Generators, Ultrasonic Electrosurgery Generators, Molecular Resonance Electrosurgery Generators, Argon Plasma Electrosurgery Generators, Accessories), By Specialty (Urology, Gynecology, Gastroenterology, ENT, General Surgery, Others), By End Use (Hospitals, Ambulatory Surgical Centers, Clinics, Others), and United States Electrosurgical Generators Market Insights Forecasts to 2033

Industry: HealthcareUnited States Electrosurgical Generators Market Insights Forecasts to 2033

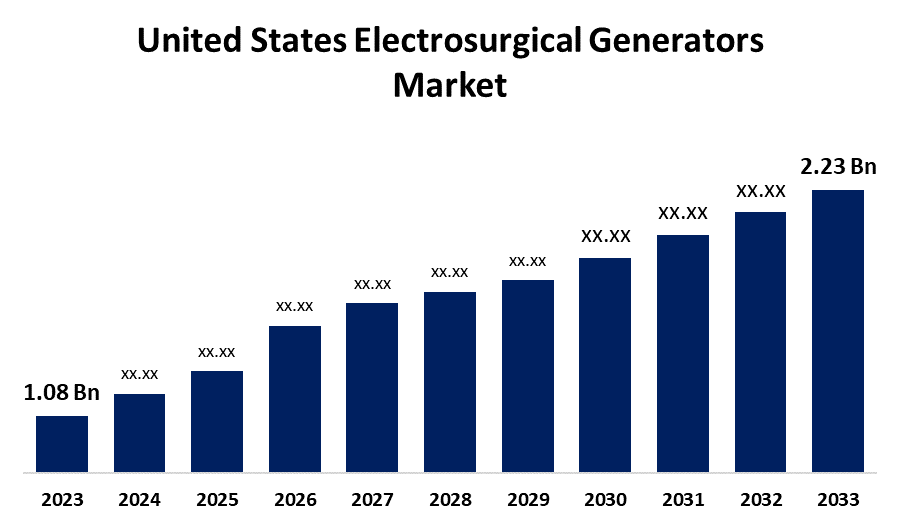

- The United States Electrosurgical Generators Market Size was valued at USD 1.08 Billion in 2023

- The Market Size is Growing at a CAGR of 7.5% from 2023 to 2033

- The United States Electrosurgical Generators Market Size is Expected to Reach USD 2.23 Billion by 2033

Get more details on this report -

The United States Electrosurgical Generators Market Size is expected to reach USD 2.23 Billion by 2033, at a CAGR of 7.5% during the forecast period 2023 to 2033.

Market Overview

The term "electrosurgery" refers to a variety of techniques that use electricity to thermally destruct a tissue through dehydration, vaporization, or coagulation. An electrosurgical unit consists of a generator and a handpiece with one or more electrodes attached. The generator can generate a variety of electrical waveforms, resulting in a corresponding tissue effect. It is now one of the most important pieces of equipment in the majority of operating rooms, and surgeons regard it as their most useful tool. The technique of using heat as a form of therapy and treatment to stop bleeding has been used for centuries. It is known as thermal cautery, and it involves burning tissues with thermal heat such as steam or hot metal in order to reduce bleeding or destroy damaged tissue. However, as technology advanced, numerous devices that used electricity to heat tissue and control bleeding were created. Electrocautery had limitations in terms of its ability to effectively coagulate large vessels or tissue. Further advancements in the electrical field resulted in the use of radiofrequency current to heat living tissue without causing muscle or nerve stimulation.

Report Coverage

This research report categorizes the market for the United States electrosurgical generators market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States electrosurgical generators market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States electrosurgical generators market.

United States Electrosurgical Generators Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.08 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.5% |

| 2033 Value Projection: | USD 2.23 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Specialty, By End Use |

| Companies covered:: | CONMED Corporation, Erbe Elektromedizin, Smith & Nephew, Elliquence, Utah Medical Products, Cooper Surgical, Medtronic plc, Johnson & Johnson, Olympus Corporation, Boston Scientific Corporation, Bovie Medical Corporation, B. Braun Melsungen AG, Ethicon, Inc. (a subsidiary of Johnson & Johnson), Megadyne Medical Products, Inc., and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising prevalence of chronic diseases, such as cardiovascular disorders, cancer, and gastrointestinal conditions, is driving demand for surgical interventions, thereby fueling the growth of the electrosurgical generators market. Furthermore, continuous advancements in electrosurgical technologies, such as the incorporation of advanced energy sources and the development of innovative energy delivery systems, improve the efficacy and safety of electrosurgical procedures, driving market growth. Furthermore, the growing preference for minimally invasive procedures among patients and healthcare providers is a major driving force behind the use of electrosurgical generators. These generators enable precise tissue cutting and coagulation, allowing for minimally invasive procedures with smaller incisions and faster recovery. Furthermore, healthcare providers are focusing more on improving surgical outcomes by using advanced surgical tools and equipment. Furthermore, electrosurgical generators play an important role in improving surgical precision, reducing bleeding, and increasing patient safety, which drives their market demand.

Restraining Factors

The high cost of electrosurgical generators is a significant barrier to market growth, particularly for small healthcare facilities and emerging economies. Healthcare providers may struggle to afford the initial investment and maintenance costs, limiting their adoption of these devices. Furthermore, while electrosurgical generators are generally safe and effective, they do carry the risk of burns, tissue damage, and electrical shocks. These risks can be mitigated by providing adequate training and adhering to safety protocols; however, concerns about patient safety may hamper market growth.

Market Segment

- In 2023, the radiofrequency electrosurgery generators segment accounted for the largest revenue share over the forecast period.

Based on the product, the United States electrosurgical generators market is segmented into radiofrequency electrosurgery generators, ultrasonic electrosurgery generators, molecular resonance electrosurgery generators, argon plasma electrosurgery generators, and accessories. Among these, the radiofrequency electrosurgery generators segment has the largest revenue share over the forecast period owing to they are useful for a variety of surgical procedures. RF generators generate an electric field that can be used to cut or coagulate tissue via high-frequency alternating current. This type of electrosurgery is relatively safe, efficient, and reasonably priced.

- In 2023, the urology segment accounted for the largest revenue share over the forecast period.

Based on the specialty, the United States electrosurgical generators market is segmented into urology, gynecology, gastroenterology, ENT, general surgery, and others. Among these, the urology segment has the largest revenue share over the forecast period. This dominance is fueled by a growing preference for minimally invasive urological procedures, which are known for their shorter recovery time and lower pain. Laparoscopy and robotic surgery are two procedures that rely heavily on electrosurgical generators.

- In 2023, the hospitals segment accounted for the largest revenue share over the forecast period.

Based on the end use, the United States electrosurgical generators market is segmented into hospitals, ambulatory surgical centers, clinics, and others. Among these, the hospitals segment has the largest revenue share over the forecast period. Hospitals use electrosurgical generators extensively for a variety of surgical procedures owing to their high patient volume, hospitals frequently require electrosurgery operations. Furthermore, given the critical role hospitals play in patient safety and high-quality care, strict laws requiring the use of safe and effective electrosurgical generators are required.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States electrosurgical generators market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CONMED Corporation

- Erbe Elektromedizin

- Smith & Nephew

- Elliquence

- Utah Medical Products

- Cooper Surgical

- Medtronic plc

- Johnson & Johnson

- Olympus Corporation

- Boston Scientific Corporation

- Bovie Medical Corporation

- B. Braun Melsungen AG

- Ethicon, Inc. (a subsidiary of Johnson & Johnson)

- Megadyne Medical Products, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2022, Medtronic plc a healthcare technology pioneer, announced that its HugoTM robotic-assisted surgery (RAS) system has received three key global market-entry and indication expansion approvals.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States Electrosurgical Generators Market based on the below-mentioned segments:

United States Electrosurgical Generators Market, By Product

- Radiofrequency Electrosurgery Generators

- Ultrasonic Electrosurgery Generators

- Molecular Resonance Electrosurgery Generators

- Argon Plasma Electrosurgery Generators

- Accessories

United States Electrosurgical Generators Market, By Specialty

- Urology

- Gynecology

- Gastroenterology

- ENT

- General Surgery

- Others

United States Electrosurgical Generators Market, By End Use

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Others

Need help to buy this report?