United States Elevator Maintenance Market Size, Share, and COVID-19 Impact Analysis, By Type (Hydraulic Elevators, Traction Elevators, Machine-Room-Less Elevators), By Building Size (Low Rise, Mid Rise, High Rise), By End User (Residential buildings, Commercial, Marine & Off-Shore, Industrial, Institutional, Others), and United States Elevator Maintenance Market Insights Forecasts to 2033

Industry: Machinery & EquipmentUnited States Elevator Maintenance Market Insights Forecasts to 2033

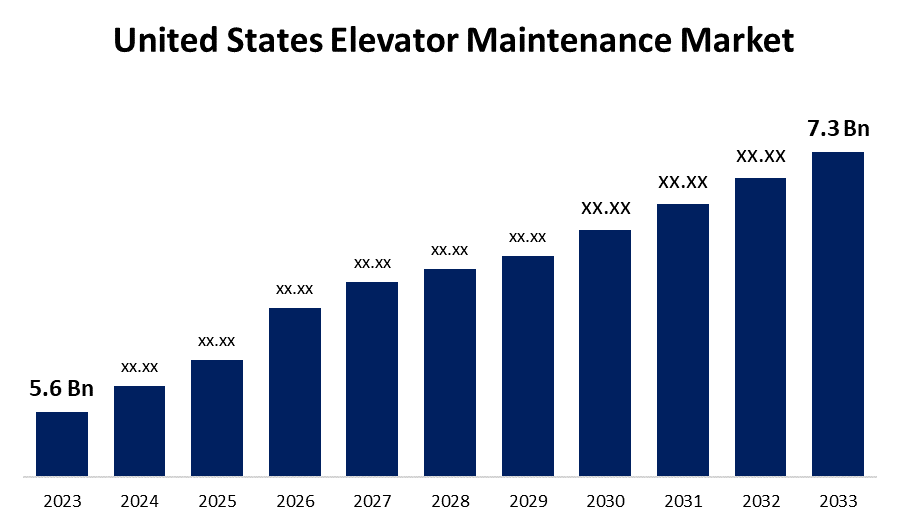

- The United States Elevator Maintenance Market Size was valued at USD 5.6 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.7% from 2023 to 2033.

- The United States Elevator Maintenance Market Size is Expected to Reach USD 7.3 Billion by 2033.

Get more details on this report -

The United States Elevator Maintenance Market Size is Expected to Reach USD 7.3 Billion by 2033, at a CAGR of 2.7% during the forecast period 2023 to 2033.

Market Overview

Elevators and lifts are vertical transport berths housed in a shaft or platform that help people or materials ascend and descend between floors and levels. Electric motors typically power counterweight equipment and traction cables or pump hydraulic fluid to ascend a cylindrical system. The majority of multistory buildings have lifts to aid in travel and wheelchair access laws. Elevators are commonly used in the construction industry to transport goods and people from one floor to another. The increased demand for residential construction as a result of multi-family housing projects is driving the growth of this market. In the near future, rising demand for energy-efficient elevators will drive product penetration even further. Customers are increasingly interested in smart elevators due to their improved connectivity and predictive maintenance capabilities. The surge in demand for high-rise housing due to population growth and rapid urbanization is likely to result in increased product adoption.

Report Coverage

This research report categorizes the market for United States elevator maintenance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States elevator maintenance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States elevator maintenance market.

United States Elevator Maintenance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.6 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.7% |

| 2033 Value Projection: | USD 7.3 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Building Size, By End User and COVID-19 Impact Analysis. |

| Companies covered:: | ThyssenKrupp AG, Otis elevator, Pine state, KONE Corporation, Mitsubishi electric, FUJITEC, dover corporation, amtec, Anlev, Armor, automobile rotary lift co., canton, Haughton, Imperial, Kiesling, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Elevator Maintenance would be able to continue its upward trajectory if the construction market expanded and economic conditions improved. Improvements in the US real estate market is expected to drive growth, primarily by expanding markets for residential, industrial, commercial, and institutional construction. These downstream markets account for nearly three-quarters of the industry's total market. As a result, strong growth in these downstream markets is expected to increase demand for installation contractors, benefiting industrial operators. Factors contributing to the increased use of elevator maintenance services include rapid industrialization and construction activity. The rapid growth of residential and non-residential building construction in the country has resulted in widespread use of elevators.

Restraining Factors

As safety concerns have grown, product adoption has been slow. However, rising safety standards in elevators are expected to propel the market forward. Manufacturers are focusing on implementing safety measures for both customers and employees.

Market Segment

- In 2023, the traction elevators segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States elevator maintenance market is segmented into hydraulic elevators, traction elevators, and machine-room-less elevators. Among these, the traction elevators segment has the largest revenue share over the forecast period. As traction elevators rely on ropes and sheaves, regular monitoring and maintenance are essential to avoid critical conditions in the long run, especially since they are used in a variety of industrial settings. Continuous wear and tear reduce the traction between the sheave and the cables, resulting in more frequent slippage, which reduces efficiency standards and can be dangerous if left unchecked. Such factors necessitate a high level of scheduled maintenance in order to improve the productivity of such elevators, thereby boosting the market.

- In 2022, the low-rise segment accounted for the largest revenue share over the forecast period.

Based on the building size, the United States elevator maintenance market is segmented into low-rise, mid rise, and high-rise. Among these, the low-rise segment has the largest revenue share over the forecast period. Rising technological advancements in order to improve elevator maintenance standards across various low-rise building sites have also been a major driver of elevator market dominance. Elevator maintenance, in conjunction with automatic operations such as door closing and opening without the use of buttons, improves the functionality of the machines, thereby assisting in the creation of high demand across low-rise building operations.

- In 2022, the commercial segment accounted for the largest revenue share over the forecast period.

Based on the end user, the United States elevator maintenance market is segmented into residential buildings, commercial, marine & off-shore, industrial, institutional, and others. Among these, the commercial segment has the largest revenue share over the forecast period. The growing construction of malls, hospitals, offices, and hotels in this region increases demand for elevators, which drives the elevator maintenance market. Furthermore, as commercial building construction continues to rise, various market players are investing in smart elevator systems. The use of advanced features such as cloud technologies assists authorities in the proper maintenance of elevators in hospitals, hotels, malls, and other locations. Such factors have pushed market demand for higher elevator maintenance standards.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States elevator maintenance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ThyssenKrupp AG

- Otis elevator

- Pine state

- KONE Corporation

- Mitsubishi electric

- FUJITEC

- dover corporation

- amtec

- Anlev

- Armor

- automobile rotary lift co.

- canton

- Haughton

- Imperial

- Kiesling

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States elevator maintenance market based on the below-mentioned segments:

United States Elevator Maintenance Market, By Type

- Hydraulic Elevators

- Traction Elevators

- Machine-Room-Less Elevators

United States Elevator Maintenance Market, By Building Size

- Low Rise

- Mid Rise

- High Rise

United States Elevator Maintenance Market, By End User

- Residential buildings

- Commercial

- Marine & Off-Shore

- Industrial

- Institutional

- Others

Need help to buy this report?