United States Enhanced Water Market Size, Share, and COVID-19 Impact Analysis, By Water Type (Alkaline Water, Nutrient Water, Electrolyte Water, Oxygenated Water), By Distribution Channel (Offline, Online), By End User (Residential, Commercial), and United States Enhanced Water Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesUnited States Enhanced Water Market Insights Forecasts to 2033

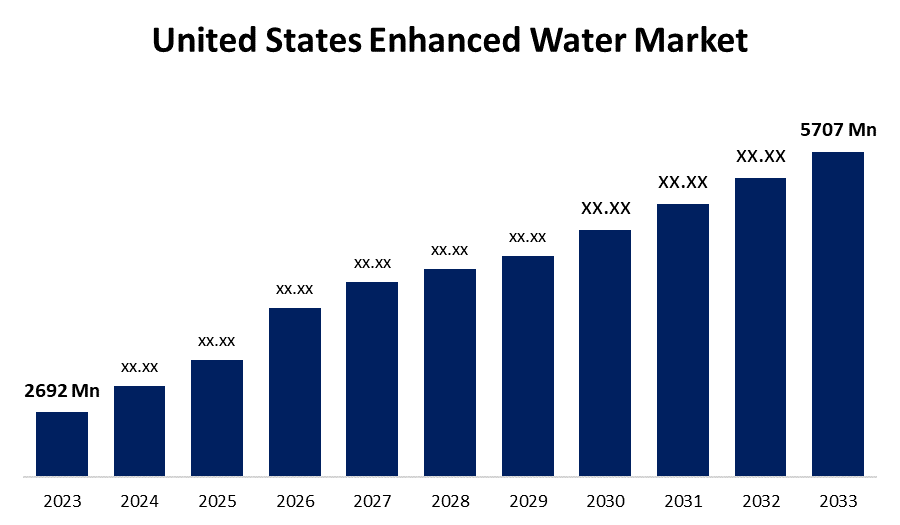

- The United States Enhanced Water Market Size was valued at USD 2692 Million in 2023.

- The Market Size is Growing at a CAGR of 7.8% from 2023 to 2033

- The United States Enhanced Water Market Size is expected to reach USD 5707 Million by 2033

Get more details on this report -

The United States Enhanced Water Market Size is anticipated to exceed USD 5707 Million by 2033, Growing at a CAGR of 7.8% from 2023 to 2033. The US market is thriving with enhanced water, gaining popularity due to health benefits and unique flavors, driven by urbanization, outdoor usage, and health concerns are driving the growth of the enhanced water market in the United States.

Market Overview

Enhanced waters, sometimes known as vitamin water, are simply marketed as water but actually contain beneficial substances like vitamins and minerals. When compared to non-diet beverages, enhanced waters often have fewer calories. Health advantages, this drink appeals to customers with its distinctive blend of artificial and natural flavors and colors. The most well-liked flavors of enhanced water are strawberry lemonade, tropical mango, raspberry lime, etc. Flavored with natural botanical extracts and zero-calorie beverages are examples of enhanced waters. Because enhanced water is preferred over alcoholic beverages and ordinary water, it is becoming more and more popular in the US. The US enhanced water market is experiencing growth due to increased demand for healthful thirst-quenchers and the variety of flavors available. The hydration drink industry is expected to grow due to increasing consumer awareness of the negative effects of dehydration. Enhanced water products, containing minerals and carbohydrates, are expected to gain market share due to their plant-based ingredients and various flavors. Essential minerals like magnesium, potassium, sodium, and carbohydrates in fruits and vegetables aid in body refuelling, but not a substitute for a balanced diet.

Report Coverage

This research report categorizes the market for the United States enhanced water market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing enhanced water market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the enhanced water market.

United States Enhanced Water Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2692 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.8% |

| 2033 Value Projection: | USD 5707 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Water Type, By Distribution Channel, By End User. |

| Companies covered:: | PepsiCo, Coca Cola, Hint Water Inc., Karma Culture LLC, Supplying Demand Inc., United Breweries Limited, Keurig Dr Pepper, H2rose, Montane Sparkling Water, Constellation Brands Inc., Just Goods Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Enhanced water in the US market is popular for its health benefits and variety of flavors. Manufacturers use herbal ingredients like milk thistle and extracts to add unique flavors. VOSS Water recently launched VOSS+, featuring three enhanced waters with berry essence and citrus fruit flavors. The water market is driven by the demand for fresh, wholesome, and moisturizing liquors, as well as the preference for flavored beverages over carbonated ones. Urbanization and outdoor bottled water usage are driving growth, while fatigued lifestyles and health concerns are driving demand for better water. Apple and peach-flavored drinks are popular, and enhanced water drinks are fortified with vitamins and minerals, increasing their nutritional value and driving industry growth. Enhanced water in the US is popular for its health benefits and flavor options, with manufacturers using herbal ingredients like milk thistle and herbal extracts. Hence, these factors are significant growth of the United States enhanced water market during the forecast period.

Restraining Factors

Enhanced water is preferred due to its health benefits and nutritional benefits, but US citizens often rely on supplements for vitamins and minerals. Some enhanced drinks are overly rich in certain nutrients, and overdosing on certain vitamins can be harmful, limiting the market growth. Hence, these factors may hamper the market growth of the United States enhanced water market during the forecast period.

Market Segmentation

The United States enhanced water market share is classified into water type, distribution channel, and end user.

- The nutrient water segment is expected to hold a significant share of the United States enhanced water market during the forecast period.

The United States enhanced water market is segmented by water type into alkaline water, nutrient water, electrolyte water, and oxygenated water. Among these, the nutrient water segment is expected to hold a significant share of the United States enhanced water market during the forecast period. The segmental growth can be attributed to the young and working adults preferring flavored water without sugar or sugar substitutes to preserve their bodies' vitamin and mineral levels.

- The offline segment is expected to hold the largest share of the United States enhanced water market during the forecast period.

Based on the distribution channel, the United States enhanced water market is divided into offline, online. Among these, the offline segment is expected to hold the largest share of the United States enhanced water market during the forecast period. The segmental growth can be attributed to the biggest market share due to the ease of access to enhanced water at pharmacies, convenience stores, supermarkets/hypermarkets, and other establishments. These shops offer a large selection of goods in a variety of flavors, costs, and volumes. The manufacturers are often dependent on offline channels for boosting the sale of their products.

- The residential segment is expected to hold the largest share of the United States enhanced water market during the forecast period.

Based on the end user, the United States enhanced water market is divided into residential and commercial. Among these, the residential segment is expected to hold the largest share of the United States enhanced water market during the forecast period. The segmental growth can be attributed to the prevailing health and fitness trends, particularly among younger consumers, and the growing health consciousness among consumers. The rising awareness of dehydration's detrimental effects on human health and rising potable water contamination levels are driving the demand for improved water quality in residential areas.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States enhanced water market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PepsiCo

- Coca Cola

- Hint Water Inc.

- Karma Culture LLC

- Supplying Demand Inc.

- United Breweries Limited

- Keurig Dr Pepper

- H2rose

- Montane Sparkling Water

- Constellation Brands Inc.

- Just Goods Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2021, "Arousal," a new addition to its line of functional beverages, was introduced by FREE RAIN, an improved sparkling water company. It contains pink grapefruit, maca, and a hint of basil.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States enhanced water market based on the below-mentioned segments:

United States Enhanced Water Market, By Water Type

- Alkaline Water

- Nutrient Water

- Electrolyte Water

- Oxygenated Water

United States Enhanced Water Market, By Distribution Channel

- Offline

- Online

United States Enhanced Water Market, By End User

- Residential

- Commercial

Need help to buy this report?