United States Epinephrine for Anaphylaxis Treatment Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Autoinjectors, Prefilled Syringes, and Others), By Type (Branded and Generics), and United States Epinephrine for Anaphylaxis Treatment Market Insights Forecasts to 2033

Industry: HealthcareUnited States Epinephrine for Anaphylaxis Treatment Market Insights Forecasts to 2033

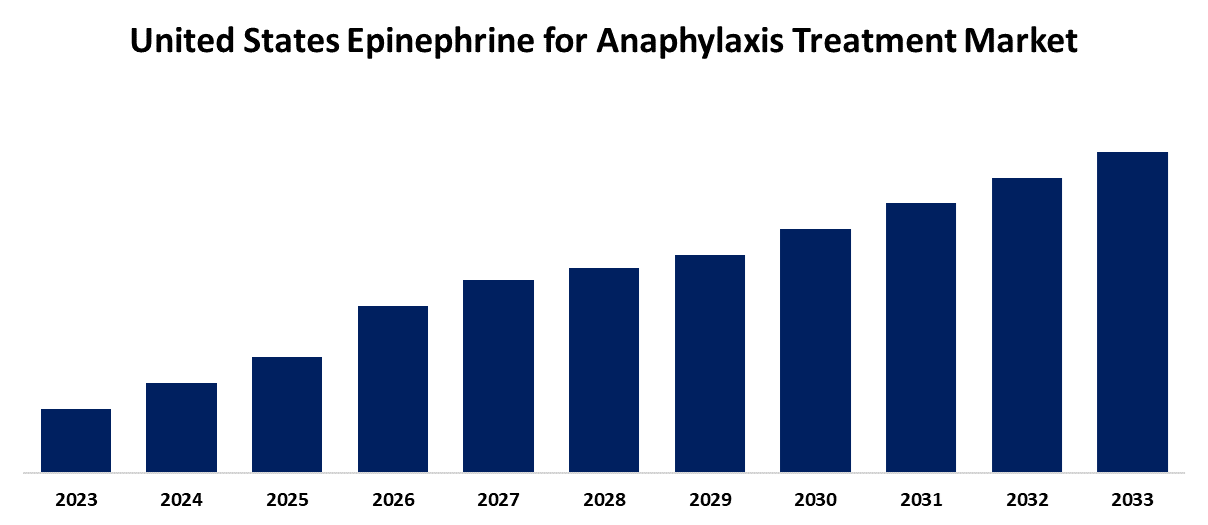

- The Market is Growing at a CAGR of 8.1% from 2023 to 2033

- The US Epinephrine for Anaphylaxis Treatment Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The US Epinephrine for Anaphylaxis Treatment Market Size is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 8.1% from 2023 to 2033.

Market Overview

Epinephrine as treatment for anaphylaxis using epinephrine, or adrenaline, is the first line and most effective treatment for cases of severe allergic reactions known as anaphylaxis. Epinephrine reverses the dangerous symptoms of anaphylaxis by constricting blood vessels, relaxing the smooth muscles of the airways, and increasing the heart rate in a given individual. The growth of epinephrine for the treatment of anaphylaxis in the US market has been driven by an increased prevalence of allergic conditions such as food allergies, insect sting reactions, and drug allergies. In addition, increasing awareness of anaphylaxis symptoms and the importance of prompt treatment has led to increased demand for epinephrine auto-injectors along with high-end development of devices for epinephrine delivery. The government's efforts to establish school-based epinephrine administration policies and provide affordable epinephrine devices positively impact the market. The recent advancements in the market include the launch of generic epinephrine auto-injectors, which have made the treatment accessible to a larger population. Innovations in formulations of epinephrine and new delivery systems approved by the end of 2012 would be expected to continue to grow, with an impact on ease of administration in an emergency setting and patient outcome.

Report Coverage

This research report categorizes the market for the United States epinephrine for anaphylaxis treatment based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States epinephrine for anaphylaxis treatment market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States epinephrine for anaphylaxis treatment market sub-segment.

United States Epinephrine for Anaphylaxis Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.1% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Product Type, By Type and COVID-19 Impact Analysis. |

| Companies covered:: | Viatris Inc., Teva Pharmaceutical Industries Ltd., Adamis Pharmaceuticals LLC., Amneal Pharmaceuticals LLC, DMK Pharmaceuticals, ALK-Abello A/S, ARS Pharmaceuticals Operations, Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The steadily rising incidence of allergic conditions such as food allergies, insect stings, and drug reactions has been increasing the demand for immediate treatments, which has become the primary growth driver for the epinephrine for anaphylaxis treatment market. Increasing public awareness of anaphylaxis symptoms and the urgency to treat this condition immediately accelerates more growth in the market. With advanced technology used in the development of new epinephrine auto-injectors which improve convenience in the usage of devices and are available for wider use, it is adopted more widely. Other market drivers are the policy created by the government to ensure that epinephrine has easy access in schools and public places, and then low-priced generic versions.

Restraining Factors

However, there are restraints to this market such as the high cost of branded epinephrine auto-injectors, availability issues in rural geographies, and sometimes the issue of malfunctioning devices or medication expiry. Regulatory barriers and lack of awareness prevail in other areas.

Market Segment

The U.S. epinephrine for anaphylaxis treatment market share is classified into product type and type.

- The autoinjectors segment is expected to hold the largest market share through the forecast period.

The US epinephrine for anaphylaxis treatment market is by product type into autoinjectors, prefilled syringes, and others. Among these, the autoinjectors segment is expected to hold the largest market share through the forecast period. This is attributed to the advantages of epinephrine autoinjectors. It is user-friendly and releases medication within the right dose, with minimal chances of dosing errors, thus quickly reducing anaphylaxis reactions.

- The generics segment is expected to hold the largest market share through the forecast period.

The US epinephrine for anaphylaxis treatment market is segmented by type into branded and generics. Among these, the generics segment is expected to hold the largest market share through the forecast period. This is attributed to the factor contributing to increased demand for generic drugs is that branded drugs are losing patents in the market. Hiked demand for anaphylaxis treatment at a low cost is also fueling the demand for generic medicines in the country. Also, the presence of established generic players in the market along with the regulatory approvals and product launches has helped drive the growth in the segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States epinephrine for anaphylaxis treatment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Adamis Pharmaceuticals LLC.

- Amneal Pharmaceuticals LLC

- DMK Pharmaceuticals

- ALK-Abello A/S

- ARS Pharmaceuticals Operations, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, ARS Pharmaceuticals Operations, Inc. submitted the New Drug Application (NDA) for neffy (epinephrine nasal spray) to the U.S. FDA for the treatment of Type I allergic reactions, including anaphylaxis.

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States epinephrine for anaphylaxis treatment market based on the below-mentioned segments:

United States Epinephrine for Anaphylaxis Treatment Market, By Product Type

- Autoinjectors

- Prefilled Syringes

- Others

United States Epinephrine for Anaphylaxis Treatment Market, By Type

- Branded

- Generics

Need help to buy this report?