United States Esoteric Testing Market Size, Share, and COVID-19 Impact Analysis, By Type (Infectious Diseases Testing, Endocrinology Testing, Oncology Testing, Genetic Testing, Toxicology Testing, Immunology Testing, Neurology Testing, and Others), By Technology (Chemiluminescence Immunoassay, Enzyme-Linked Immunosorbent Assay, Mass Spectrometry, Real-Time PCR, Flow Cytometry, Radioimmunoassay, and Other), By End-user (Independent & Reference Laboratories, Hospital-Based Laboratories), and United States Esoteric Testing Market Insights Forecasts 2023 – 2033

Industry: HealthcareUnited States Esoteric Testing Market Insights Forecasts to 2033

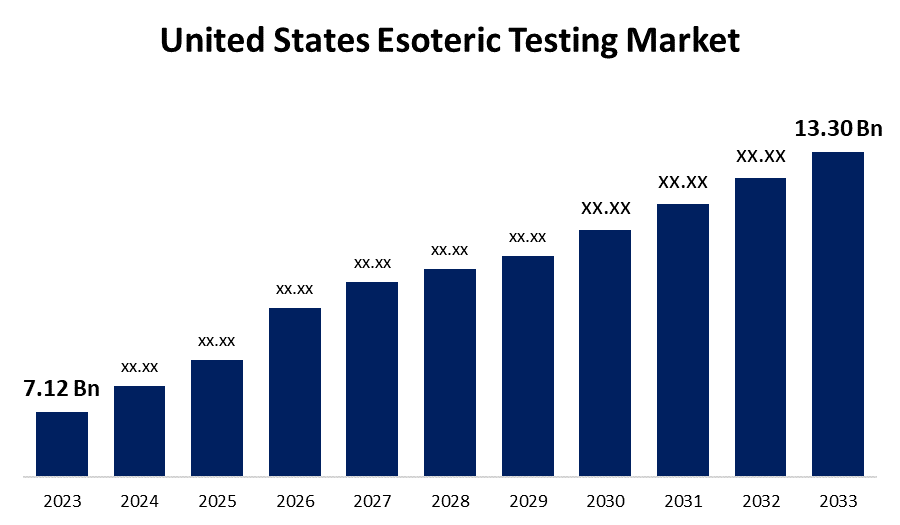

- The United States Esoteric Testing Market Size was valued at USD 7.12 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.45% from 2023 to 2033.

- The United States Esoteric Testing Market Size is Expected to Reach USD 13.30 Billion by 2033.

Get more details on this report -

The United States Esoteric Testing Market Size is Expected to Reach USD 13.30 Billion by 2033, at a CAGR of 6.45% during the forecast period 2023 to 2033.

Market Overview

Esoteric testing enables the investigation of rare chemicals or molecules that would not normally be performed in a clinical lab. Many large commercial labs outsource difficult tests to specialized and reference testing facilities. However, as laboratory testing technology advances, tests that are currently considered obscure may become commonplace in a matter of years. This is frequently the result of the efforts of dedicated research and development professionals. When a doctor requires more specific information than regular lab testing to complete a diagnosis, establish a prognosis, or choose and monitor a therapy regimen, these tests are ordered. To perform and evaluate results, esoteric testing typically necessitates the use of complex apparatus and materials, as well as trained personnel. These tests are generally more expensive than standard tests and are ordered less frequently. Endocrinology, genetics, immunology, microbiology, molecular diagnostics, cancer, serology, and toxicology are all examples of esoteric testing.

Report Coverage

This research report categorizes the market for the United States Esoteric Testing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Esoteric Testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States Esoteric Testing market.

United States Esoteric Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.12 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.45% |

| 2033 Value Projection: | USD 13.30 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Technology, By End-user, and COVID-19 Impact Analysis. |

| Companies covered:: | Laboratory Corporation of America, Opko Health Company, Mayo Medical Laboratories, Myriad Genetics, Exact Science Corporation, Avista Capital Partners (Miraca Holdings Inc), Fulgent Genetics Inc, Invite, Quest Diagnostic, Nordic Laboratories,, Sonic Healthcare (American Esoteric Laboratories (AEL)),, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The primary goal of healthcare practitioners is to add value to patients' lives by providing high-quality medical care. Healthcare organizations are eager to adapt their business models, provide services at reasonable prices, and focus on improving patient health. This has resulted in a significant emphasis on outsourcing complex clinical tests, which has contributed to growth trends in the obscure diagnostics market in the United States. Technological advancements such as antidote automation, advanced device standardization, and analysis systems will accelerate the growth of esoteric testing over time. Increased demand for proteomics and genomics, as well as increased investment in developing innovative body detection testing solutions, will drive business growth.

Restraining Factors

The high cost of esoteric testing and a scarcity of skilled technicians are expected to limit market growth. Furthermore, a lack of necessary infrastructure in developing economies will hinder market growth.

Market Segment

- In 2023, the infectious diseases testing segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States esoteric testing market is segmented into infectious diseases testing, endocrinology testing, oncology testing, genetic testing, toxicology testing, immunology testing, neurology testing, and others. Among these, the infectious diseases testing segment has the largest revenue share over the forecast period. Pathogenic microorganisms such as bacteria, viruses, parasites, or fungi cause infectious diseases. Diseases can be passed from person to person, either directly or indirectly. Zoonotic diseases are infectious diseases spread by animals that can infect humans. HIV testing in the United States and its dependencies. The rise in infectious diseases is expected to fuel the growth of the esoteric testing market in the United States. Furthermore, new R&D, technological breakthroughs, and the introduction of technologically upgraded items by key competitors are expected to drive market growth.

- In 2023, the chemiluminescence immunoassay segment accounted for a significant revenue share over the forecast period.

Based on technology, the United States esoteric testing market is segmented into chemiluminescence immunoassay, enzyme-linked immunosorbent assay, mass spectrometry, real-time PCR, and others. Among these, the chemiluminescence immunoassay segment has a significant revenue share over the forecast period. Chemiluminescence (CL) is defined as the discharge of electromagnetic radiation caused by a chemical reaction that produces light. Chemiluminescence immunoassay (CLIA) is an assay that combines the chemiluminescence technique with immunochemical reactions. The rising prevalence of chronic diseases, as well as product launches by market participants, are driving the segment's growth. The rising prevalence and burden of chronic diseases in the country necessitate effective diagnosis and treatment methods, which has led to an increase in the use of CLIA methods. This is expected to contribute to market growth.

- In 2023, the independent & reference laboratories segment accounted for the largest revenue share over the forecast period.

Based on the end-user, the United States esoteric testing market is segmented into independent & reference laboratories, and hospital-based laboratories. Among these, the independent & reference laboratories segment has the largest revenue share over the forecast period. The majority is accounted for by high testing volumes. Furthermore, ongoing automation and digitization of diagnostic laboratories, an increase in the number of accredited laboratories, significant reimbursement coverage, and competitive perks provided by these providers are all driving growth. Furthermore, the segment's growth is being driven by the ongoing automation and digitization of diagnostic laboratories, an increasing number of accredited laboratories, significant reimbursement coverage, and competitive perks offered by these providers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States esoteric testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Laboratory Corporation of America

- Opko Health Company

- Mayo Medical Laboratories

- Myriad Genetics

- Exact Science Corporation

- Avista Capital Partners (Miraca Holdings Inc)

- Fulgent Genetics Inc

- Invite

- Quest Diagnostic

- Nordic Laboratories,

- Sonic Healthcare (American Esoteric Laboratories (AEL)),

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2022, the innovative Veratox VIP assay to detect cashews is the second in Neogen's new Veratox VIP line of enhanced quantitative ELISA products.

- In March 2022, The Xevo TQ Absolute system, a highly sensitive and compact benchtop tandem mass spectrometer, was introduced by Waters Corporation. According to the company, this latest mass spectrometer is up to 15X more sensitive than its predecessor for quantifying negatively ionizing compounds, is 45% smaller, and uses up to 50% less electricity and gas supply.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Esoteric Testing Market based on the below-mentioned segments:

United States Esoteric Testing Market, By Type

- Infectious Diseases Testing

- Endocrinology Testing

- Oncology Testing

- Genetic Testing

- Toxicology Testing

- Immunology Testing

- Neurology Testing

- Others

United States Esoteric Testing Market, By Technology

- Chemiluminescence Immunoassay

- Enzyme-Linked Immunosorbent Assay

- Mass Spectrometry

- Real-Time PCR

- Flow Cytometry

- Radioimmunoassay

- Other

United States Esoteric Testing Market, By End-user

- Independent & Reference Laboratories

- Hospital-Based Laboratories

Need help to buy this report?