United States Essential Oils Market Size, Share, and COVID-19 Impact Analysis, By Product (Orange, Spearmint, Turmeric, and Others), By Application (Food & Beverage, Spa & Relaxation, Medical, Cleaning & Home, and Others), and U.S. Essential Oils Market Insights, Industry Trend, Forecasts to 2033

Industry: Specialty & Fine ChemicalsUnited States Essential Oils Market Insights Forecasts to 2033

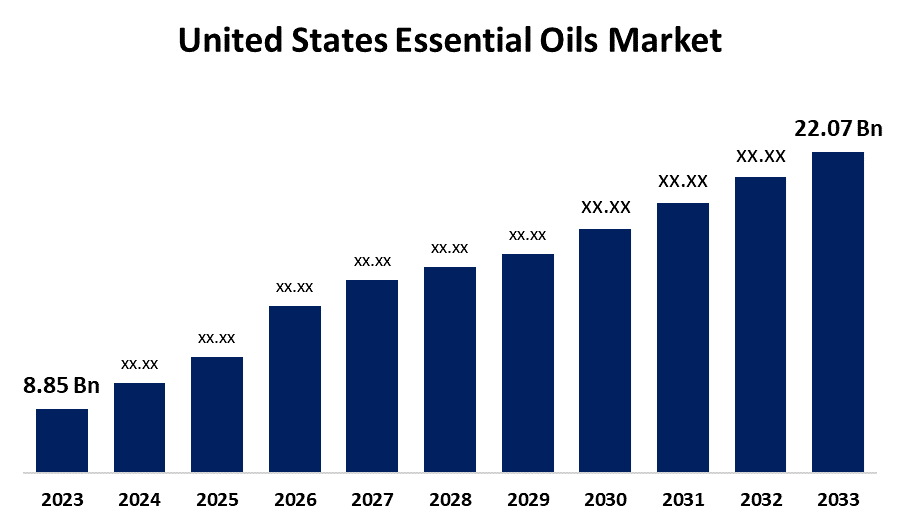

- The United States Essential Oils Market Size Was Estimated at USD 8.85 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.57% from 2023 to 2033

- The USA Essential Oils Market Size is Expected to Reach USD 22.07 Billion by 2033

Get more details on this report -

The United States Essential Oils Market Size is Expected to reach USD 22.07 Billion by 2033, Growing at a CAGR of 9.57% from 2023 to 2033.

Market Overview

The market for essential oils in the US is dominated by concentrated plant extracts that preserve the inherent flavor, aroma, and essence of their source. The food and beverage, cosmetics, personal care, healthcare, and aromatherapy industries all make extensive use of these oils, which are produced by methods like distillation or cold pressing. The US market size for essential oils is being driven primarily by the growing awareness of and preference for natural ingredients in food and beverages. This shift in consumer behavior is especially noticeable among younger generations, who exhibit a strong preference for healthy options and a dislike of artificial substances. Additionally, growth in the market is being driven by important end-use sectors such as aromatherapy, food and beverage, and beauty and personal care. Essential oils' health advantages and low side effects have led to their expanding use in a variety of businesses. Furthermore, research and development (R&D) and product development uses of essential oils are growing quickly, which projects well for the future of the US market.

Report Coverage

This research report categorizes the market for the U.S. essential oils market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US essential oils market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA essential oils market.

United States Essential Oils Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 8.85 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.57% |

| 2033 Value Projection: | USD 22.07 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Aura Cacia, Nature’s Truth, Nature’s Bounty, The Essential Oil Company, Eden Botanicals, Edens Garden, doTERRA, Rocky Mountain Oils, LLC, Lebermuth, Inc., Ungerer & Company, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The US essential oils market is primarily driven by the various uses of essential oils in food and beverage, aromatherapy, personal care, and medicines. Consumer access is improved by the expansion of e-commerce while changing health concerns and natural fragrance preferences are addressed by innovative novel compositions. Additionally, the use of essential oils in aromatherapy, a well-liked treatment for emotional well-being, stress reduction, sleep, and relaxation, is becoming more and more popular among customers looking for alternative therapies for mental health conditions. Furthermore, customers' increasing awareness of ecology and the focus on eco-friendly production methods are driving up demand for essential oils that are produced ethically and ethically.

Restraining Factors

The market for essential oils in the United States is constrained by several reasons, such as high manufacturing costs, a lack of standardization and quality control, the possibility of allergic reactions and safety issues, market saturation, fierce rivalry, and unclear regulations. These difficulties may reduce market reach, reduce customer trust, and limit company expansion prospects.

Market Segmentation

The U.S. essential oils market share is classified into product and application.

- The orange segment holds a significant market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the U.S. essential oils market is divided into orange, spearmint, turmeric, and others. Among these, the orange segment holds a significant market share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is expanding due to its ability to improve sensory appeal and product value across a range of industry aids. Its popularity in organic personal care and agricultural applications is strengthened by its recognition for improving skin health and lowering stress levels, as well as its alignment with the demand for natural alternatives.

- The spa & relaxation segment accounted for the highest market share of 40.36% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the application, the U.S. essential oils market is categorized into food & beverage, spa & relaxation, medical, cleaning & home, and others. Among these, the spa & relaxation segment accounted for the highest market share of 40.36% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing because essential oils are often used in aromatherapy to reduce anxiety and improve mood because of their well-established therapeutic advantages. In addition, the market has grown as a result of the growing popularity of wellness-focused lifestyles and their integration into holistic therapies and spas.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. essential oils market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aura Cacia

- Nature’s Truth

- Nature’s Bounty

- The Essential Oil Company

- Eden Botanicals

- Edens Garden

- doTERRA

- Rocky Mountain Oils, LLC

- Lebermuth, Inc.

- Ungerer & Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In September 2023, doTERRA announced the launch of several new essential oils and blends, including Birch oil, at their global convention. These products focus on sleep, gut health, and overall well-being.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. essential oils market based on the below-mentioned segments:

U.S. Essential Oils Market, By Product

- Orange

- Spearmint

- Turmeric

- Others

U.S. Essential Oils Market, By Application

- Food & Beverage

- Spa & Relaxation

- Medical

- Cleaning & Home

- Others

Need help to buy this report?