United States External Analgesics Market Size, Share, and COVID-19 Impact Analysis, By Product (Hot/Cold Products, Kinesiology Tape, Heating Pads, TENS Devices, and Red Light Therapy/ Infrared Therapy Products), By Distribution Channel (Retail/Brick & Mortar, E-Commerce, and Others), and United States External Analgesics Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States External Analgesics Market Insights Forecasts to 2033

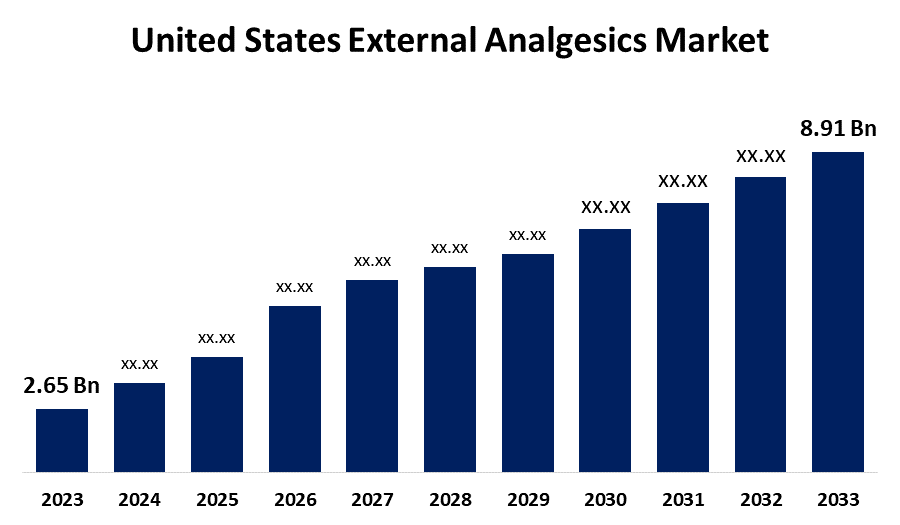

- The U.S. External Analgesics Market Size was valued at USD 2.65 Billion in 2023.

- The Market is growing at a CAGR of 12.89% from 2023 to 2033

- The U.S. External Analgesics Market Size is expected to reach USD 8.91 Billion by 2033

Get more details on this report -

The United States External Analgesics Market is anticipated to exceed USD 8.91 Billion by 2033, growing at a CAGR of 12.89% from 2023 to 2033. The growing prevalence of chronic diseases, sports & recreational activities, and government investments for R&D activities are driving the growth of the external analgesics market in the US.

Market Overview

External analgesics are a kind of analgesic, or painkiller, that is used topically to treat joint, muscle, and nerve pain, as well as other mild to moderate discomfort. There are many different formulations of topical analgesics, such as creams, gels, sprays, and patches. They are frequently used in conjunction with injections or oral drugs as additional pain relievers. They can offer relief from the negative effects of oral drugs and are frequently used to treat localized pain, such as arthritis or back pain. They are also used to relieve the pain brought on by skin diseases including psoriasis and eczema. The U.S. external analgesic industry is being propelled by novel approaches to product approval, technology improvements, and clinical phase trials. There an increasing innovations in wearable TENS therapy devices, wireless app-connected Transcutaneous Electrical Nerve Stimulation (TENS), and disposable hot/cold goods to offer specific solutions for pain management, inflammation, and chronic pain. Further, the field of osteoarthritis management is growing, and this is supported by innovative methods and pain management devices.

Report Coverage

This research report categorizes the market for the US external analgesics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States external analgesics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US external analgesics market.

United States External Analgesics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.65 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.89% |

| 2033 Value Projection: | USD 8.91 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Baxter, Stryker, Boston Scientific Corporation, Medtronic, Enovis, OMRON Healthcare, Inc., Abbott, ICU Medical Inc., Nevro Corp., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There is an increasing demand for muscle and nerve stimulators due to the rising prevalence of obesity and diabetic neuropathy which leads to driving the market growth. Further, the prevalence of chronic diseases as well as the rising incidence of sports accidents are also responsible for propelling the market demand. The increasing use of different painkillers for increased cases of migraines especially in women is fueling the market demand. According to CDC data released in June 2023, approximately 1 in 5 persons in the United States—or 53.2 million people—have arthritis. The need for external analgesics to relieve chronic pain brought on by mild or severe arthritis is driven by the growing number of people who are susceptible to the condition. In addition, the increasing government investment in R&D activities for developing innovative products is escalating the US external analgesics market.

Restraining Factors

Patient care was interrupted and home-based device usage rose as a result of the elimination of non-urgent operations and the closing of specialty pain management facilities during the COVID-19 epidemic, which hindered the market growth.

Market Segmentation

The United States External Analgesics Market share is classified into product and distribution channel.

- The hot/cold products segment dominated the market with the largest market share in 2023.

The United States external analgesics market is segmented by product into hot/cold products, kinesiology tape, heating pads, TENS devices, and red light therapy/ infrared therapy products. Among these, the hot/cold products segment dominated the market with the largest market share in 2023. There is an increased use of heat and cold therapies for managing chronic pain conditions due to non-invasiveness and user-friendliness. The effectiveness of hot/cold external analgesics for a range of pain conditions is responsible for driving the market expansion.

- The retail/brick & mortar segment dominates the US external analgesics market with the largest revenue share in 2023.

Based on the distribution channel, the U.S. external analgesics market is divided into retail/brick & mortar, e-commerce, and others. Among these, the retail/brick & mortar segment dominates the US external analgesics market with the largest revenue share in 2023. According to a Forbes research, traditional brick and mortar stores showed a greater growth rate than e-commerce for the first time in 2022, with physical store sales rising by 18.5%. The long-standing existence of physical stores that offer over-the-counter external pain treatment products is responsible for driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. external analgesics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Baxter

- Stryker

- Boston Scientific Corporation

- Medtronic

- Enovis

- OMRON Healthcare, Inc.

- Abbott

- ICU Medical Inc.

- Nevro Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, Nutriband Inc., a developer of transdermal pharmaceutical products, announced the launch of its new Heating and Cooling Kinesiology Tape as part of its Active Intelligence (AI Tape) Brand portfolio. AI Tape Heating and Cooling provides all of the stretch, support, and benefits of traditional kinesiology tape, plus pain-relieving ingredients that provide both heating and cooling sensation for the temporary relief of minor aches and pains of muscles and joints.

- In October 2023, Kinesiology tape brand KT announced its partnership with Boxout, a national distributor in the field of sports medicine. Together, they are introducing the all-new exclusive KT Tape Pro for Sports Med Professionals and building awareness for the KT Tape Mobile App as a tool for sports medicine professionals and their clients.

- In September 2023, Boston Scientific Corporation announced it has entered into a definitive agreement to acquire Relievant Medsystems—a privately held medical technology company that has developed and commercialized the Intracept intraosseous nerve ablation system to treat a form of chronic low back pain called vertebrogenic pain.

- In July 2023, Medical technology company Motive Health officially introduced Motive Knee, its US Food and Drug Administration (FDA)-approved muscle stimulation device.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States External Analgesics Market based on the below-mentioned segments:

US External Analgesics Market, By Product

- Hot/Cold Products

- Kinesiology Tape

- Heating Pads

- TENS Devices

- Red Light Therapy/ Infrared Therapy Products

US External Analgesics Market, By Distribution Channel

- Retail/Brick & Mortar

- E-Commerce

- Others

Need help to buy this report?