United States Facility Management Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Hard Services, Soft Services, and Other Services), By Industry Vertical (Healthcare, Government, Education, Military & Defense, Real Estate, and Others), and United States Facility Management Market Insights, Industry Trend, Forecasts to 2033

Industry: Electronics, ICT & MediaUnited States Facility Management Market Insights Forecasts to 2033

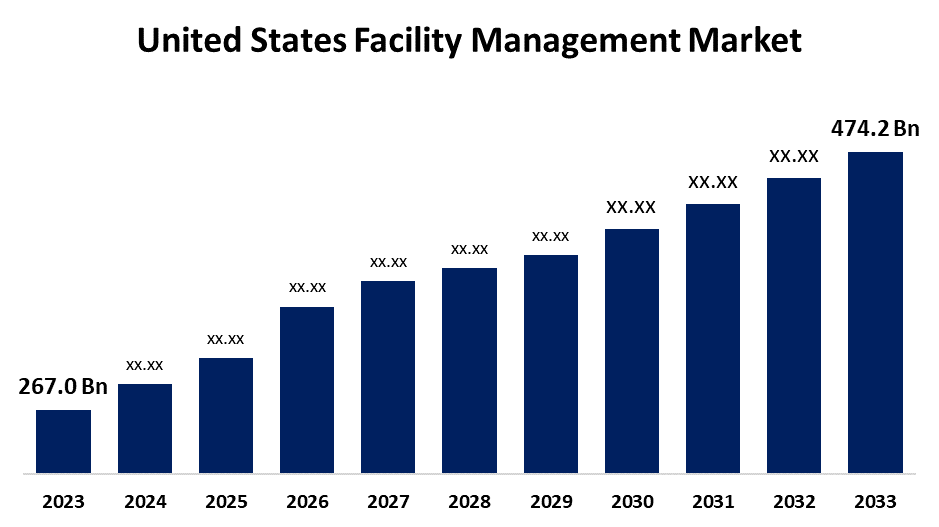

- The U.S. Facility Management Market Size was valued at USD 267.0 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.91% from 2023 to 2033

- The U.S. Facility Management Market Size is Expected to reach USD 474.2 Billion by 2033

Get more details on this report -

The United States Facility Management Market Size is anticipated to Exceed USD 474.2 Billion by 2033, Growing at a CAGR of 5.91% from 2023 to 2033. The Growing investments in healthcare infrastructure and the construction of healthcare facilities in the US as well as the requirement of building information modeling (BIM) in commercial buildings are driving the Growth of the facility management Market in the US.

Market Overview

Facility management is the maintenance of an organization, ensuring the functionality, comfort, safety, and efficiency of buildings and grounds, infrastructure, and real estate. The primary purpose is to improve the quality of life of people and the productivity of the core business. The increasing preference for third-party outsourcing facility management tasks is driving the demand for facility management. There has been a notable surge in the United States in the outsourcing of facility management services by healthcare establishments, including hospitals, nursing homes, and independent contractors owing to the rise in healthcare spending. The introduction of BIM (building information modeling) in facility management enables effective collaboration, reduces errors, and increases productivity, helping to drive productivity, quality, safety, and sustainability in the construction industry. The growing emphasis on the incorporation of BIM in facility management solutions offers lucrative market opportunities for facility management.

Report Coverage

This research report categorizes the market for the US facility management market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States facility management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US facility management market.

United States Facility Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 267.0 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.91% |

| 2033 Value Projection: | USD 474.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 154 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service Type, By Industry Vertical |

| Companies covered:: | CBRE Group, Inc., Aramark, ABM Industries, Jones Lang LaSalle Inc., Emeric Facility Services, SMI Facility Services, Cushman & Wakefield plc., Guardian Service Industries, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

According to SPI Insights report, the 2021 American Rescue Plan Act allocated $1 trillion to build, renovate and modernize healthcare facilities. An additional $10 billion was made available for healthcare facility-related initiatives that same year by the Build Back Better Act. The increasing launch of healthcare projects with the increased healthcare expenditures is driving the market growth of facility management. With the growing emphasis on integrated facility management services and compliance with the technological age to encourage the use of BIM solutions, the US has been among the early adopters of BIM solutions.

Restraining Factors

The risk of data breaches and security threats surges the implementation of numerous complex regulations which increases the cost and complexity of facility management activities. This factor is challenging the market of facility management.

Market Segmentation

The United States Facility Management Market share is classified into service type and industry vertical.

- The hard services segment dominates the US facility management market with the largest share during the forecast period.

The United States facility management market is segmented by service type into hard services, soft services, and other services. Among these, the hard services segment dominates the US facility management market with the largest share during the forecast period. Hard services in facility management refers to the physical structure of a building. These safeguard employee and workplace safety and are typically non-negotiable. The continuous growth in the infrastructure industry is driving the market in the hard services segment.

- The real estate segment dominates the market with a significant market share during the forecast period.

The United States facility management market is segmented by industry vertical into healthcare, government, education, military & defense, real estate, and others. Among these, the real estate segment dominates the market with a significant market share during the forecast period. Managing and administrating real estate properties, such as commercial buildings, apartment complexes, retail establishments, and industrial facilities, is the responsibility of facility management. The rising need for facility management in real estate drives market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. facility management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CBRE Group, Inc.

- Aramark

- ABM Industries

- Jones Lang LaSalle Inc.

- Emeric Facility Services

- SMI Facility Services

- Cushman & Wakefield plc.

- Guardian Service Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, CBRE Group, Inc. and Arlington Capital Partners announced CBRE’s completion of its acquisition of J&J Worldwide Services, a leading provider of engineering services, base support operations and facilities maintenance for the U.S. federal government from Arlington, a Washington, D.C.-area private investment firm specializing in government regulated industries.

- In July 2023, EMCOR Group, Inc. announced that it has entered into a definitive agreement to acquire ECM Holding Group, Inc. (“ECM”), a leading national energy efficiency specialty services firm, in an all-cash transaction.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Facility Management Market based on the below-mentioned segments:

US Facility Management Market, By Service Type

- Hard Services

- Soft Services

- Other Services

US Facility Management Market, By Industry Vertical

- Healthcare

- Government

- Education

- Military & Defense

- Real Estate

- Others

Need help to buy this report?