United States Faucet Market Size, Share, and COVID-19 Impact Analysis, By Product (Ball, Cartridge, Compression, and Disc), By Technology (Automatic and Manual), By Distribution Channel (Online and Offline), and U.S. Faucet Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited States Faucet Market Insights Forecasts to 2033

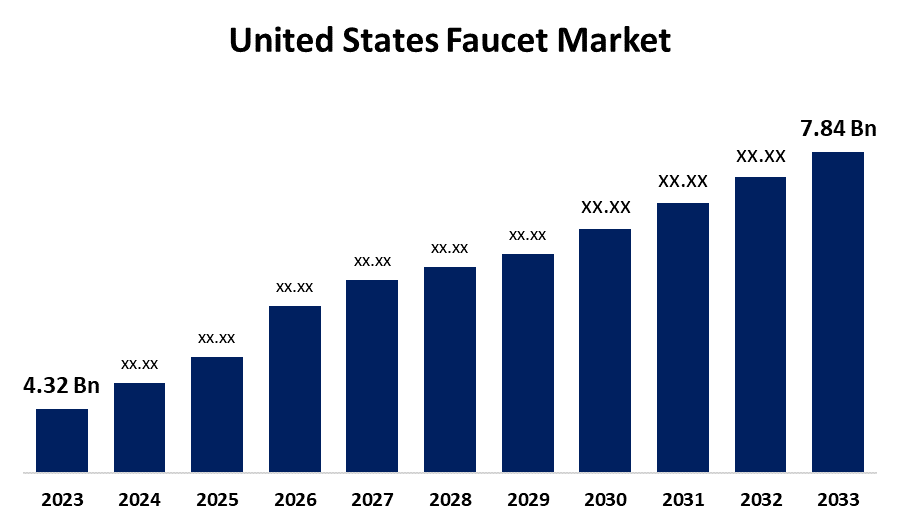

- The United States Faucet Market Size Was Estimated at USD 4.32 Billion in 2023.

- The Market is Growing at a CAGR of 6.14% from 2023 to 2033

- The USA Faucet Market Size is Expected to Reach USD 7.84 Billion by 2033

Get more details on this report -

The United States Faucet Market is Expected to Reach USD 7.84 Billion by 2033, Growing at a CAGR of 6.14% from 2023 to 2033.

Market Overview

The manufacturing, marketing, and distribution of faucets for use in commercial, industrial, and residential settings is the focus of the US faucet market. These faucets are necessary plumbing components used to regulate water flow in bathrooms, kitchens, and other spaces. The increased demand for renovated kitchens and bathrooms is creating profitable chances for faucets due to the bathroom fittings industry's rapid rise. The demand for a range of faucets is also being increased by the growing relevance of multifunctional functions on plumbing fixtures, with adequate consideration paid to aesthetic appeal. Additionally, the need for faucets in the U.S. is increasing due to changing customer tastes, legal requirements, and developments in smart home technologies, the market for faucets in the United States is expanding rapidly. This increasing trend is caused by a number of important variables, such as a rise in domestic remodeling projects, a rise in the use of water-efficient fixtures, and a greater emphasis on convenience and hygiene.

Report Coverage

This research report categorizes the market for the U.S. faucet market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US faucet market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA faucet market.

United States Faucet Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.32 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.14% |

| 2033 Value Projection: | USD 7.84 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Technology, By Distribution and COVID-19 Impact Analysis. |

| Companies covered:: | Hansgrohe, Chicago Faucets, Kohler Co, Kraus, USA, Delta Faucet Company, Moen Incorporated, AquaSource Faucet, American Standard Brands, GROHE America Inc., Pfister,and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States faucet market due to the increase in house remodeling and renovation projects, which has been driven by post-pandemic time spent at home and rising disposable income, is one of the primary driving factors. Additionally, the U.S. market is undergoing a significant shift towards water-efficient faucets, driven by environmental concerns and stringent water conservation regulations. Furthermore, technological developments also help the market grow by bringing in novel products like smart and touchless faucets. In addition, there are presently more styles, coatings, and materials available to suit a variety of consumer preferences attributable to the increased focus on design and customization.

Restraining Factors

The market for faucet in the United States is hampered by issues like high manufacturing costs for novel designs and fluctuating raw material prices for steel and aluminum are obstacles facing the U.S. faucet business. These elements make it more difficult for acceptance and affordability, particularly in price-sensitive markets.

Market Segmentation

The U.S. faucet market share is categorized into product, technology, and distribution channel.

- The ball segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the U.S. faucet market is classified into ball, cartridge, compression, and disc. Among these, the ball segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is driven by their durable performance and sturdy construction, which makes them a popular option for both commercial and residential settings. The increasing popularity of kitchen and bathroom upgrades and house renovations has increased demand for fashionable and useful faucets, such as ball faucets.

- The manual segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the technology, the U.S. faucet market is divided into automatic and manual. Among these, the manual segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is driven by their affordability and dependability, which complement the goals of companies looking for workable solutions. Manual faucets, like those made by Chicago Faucets, provide long-term performance and customer satisfaction with a range of fitting options and industry-leading warranties.

- The offline segment anticipated the largest market share in 2023 and is estimated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the U.S. faucet market is classified into online and offline. Among these, the offline segment anticipated the largest market share in 2023 and is estimated to grow at a significant CAGR during the forecast period. This segment is driven by the inclination of consumers to choose high-involvement products, like faucets, in person. In addition to evaluating the design, finish, and quality of faucets before making a purchase, many customers prefer to physically inspect them in retail establishments like home improvement centers and specialty bath and plumbing stores.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. faucet market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hansgrohe

- Chicago Faucets

- Kohler Co

- Kraus, USA

- Delta Faucet Company

- Moen Incorporated

- AquaSource Faucet

- American Standard Brands

- GROHE America Inc.

- Pfister

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, the Jema Kitchen Faucet Collection was introduced by San Francisco-based entrepreneur Brondell at KBIS 2025 in Las Vegas. For enhanced performance and water saving, Brondell's flagship product in its new faucet category, the Jema faucet, incorporates proprietary Nebia spray technology. Jema has remarkable cleaning strength at just 0.8 gpm. with four spray modes, including the effective RapidRinse and GentleClean. Its high-arch, streamlined design makes the most of the sink's space, and technologies like the Accelerate Installation System make assembly simple.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. faucet market based on the below-mentioned segments.

U.S. Faucet Market, By Product

- Ball

- Cartridge

- Compression

- Disc

U.S. Faucet Market, By Technology

- Automatic

- Manual

U.S. Faucet Market, By Distribution Channel

- Online

- Offline

Need help to buy this report?