United States Feed Amino Acids Market Size, Share, and COVID-19 Impact Analysis, By Type (Lysine, Methionine, Threonine, Tryptophan, and Others), By Livestock (Poultry, Ruminants, Swine, Aquatic Animals, and Others), and United States Feed Amino Acids Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsUnited States Feed Amino Acids Market Insights Forecasts to 2033

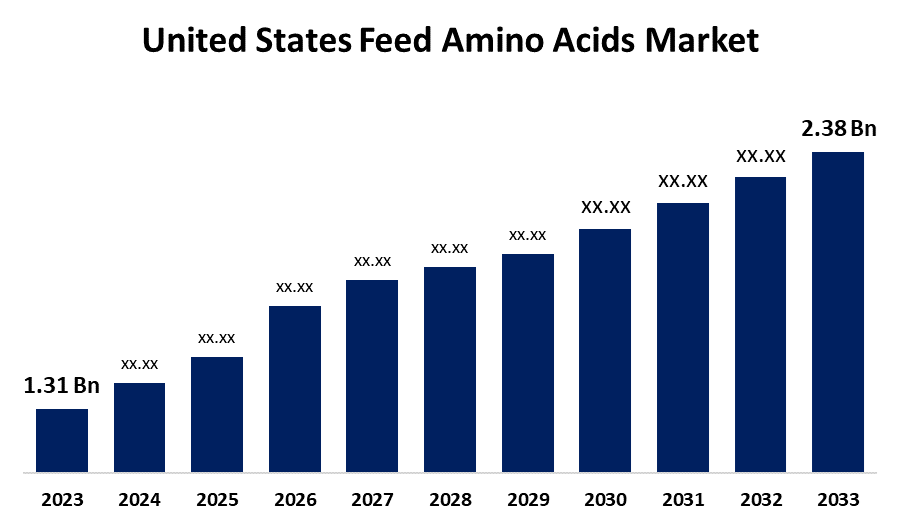

- The U.S. Feed Amino Acids Market Size was valued at USD 1.31 Billion in 2023.

- The Market is growing at a CAGR of 6.15% from 2023 to 2033

- The U.S. Feed Amino Acids Market Size is expected to reach USD 2.38 Billion by 2033

Get more details on this report -

The United States Feed Amino Acids Market is anticipated to exceed USD 2.38 Billion by 2033, growing at a CAGR of 6.15% from 2023 to 2033. The growing demand for animal growth, meat production, and awareness about the benefits of consuming meat are driving the growth of the feed amino acids market in the US.

Market Overview

Feed amino acids are dietary supplements comprising amino acids that play an important role in health nutrition, especially in parenteral nutrition. Feed amino acids include a variety of nutrients that provide energy, including vitamins, minerals, and proteins like amino acids, lipids, oils, and carbs. Amino acids improve the metabolic rate and nourish animals like pigs, broilers, and cattle when fed to them. Furthermore, feed amino acids support animal reproductive, lactation, and overall health. These amino acids have gained popularity because of their ability they work to improve animal digestion and gut health while also increasing meat output. There are 21 different kinds of necessary amino acids found in animal bodies that the body is unable to produce on its own. Tryptophan, methionine, and lysine are a few of these vital amino acids that can be given to animals through feed. Lysine and methionine are the most significant feed amino acids in terms of market value. The growth, development, and reproduction as well as increased nutritional efficiency are anticipated to leverage the market opportunities.

Report Coverage

This research report categorizes the market for the US feed amino acids market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States feed amino acids market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US feed amino acids market.

United States Feed Amino Acids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.31 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 6.15% |

| 2033 Value Projection: | USD 2.38 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Livestock, and COVID-19 Impact Analysis |

| Companies covered:: | Ajinomoto Co., Inc., Adisseo, Archer Daniel Midland Co., Evonik Industries AG, Kemin Industries, Alltech, Inc., Land O’Lakes, IFF(Danisco Animal Nutrition), Novus International, Inc., and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for animal growth and meat production is driving up the US feed amino acids market. The rising use of animals and growing awareness about the importance of meat for immunity boosting are also responsible for propelling the market demand. Further, the increasing need for meat products and awareness about the benefit of amino acids for gut pH and health are positively influencing the market growth.

Restraining Factors

The increasing regulatory legislations due to the impact of animal husbandry on environmental sustainability, food safety, etc. are restraining the market for feed amino acids. Further, the development of alternative proteins and the high price of amino acid feeds also pose market challenges.

Market Segmentation

The United States Feed Amino Acids Market share is classified into type and livestock.

- The threonine segment is anticipated to grow at the fastest CAGR growth during the forecast period.

The United States feed amino acids market is segmented by type into lysine, methionine, threonine, tryptophan, and others. Among these, the threonine segment is anticipated to grow at the fastest CAGR growth during the forecast period. Threonine-containing feed primarily accelerates protein synthesis and helps to gain weight as well as maintain immunity and gut integrity. The use of lysine, feed formylation optimization, feed formulation, and animal production cost due to L-threonine drive the market.

- The poultry segment is anticipated to hold the largest market share during the forecast period.

The United States feed amino acids market is segmented by livestock into poultry, ruminants, swine, aquatic animals, and others. Among these, the poultry segment is anticipated to hold the largest market share during the forecast period. The overall amount of poultry produced has been rising, and as a result, it is now more crucial than ever for meat producers to pay closer attention to the quality of their products. The rising concerns about animal health and the advantages of amino acids for feed are responsible for driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. feed amino acids market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ajinomoto Co., Inc.

- Adisseo

- Archer Daniel Midland Co.

- Evonik Industries AG

- Kemin Industries

- Alltech, Inc.

- Land O'Lakes

- IFF(Danisco Animal Nutrition)

- Novus International, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, Global animal health and nutrition company Novus International acquired biotech company Agrivida. Through the purchase, Novus takes ownership of the proprietary INTERUS technology Agrivida developed to embed feed additives inside the grain.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Feed Amino Acids Market based on the below-mentioned segments:

US Feed Amino Acids Market, By Type

- Lysine

- Methionine

- Threonine

- Tryptophan

- Others

US Feed Amino Acids Market, By Livestock

- Poultry

- Ruminants

- Swine

- Aquatic Animals

- Others

Need help to buy this report?