United States Fetal & Neonatal Care Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product (Fetal Care Equipment and Neonatal Care Equipment), By End-Use (Hospitals, Clinics, and Others), and United States Fetal & Neonatal Care Equipment Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Fetal & Neonatal Care Equipment Market Insights Forecasts to 2033

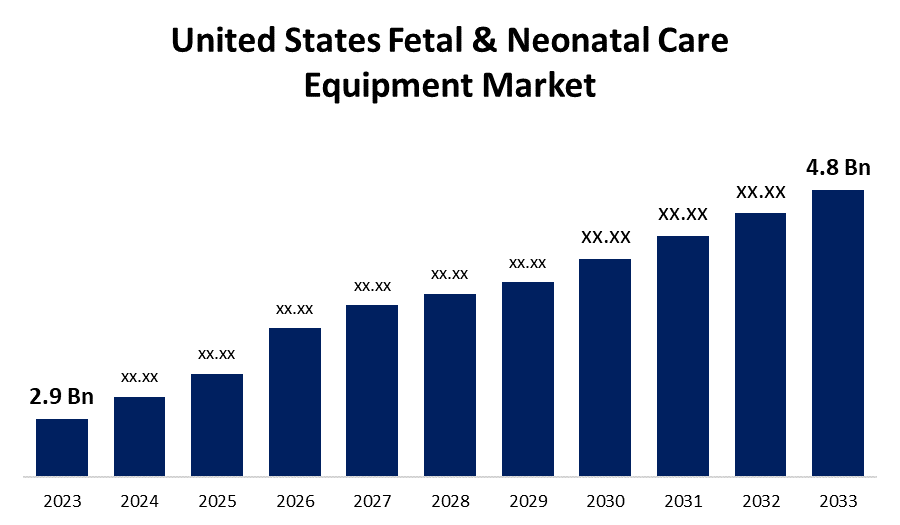

- The U.S. Fetal & Neonatal Care Equipment Market Size was valued at USD 2.9 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.17% from 2023 to 2033

- The U.S. Fetal & Neonatal Care Equipment Market Size is Expected to Reach USD 4.8 Billion by 2033

Get more details on this report -

The United States Fetal & Neonatal Care Equipment Market is Anticipated to Exceed USD 4.8 Billion by 2033, growing at a CAGR of 5.17% from 2023 to 2033. The growing awareness about fetal & neonatal care, NICU admissions, and increasing prevalence of HAI (hospital-acquired infections) among neonates are driving the growth of the fetal & neonatal care equipment market in the US.

Market Overview

Fetal & neonatal care equipment are the vital tools routinely used in gynecology and obstetrics interventions to examine fetal health during labor and delivery. They are widely utilized in neonatal intensive care units (NICUs), where complex machines and monitoring devices are designed for the unique needs of newborn babies. The National Vital Statistics Report states that in 2021, there were about 21,105 fetal deaths in the United States at 20 weeks of gestation. This demonstrates the urgency with which infant care devices are needed. One out of every ten babies born in the nation is affected by preterm births, according to the CDC. Preterm birth rates for African-American women in 2022 were 14.6%, higher than those among white women (9.4%) and Hispanic women (10.1%). Moreover, a sizable portion of newborns born in the United States had low birth weights. The considerable increase in preterm births and newborn fatalities is expected to drive up the product demand with the availability of funding for equipment research and acquisition. Additionally, manufacturers are introducing more affordable and efficient products, which should lower treatment costs. The technological developments in sensors and monitoring systems have made it possible faster and reliable measure a newborn’s vital health parameters with safe and more effectively.

Report Coverage

This research report categorizes the market for the US fetal & neonatal care equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States fetal & neonatal care equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US fetal & neonatal care equipment market.

United States Fetal & Neonatal Care Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 2.9 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.17% |

| 023 – 2033 Value Projection: | USD 4.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-Use |

| Companies covered:: | Cardinal Health, GE Healthcare, Drägerwerk AG & Co. KGaA, Medtronic, Koninklijke Philips N.V, BD, Vyaire, Natus Medical Incorporated, Ambu A/S, Masimo, Inspiration Healthcare Group plc Utah Medical Products, Inc., Fisher & Paykel Healthcare Limited, Atom Medical Corp, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The significant rise in preterm births and neonatal deaths surges the market demand. Further, the low birthweights of newborn babies as well as the growing awareness about fetal & neonatal care are driving up the market demand. NICU admissions at 22 weeks gestation increased from 2008-09 to 2020-21 by 388% as per the report article published by JAMA Network in February 2024. Further, the increasing prevalence of HAI (hospital-acquired infections) such as central line-associated bloodstream infections (CLABSI), hospital-acquired pneumonia, and skin infection caused by staphylococcus aureus among neonates especially premature infants and infants with medical disorders requiring prolonged hospitalization surges the need for these equipment which is propelling the market demand.

Restraining Factors

The high costs of fetal and neonatal care equipment and stringent regulatory constraints for the approval of innovative devices are responsible for restraining the US fetal & neonatal care equipment market.

Market Segmentation

The United States Fetal & Neonatal Care Equipment Market share is classified into product and end-use.

- The fetal care equipment segment dominates the market with the largest market share in 2023.

The United States fetal & neonatal care equipment market is segmented by product into fetal care equipment and neonatal care equipment. Among these, the fetal care equipment segment dominates the market with the largest market share in 2023. Fetal care equipment includes MRI systems, ultrasound devices, pulse oximeters, dopplers, and monitors. The increasing awareness about fetal and neonatal care and ongoing technological advancements, as well as the significant surge in home-use portable and do-it-yourself ultrasound devices, are driving the market growth.

- The hospitals segment dominates the US fetal & neonatal care equipment market accounted for the largest revenue share during the forecast period.

Based on the end-use, the U.S. fetal & neonatal care equipment market is divided into hospitals, clinics, and others. Among these, the hospitals segment dominates the US fetal & neonatal care equipment market accounted for the largest revenue share during the forecast period. There is a presence of the newest and most sophisticated medical technology to enhance patient care and the accessibility of specialists. Additionally, the growing number of NICUs in hospitals and increased patient load are propelling the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. fetal & neonatal care equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cardinal Health

- GE Healthcare

- Drägerwerk AG & Co. KGaA

- Medtronic

- Koninklijke Philips N.V

- BD

- Vyaire

- Natus Medical Incorporated

- Ambu A/S

- Masimo

- Inspiration Healthcare Group plc Utah Medical Products, Inc.

- Fisher & Paykel Healthcare Limited

- Atom Medical Corp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, Dräger redefined open care with the FDA-cleared Babyroo TN300, a new open warmer that offers supportive lung protection and temperature stability from the moment of birth through discharge home.

- In April 2023, Cardinal Health announced the celebration of the opening of two new distribution centers in Central Ohio this month. Both facilities would support the company's Medical Segment, focusing on its U.S. Medical Products and Distribution (USMPD) and at-home solutions businesses.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Fetal & Neonatal Care Equipment Market based on the below-mentioned segments:

US Fetal & Neonatal Care Equipment Market, By Product

- Fetal Care Equipment

- Neonatal Care Equipment

US Fetal & Neonatal Care Equipment Market, By End-Use

- Hospitals

- Clinics

- Others

Need help to buy this report?