United States Fiberglass Market Size, Share, and COVID-19 Impact Analysis, By Glass Type (E-Glass and Specialty), By Product (Glass Wool, Yarn, Roving, Chopped Strands, and Others), By Application (Transportation, Building & Construction, Electrical & Electronics, Pipe & Tank, Consumer Goods, Wind Energy, and Others), and United States Fiberglass Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsUnited States Fiberglass Market Insights Forecasts to 2033

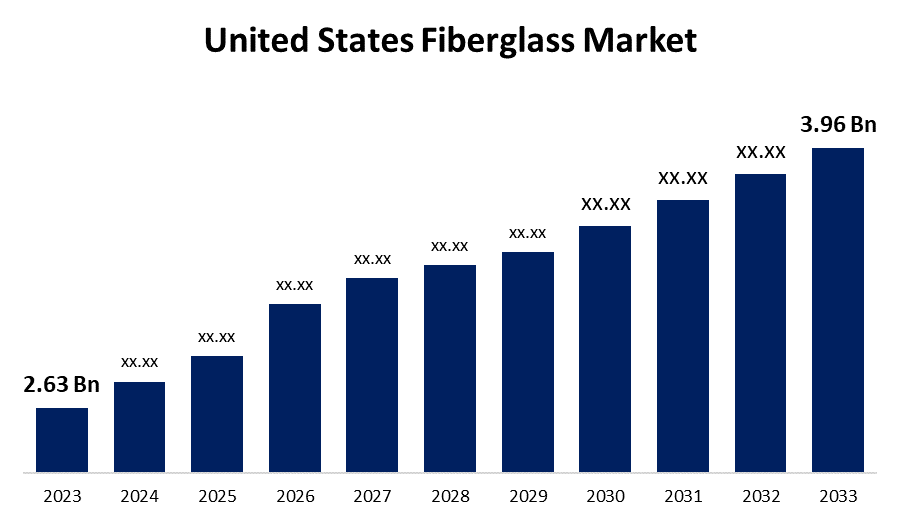

- The U.S. Fiberglass Market Size was valued at USD 2.63 Billion in 2023.

- The Market is growing at a CAGR of 4.18% from 2023 to 2033

- The U.S. Fiberglass Market Size is expected to reach USD 3.96 Billion by 2033

Get more details on this report -

The United States Fiberglass Market is anticipated to exceed USD 3.96 Billion by 2033, growing at a CAGR of 4.18% from 2023 to 2033. The growing construction industry is driving the growth of the fiberglass market in the US.

Market Overview

Fiberglass is a flexible, lightweight, and less brittle material that has widespread application in aircraft, boats, automobiles, electronic goods, and others. These materials are made of tiny glass fibers that can be wrapped into a layer or utilized as reinforcement. Limestone, soda ash, and silica sand are the main ingredients in the production of fiberglass. The property of dielectric strength of fiberglass materials is important for electric vehicles as it is used to ensure effective insulation of electrical currents and prevent electrical breakdown. The growing automotive industry in the country owing to the increasing sales of electric vehicles over gas-powered vehicles drives the market growth for the fiberglass market. Furthermore, the expanding wind power industry in the country surges the demand for fiberglass owing to its strength, durability, and lightweight properties which is required for constructing large wind turbine blades in order to harness wind energy.

Report Coverage

This research report categorizes the market for the US fiberglass market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States fiberglass market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US fiberglass market.

United States Fiberglass Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.63 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.18% |

| 2033 Value Projection: | USD 3.96 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Glass Type, By Product, By Application |

| Companies covered:: | Owens Corning, Johns Manville, Knauf Insulation, PPG Industries, Inc., American Fiberglass, Quietflex, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In the construction industry, fiberglass is used as a raw material for insulation, cladding, surface coating, and roofing. The widespread application of fiberglass in the construction industry drives the market expansion. Further, fiberglass yarns are used in the aerospace and automotive industry as well as the FRPs that developed with the contribution of fiberglass are becoming more and more widely used in the interior and exterior of buildings. Further, government regulation on incorporating lightweight material in vehicles as well as penetration of electronics in the country are anticipated to drive the market.

Restraining Factors

The fluctuation in the prices of raw materials affects the manufacturing of fiberglass, hampering the market.

Market Segmentation

The United States Fiberglass Market share is classified into glass type, product, and application.

- The specialty segment dominates the US fiberglass market with the largest share in 2023.

The United States fiberglass market is segmented by type into e-glass and specialty. Among these, the specialty segment dominates the US fiberglass market with the largest share in 2023. Specialty glass includes s-glass that typically contains oxides of silicon, aluminium, and magnesium. The greater tensile strength and elastic modules as well as the greater stiffness over e-glass drive the market in the specialty segment.

- The glass wool segment held the largest revenue share of the US fiberglass market in 2023.

The United States fiberglass market is segmented by product into glass wool, yarn, roving, chopped strands, and others. Among these, the glass wool segment held the largest revenue share of the US fiberglass market in 2023. Glass wool is used as insulating material in cavity wall insulation, ceiling walls, and ducting. It also prevents heat transfer and sound transmission. The rising demand for insulation in the construction industry drives the market demand in the glass wool segment.

- The transportation segment accounted for the largest revenue share of the US fiberglass market in 2023.

The United States fiberglass market is segmented by application into transportation, building & construction, electrical & electronics, pipe & tank, consumer goods, wind energy, and others. Among these, the transportation segment accounted for the largest revenue share of the US fiberglass market in 2023. Fiberglass is revolutionizing mass transit by improving vehicle efficiency, longer lifespan, more design flexibility, and streamlined production due to various advantages of fiberglass. The increasing demand for lightweight material vehicles is driving the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. fiberglass market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Owens Corning

- Johns Manville

- Knauf Insulation

- PPG Industries, Inc.

- American Fiberglass

- Quietflex

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, Johns Manville (Denver, Colo., U.S.) announced that it would restart a glass melter in Trnava, Slovakia on April 25, after it was taken out of service for a routine rebuild. The furnace had previously reached the end of its service life after a record campaign of 10 years.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Fiberglass Market based on the below-mentioned segments:

US Fiberglass Market, By Glass Type

- E-Glass

- Specialty

US Fiberglass Market, By Product

- Glass Wool

- Yarn

- Roving

- Chopped Strands

- Others

US Fiberglass Market, By Application

- Transportation

- Building & Construction

- Electrical & Electronics

- Pipe & Tank

- Consumer Goods

- Wind Energy

- Others

Need help to buy this report?