United States Financial Risk Management Software Market Size, Share, and COVID-19 Impact Analysis, By Deployment (On-premises and Cloud), By Enterprise Type (SMEs and Large Enterprises), and US Financial Risk Management Software Market Insights, Industry Trend, Forecasts to 2033

Industry: Electronics, ICT & MediaUnited States Financial Risk Management Software Market Insights Forecasts to 2033

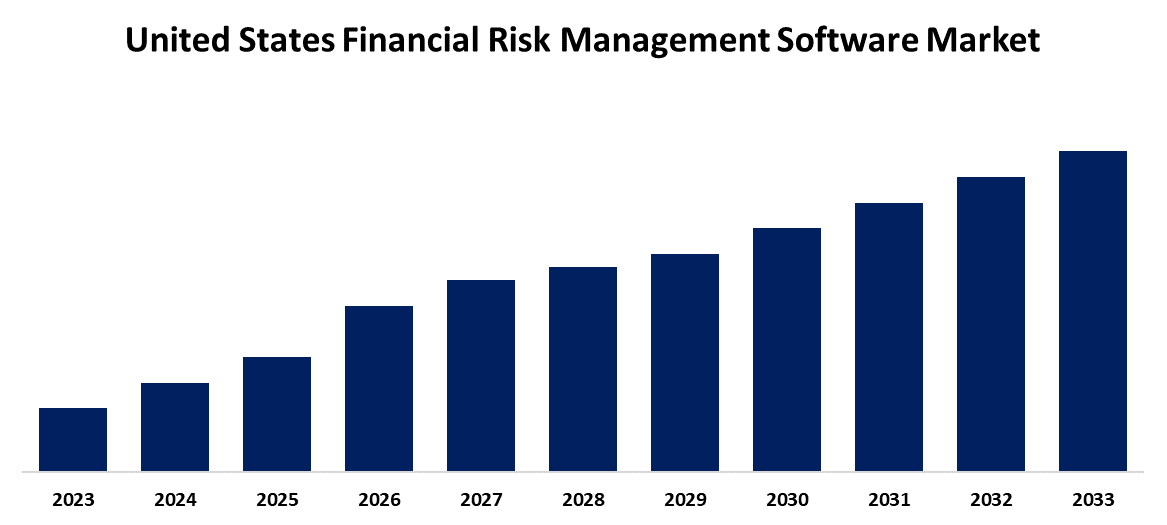

- The Market is Growing at a CAGR of 16.4% from 2023 to 2033

- The U.S. Financial Risk Management Software Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The U.S. Financial Risk Management Software Market Size is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 16.4% from 2023 to 2033.

Market Overview

Financial risk management software solutions are a wide range of technologies that help an enterprise identify, assess, monitor, and mitigate various financial risks in the face of market risks, credit risks, liquidity risks, and operational risks, to mention others. Increasing complexity in financial markets, regulatory demands, and real-time risk analysis contribute extensively to the growth of the market. Also, this software helps organizations comply with their regulatory requirements because it automates the process of submitting reports with the correctness of the data submitted. All these are contributing to the growth of the United States financial risk management software market. Generally, these types of software are to be used in analyzing data and generating reports that might give an outline of the organization's financial risks using a combination of tools and techniques. The information can then be used as a starting point by decision-makers for making informed decisions on mitigating these risks. Such characteristics might include common elements such as risk modeling, stress testing, scenario analysis, risk measurement, risk reporting, and risk mitigation strategies. The software would also enable the automation of another financial risk management activity, such as checking against regulations and policies.

Report Coverage

This research report categorizes the market for the US financial risk management software market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States financial risk management software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. financial risk management software market.

United States Financial Risk Management Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.4% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 193 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Deployment, By Enterprise Type and COVID-19 Impact Analysis. |

| Companies covered:: | Oracle, Temenos, Riskonnect, LogicGate, Inc., SAS Institute Inc., Experian Information Solutions, Inc., CompatibL, Ncontracts, Accenture, LogicManager, Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The integration of artificial intelligence, machine learning, and big data analytics into the risk management software enhances the prediction and mitigation of the risk in these systems. By increasing this ability to do more precise risk assessments proactively, the developed technologies make them more efficient and effective. Financial institutions have to work on truly enormous amounts of highly complex data. Advancements in risk management software solutions are therefore important in the processing and analysis of this data as well as the derivation of actionable insights, thereby helping institutions manage their risk exposure much better. Further, globalization in financial services coupled with expansions in new markets by financial institutions elevates the scale at which risks are being managed.

Restraining Factors

The high front-end investment is necessary for its acquisition and deployment. It includes the costs of buying the software, customizing it to make adjustments to present systems, integrating it with them, and training employees to operate with it.

Market Segmentation

The US financial risk management software market share is classified into deployment and enterprise type.

- The cloud segment is expected to hold a significant market share through the forecast period.

The United States financial risk management software market is segmented by deployment into on-premises and cloud. Among these, the cloud segment is expected to hold a significant market share through the forecast period. The flexibility and scalability of cloud-based financial risk management software at a much lesser cost than such on-premises systems conventionally would make available. This facility enables the banks to avail high-risk management tools without undertaking large up-front investments in hardware devices.

- The large enterprises segment is expected to dominate the US financial risk management software market during the projected period.

Based on the enterprise type, the United States financial risk management software market is divided into SMEs and large enterprises. Among these, the large enterprises segment is expected to dominate the US financial risk management software market during the projected period. As they operate through various geographies and sectors, involving high-order diverse financial risks such as market, credit, operational, and compliance risks, the financial risk management software of such companies manages such intricately complex risks with the help of advanced analytics, scenario analysis, and real-time monitoring. In addition, it allows executives to make strategic insights based on informed investment decisions, mergers, acquisitions, and other financial strategies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States financial risk management software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Oracle

- Temenos

- Riskonnect

- LogicGate, Inc.

- SAS Institute Inc.

- Experian Information Solutions, Inc.

- CompatibL

- Ncontracts

- Accenture

- LogicManager, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Accenture invested in generative AI tools and solutions through a collaboration with Oracle. This solution is expected to enhance the value of data for organizations and drive continuous innovation in its application.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States financial risk management software market based on the below-mentioned segments:

United States Financial Risk Management Software Market, By Deployment

- On-premises

- Cloud

United States Financial Risk Management Software Market, By Enterprise Type

- SMEs

- Large Enterprises

Need help to buy this report?