United States Fintech Market Size, Share, and COVID-19 Impact Analysis, By Service Proposition (Digital Payments and Digital Commerce), By Type of Services (Payment, Wealth Management, Insurance, Personal Loans, Fund Transfer, Others), By Technology (API, Artificial Intelligence, RPA, Blockchain, Others), and United States Fintech Market Insights Forecasts 2023 – 2033

Industry: Information & TechnologyUnited States Fintech Market Size Insights Forecasts to 2033

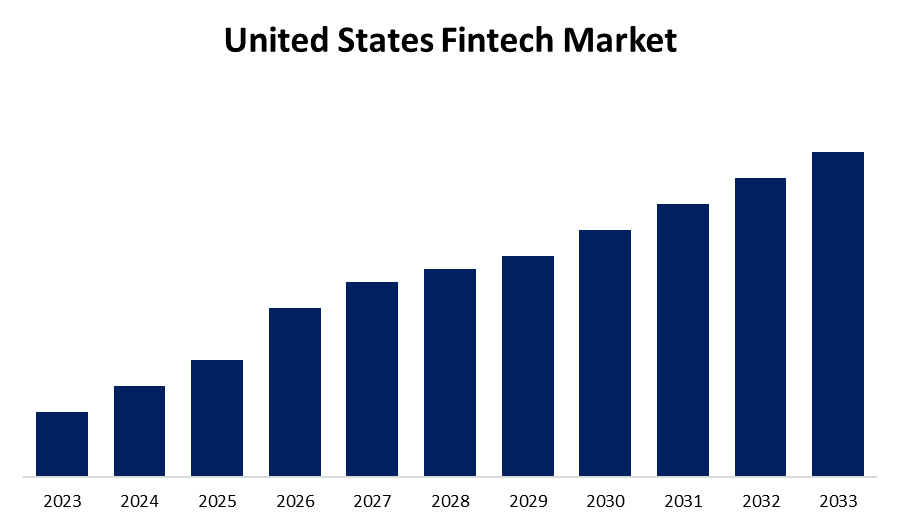

- The Market Size is Growing at a CAGR of 10.90% from 2023 to 2033.

- The United States Fintech Market Size is Expected to Hold a Substantial Share by 2033.

Get more details on this report -

The United States Fintech Market Size is Expected to Hold a Substantial Share by 2032, at a CAGR of 10.90% during the forecast period 2023 to 2033.

Market Overview

Fintech is defined as the use of software and other modern technologies by businesses to provide automated and improved financial services. Fintech employs innovation and technology to provide financial services via internet-based platforms. Fintech offers end-to-end financial services and solutions for automating financial assistance via the Internet. Fintech provides numerous benefits, ranging from traditional services such as payment and fund transfer to technologically focused services that improve the process in major financial markets.

Report Coverage

This research report categorizes the market for the United States Fintech market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Fintech market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States Fintech market.

United States Fintech Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.90% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Service Proposition, By Type of services, By Technology |

| Companies covered:: | Stripe, Klarna, Kraken, Plaid, Robinhood, Brex, Chime, NYDIG, VISA, iTrustCapital, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Blockchain technology is used in the Fintech Market to improve security and operational efficiency. Blockchain technology ensures data authentication because older data cannot be changed while allowing for the recording of new data blocks, which aids in the maintenance of high security and transparency for companies operating in the Fintech market. Cybersecurity is becoming a major concern in the field of information technology. Organizations face financial losses as a result of cyber-attacks, so FinTech is a top priority. FinTech not only secures financial data but also makes transactions easier, resulting in smooth financial operations and optimal cash flow. Regulators have unfortunately eclipsed the scale of the FinTech business by enacting strict laws that limit the operability of FinTech apps. Furthermore, there is a noticeable lack of human contact in these applications, which is sometimes accompanied by the additional convenience costs associated with transactions, as evidenced by the fact that many accounts opened in FinTech mobile apps remain inactive.

Restraining Factors

Many people are still hesitant to use fintech services because they are concerned about the privacy and security of their data and funds. Traditional brokers remain active in many parts of the world because many retail and institutional investors are hesitant to deposit large sums of money in an online Demat account. This could be due to a lack of human contact.

Market Segment

- In 2023, the digital payments segment accounted for the largest revenue share over the forecast period.

Based on the service proposition, the United States fintech market is segmented into digital payments and digital commerce. Among these, the digital payments segment has the largest revenue share over the forecast period. Credit card and mobile wallet payments are preferred over other payment methods in the United States. This is primarily due to the user experience and popularity of mobile payment apps such as PayPal in the United States. Online payment methods have become the most popular in recent years and are used for every e-commerce transaction. Online payments have been successful because people have been using them for a long time. Credit and debit card penetration in the United States is among the highest in the world. The widespread availability of debit and credit cards has made it easier for people in the United States to use digital wallets with their smartphones.

- In 2023, the insurance segment accounted for the largest revenue share over the forecast period.

Based on type of services, the United States fintech market is segmented into payment, wealth management, insurance, personal loans, fund transfer, and others. Among these, the insurance segment has the largest revenue share over the forecast period. The dominance is due to a growing recognition of technology's ability to reshape and optimize the insurance industry. Insurance-related fintech solutions include a variety of services such as digital underwriting, claims processing, policy management, and risk assessment. These offerings use advanced data analytics, AI-driven algorithms, and automation to improve insurance operations' efficiency, accuracy, and customer experience.

- In 2023, the blockchain segment accounted for the largest revenue share over the forecast period.

Based on the technology, the United States fintech market is segmented into API, artificial intelligence, RPA, blockchain, others. Among these, the blockchain segment has the largest revenue share over the forecast period. Blockchain technology is becoming increasingly popular, particularly among large corporations. Due to the increased transparency and automation benefits of blockchain, several large enterprises are attempting to implement it. Financial institutions are embracing blockchain technology because of the increased security and efficiency it provides. Users can be sole owners of their wealth with blockchain technology, and only they can access their assets, providing added security to both financial institutions and end-users. Blockchain's benefits are anticipated to drive the segment's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States fintech market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Stripe

- Klarna

- Kraken

- Plaid

- Robinhood

- Brex

- Chime

- NYDIG

- VISA

- iTrustCapital

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2022, With USD 125 million in funding, iTrustCapital established its new corporate headquarters in Irvine. The announcement comes two months after the company received a USD 125 million Series A growth equity investment from New York-based Left Lane Capital. The funds will be used to improve the company's offerings, expand the customer support and development teams, investigate potential strategic partnerships, and launch new marketing initiatives.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Fintech Market based on the below-mentioned segments:

United States Fintech Market, By Service Proposition

- Digital Payments

- Digital Commerce

United States Fintech Market, By Type of Services

- Payment

- Wealth Management

- Insurance

- Personal Loans

- Fund Transfer

- Others

United States Fintech Market, By Technology

- API

- Artificial Intelligence

- RPA

- Blockchain

- Others

Need help to buy this report?