United States Flavors and Fragrances Market Size, Share, and COVID-19 Impact Analysis, By Product (Natural and Aroma Chemicals), By Application (Fragrances and Flavors), and U.S. Flavors and Fragrances Market Insights, Industry Trend, Forecasts to 2033.

Industry: Specialty & Fine ChemicalsUnited States Flavors and Fragrances Market Insights Forecasts to 2033

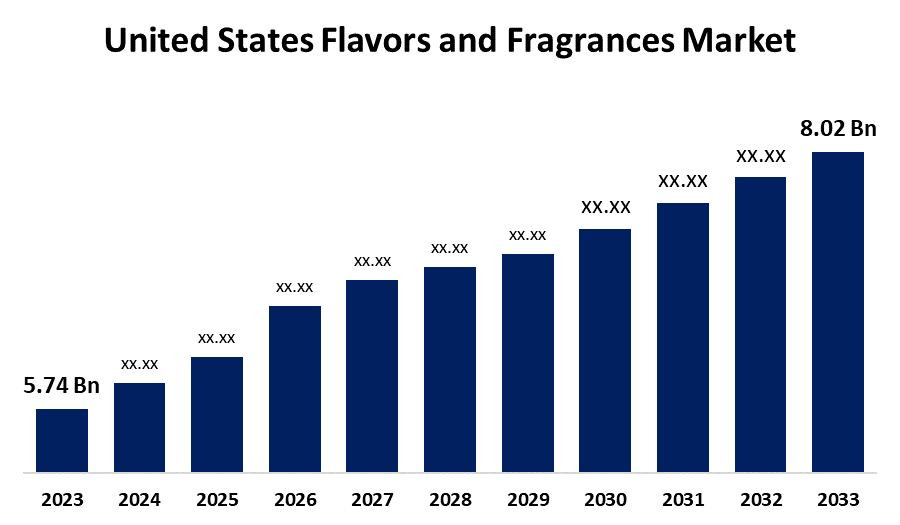

- The United States Flavors and Fragrances Market Size Was Estimated at USD 5.74 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.40% from 2023 to 2033

- The USA Flavors and Fragrances Market Size is Expected to Reach USD 8.02 Billion by 2033

Get more details on this report -

The United States Flavors and Fragrances Market Size is expected to reach USD 8.02 billion by 2033, growing at a CAGR of 3.40% from 2023 to 2033

Market Overview

The United States flavors and fragrances market encompasses the manufacturing and usage of both natural and synthetic components to improve the taste, aroma, and sensory appeal of different products. These consist of food, drinks, cosmetics, personal care products, and household goods. This growth can be ascribed to the increasing use of various flavors and fragrances in the creation of exquisite perfumes and odors. The growing demand for preferences and fragrances for usage in cosmetics, personal care items, and drinks is also anticipated to fuel market expansion. Additionally, the market for flavors and fragrances is expanding because of the growing demand for natural products, awareness of environmental sustainability, and eco-friendly substitutes. The industry is being driven by businesses spending money on R&D to replace artificial flavors and scents. Furthermore, innovative flavors and fragrance delivery methods, including controlled release mechanisms and encapsulation technologies, are being offered priority to fulfill changing consumer demands and enhance product performance, stability, and lifespan.

Report Coverage

This research report categorizes the market for the U.S. flavors and fragrances market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US flavors and fragrances market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA flavors and fragrances market.

United States Flavors and Fragrances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.74 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 3.40% |

| 023 – 2033 Value Projection: | USD 8.02 Billion |

| Historical Data for: | 2019-202 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Application |

| Companies covered:: | International Flavors & Fragrances Inc., Young Living Essential Oils, Alpha Aromatics, BASF SE, Archer-Daniels-Midland Company, Ungerer & Company, Vigon International, Inc., Elevance Renewable Sciences, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The US flavors and fragrances market is primarily driven by the consumers' changing lifestyles and rising disposable income has increased the desire to spend money on high-end flavors and perfumes for a range of uses. Additionally, digital marketing and e-commerce platforms are transforming the way consumers find and purchase fragrances and flavors by offering marketers the opportunity to interact directly with consumers, reach a larger audience, and offer individualized purchasing experiences. Furthermore, by utilizing technology, brands are providing consumers with customized fragrance and flavor options, enabling them to customize products to suit their preferences. The desire for distinctive and customized experiences in a crowded market is reflected in this trend.

Restraining Factors

The market for flavors and fragrances in the United States is constrained by several reasons, such as the volatile cost of raw materials. In addition, stringent regulations governing the use of artificial chemicals and additions may hinder the creation of new products. Additionally, the manufacturing of natural flavors and fragrances has raised environmental issues such as resource depletion and unsustainable farming methods, which has prompted demands for sustainable production and sourcing methods.

Market Segmentation

The U.S. flavors and fragrances market share is classified into product and application.

- The natural segment holds the largest market share of 71.25% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the U.S. flavors and fragrances market is divided into natural and aroma chemicals. Among these, the natural segment holds the largest market share of 71.25% in 2023 and is expected to grow at a significant CAGR during the forecast period. The market is anticipated to grow during the forecast period due to rising demand for natural essential oils in the skincare and cosmetics industries. Additionally, the demand for essential oils from end-use sectors is also expected to rise as consumers' preferences for natural and organic products grow.

- The fragrances segment accounted for the highest market share of 47.63% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the application, the U.S. flavors and fragrances market is categorized into fragrances and flavors. Among these, the fragrances segment accounted for the highest market share of 47.63% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. The high level of disposable income in the United States and the ensuing demand for high-end cosmetics, toiletries, and perfumes are the primary drivers of this segment's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. flavors and fragrances market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- International Flavors & Fragrances Inc.

- Young Living Essential Oils

- Alpha Aromatics

- BASF SE

- Archer-Daniels-Midland Company

- Ungerer & Company

- Vigon International, Inc.

- Elevance Renewable Sciences, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In January 2025, IFF unveiled IFF NEO™, a natural flavor collection free of citrus-derived components.

Market Segment

- This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. flavors and fragrances market based on the below-mentioned segments

U.S. Flavors and Fragrances Market, By Product

- Natural

- Aroma Chemicals

U.S. Flavors and Fragrances Market, By Application

- Fragrances

- Flavors

Need help to buy this report?