United States Frequency Converter Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Static and Rotary), By End-User (Aerospace and Defense, HVAC, Marine, Metal and Mining, Power Generation, and Others), and United States Frequency Converter Market Insights, Industry Trend, Forecasts to 2033.

Industry: Electronics, ICT & MediaUnited States Frequency Converter Market Insights Forecasts to 2033

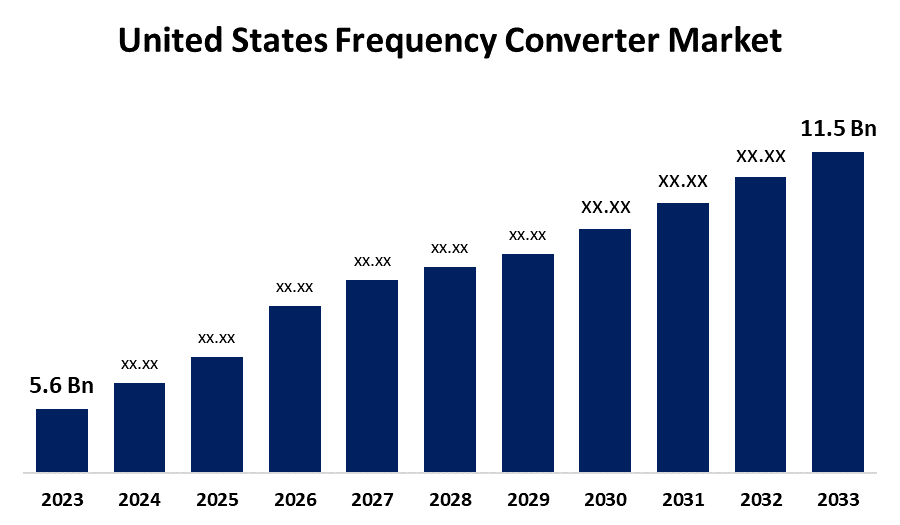

- The US Frequency Converter Market Size was valued at USD 5.6 Billion in 2023.

- The Market is growing at a CAGR of 7.46% from 2023 to 2033

- The U.S. Frequency Converter Market Size is Expected to reach USD 11.5 Billion by 2033

Get more details on this report -

The United States Frequency Converter Market Size is anticipated to Exceed USD 11.5 Billion by 2033, Growing at a CAGR of 7.46% from 2023 to 2033.

Market Overview

Electromechanical devices called frequency converters or frequency changers change the frequency of alternating current (AC). It is a power conversion device that outputs variable frequency and voltage from sine-wave or line power with fixed frequency and voltage. Frequency converters can handle power levels ranging from a few volts to megawatts. To provide the proper frequency modification, they combine semiconductors and diodes. The main purposes are to lessen the mechanical and electrical strain on the apparatus and its subcomponents and to regulate the process's temperature, torque, and speed without needing a separate controller. It does away with the requirement for additional throttle valves and dampers and lowers equipment maintenance expenses. An AC frequency converter, often known as a frequency changer is used in industrial applications to ensure that the power supply frequency matches the frequency needed by the machinery or equipment it is linked to. Reducers, inverters, isolation transformers, power filters, and electromagnetic interference filters are a few of the often-found parts of frequency converters. Due to their ability to cut electricity use by 20–50%, frequency converters are primarily used in industrial applications to provide effective energy usage control, which drives the US frequency converter market. Furthermore, the US government is moving toward sustainable infrastructure, emphasizing energy efficiency and conservation more than before.

Report Coverage

This research report categorizes the market for the United States frequency converter market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the frequency converter market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the frequency converter market.

United States Frequency Converter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.46% |

| 2033 Value Projection: | USD 11.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-User |

| Companies covered:: | General Electric Company, Eaton Corporation plc, S&C Electric Company, L3Harris Technologies, Inc, Chroma ATE Inc., AMETEK, Inc., Siemens, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

A major driver of the United States frequency converter market is the growing emphasis on energy efficiency and reducing carbon emissions. Frequency converters play an important role in achieving energy efficiency by allowing precise control over the speed and torque of electric motors that are ubiquitous in industrial applications. Frequency converters enable variable speed control, allowing motors to operate only at the required speed, thereby reducing energy consumption. This not only reduces operational costs but also contributes to reducing greenhouse gas emissions. Regulatory frameworks and government initiatives aimed at promoting energy efficiency and sustainability are adopting frequency converters. The U.S. The Department of Energy (DOE) and the Environmental Protection Agency (EPA) have implemented various programs and standards to promote the use of energy-efficient technologies.

Restraining Factors

One of the primary deterrents is the high initial cost associated with purchasing and installing a frequency converter. Moreover, frequency converter implementation entails technological complexity that calls for specific knowledge and experience.

Market Segmentation

The United States frequency converter market share is classified into product type and end-user.

- The static segment is expected to hold the largest market share through the forecast period.

The United States frequency converter market is segmented by product type into static and rotary. Among them, the static segment is expected to hold the largest market share through the forecast period. There are some compact and reasonably priced static frequency converters available. Their independence from fluctuations in the voltage power supply allows them to generate a wide range of voltage for static frequency converters with excellent control, while also taking up less space and making less noise than mechanical converters with heavy gear. Loads requiring fixed-frequency AC power are fed via static frequency converters.

- The metal and mining segment dominates the market with the largest market share over the predicted period.

The United States frequency converter market is segmented by end-user into aerospace and defense, HVAC, marine, metal and mining, power generation, and others. Among them, the metal and mining segment dominates the market with the largest market share over the predicted period. The metals industry uses a variety of power electronics, including frequency converters, in numerous applications. The process of making metal products includes multiple processes, from processing raw materials to storing them. Frequency converters are used by many large motors, and the speed is continuously changed as needed.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States frequency converter market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Electric Company

- Eaton Corporation plc

- S&C Electric Company

- L3Harris Technologies, Inc

- Chroma ATE Inc.

- AMETEK, Inc.

- Siemens

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, before Hannover Messe 2023, Siemens expanded its Sinamics family with the addition of the high-performance Sinamics G220 frequency converter. The cutting-edge frequency converters have what's known as pure power technology. Without the use of DC link chokes or line harmonics, harmonics can be reduced by up to 97%.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Frequency Converter Market based on the below-mentioned segments:

United States Frequency Converter Market, By Product Type

- Static

- Rotary

United States Frequency Converter Market, By End-User

- Aerospace and Defense

- HVAC

- Marine

- Metal and Mining

- Power Generation

- Others

Need help to buy this report?