United States Frozen Fruits and Vegetables Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Frozen Fruits and Frozen Vegetables), By Distribution Channel (Supermarkets and Hypermarkets, Independent Retailers, Convenience Stores, Online, and Others), and United States Frozen Fruits and Vegetables Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesUnited States Frozen Fruits and Vegetables Market Insights Forecasts to 2033

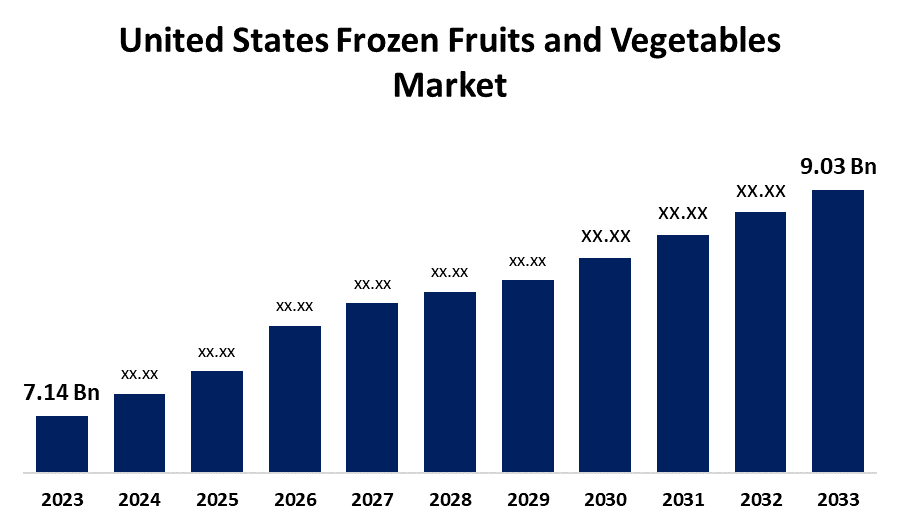

- The US Frozen Fruits and Vegetables Market Size was valued at USD 7.14 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.38% from 2023 to 2033

- The U.S. Frozen Fruits and Vegetables Market Size is Expected to Reach USD 9.03 Billion by 2033

Get more details on this report -

The United States Frozen Fruit and Vegetables Market Size is Anticipated to Exceed USD 9.03 Billion by 2033, Growing at a CAGR of 2.38% from 2023 to 2033.

Market Overview

Freezing is the most effective way to maintain food and vegetable's flavor, texture, and nutritional content. The process of freezing combines the advantages of low temperatures which prevent the growth of microorganisms with the delaying of chemical reactions and the reduction of cellular metabolic processes. Overextended durations of storage, agricultural products maintain their quality due to freezing preservation. When it comes to maintaining the sensory qualities and nutritional qualities of fruits and vegetables over an extended period of time, freezing is typically seen to be preferable to canning and dehydration. When premium raw ingredients are utilized, good manufacturing procedures are applied during the preservation process, and the products are stored at predetermined temperatures, the safety and nutritional quality of frozen foods are prioritized. Consumers' growing preferences for frozen goods, along with their curiosity about more information and want to try different nutritional values, are the main factors driving the frozen fruits and vegetables market.

Report Coverage

This research report categorizes the market for the United States frozen fruits and vegetables market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US frozen fruits and vegetables market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US frozen fruits and vegetables market.

United States Frozen Fruits and Vegetables Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.14 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.38% |

| 2033 Value Projection: | USD 9.03 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 166 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Alasko, Anacapa Foods, LLC, Cargill Incorporated, Dole Packaged Foods, LLC, Del Mar Food Products Corp, FGM FROZEN FOODS, LLC, Firestone Pacific Foods, Inc., General Mills (Cascadian Farm Organic), Goya Foods, Inc., J.R. Simplot Company, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Convenience plays a significant role in the frozen fruits and vegetables business in North America by offering consumers ready-to-eat products that require little preparation. Due to their extended shelf life and simplicity of preparation, 83% of frozen food consumers purchase these items as alternatives, according to research from the American Frozen Food Institute. Many households and demographic groups find it easier to raise their intake of food and decrease their food waste when fruits and vegetables are frozen. Overall, penetration in the United States is substantial, with 94% of households purchasing frozen fruits and vegetables. Moreover, market expansion is driven by consumer desire for seasonal fruits that are available throughout the year. Fruits that are out of season can be enjoyed by consumers due to the freezing process, which offers a varied and consistent selection of fruit selections.

Restraining Factors

The high price of purchasing freezing equipment could be a major hindrance to the expansion of the frozen fruit and vegetable business in the United States. Moreover, frozen foods have a variety of preservatives that have an impact on human health, which is another significant issue anticipated to hinder the US frozen fruits and veggies market's expansion.

Market Segmentation

The United States frozen fruits and vegetables market share is classified into product type and distribution channel.

- The frozen vegetables segment is expected to hold a significant market share through the forecast period.

The United States frozen fruits and vegetables market is segmented by product type into frozen fruits and frozen vegetables. Among them, the frozen vegetables segment is expected to hold a significant market share through the forecast period. The popularity of this category is due to its longer shelf life, convenience, and nutritional content retention as compared to fresh food. With their year-round availability, frozen veggies satisfy a wide range of dietary requirements and culinary demands in both homes and the food service industry.

- The supermarkets and hypermarkets segment is anticipated to hold a significant market share over the predicted period.

The United States frozen fruits and vegetables market is segmented by distribution channel into supermarkets and hypermarkets, independent retailers, convenience stores, online, and others. Among them, the supermarkets and hypermarkets segment is anticipated to hold a significant market share over the predicted period. Supermarkets and hypermarkets offer a consolidated setting where customers can shop and buy frozen goods; these platforms are frequently enhanced by marketing campaigns and aggressive price tactics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States frozen fruits and vegetables market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alasko

- Anacapa Foods, LLC

- Cargill Incorporated

- Dole Packaged Foods, LLC

- Del Mar Food Products Corp

- FGM FROZEN FOODS, LLC

- Firestone Pacific Foods, Inc.

- General Mills (Cascadian Farm Organic)

- Goya Foods, Inc.

- J.R. Simplot Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Sunrise Growers' subsidiary SunOpta Inc.'s frozen fruit division has been acquired by Nature's Touch. Founded in 2004, Nature's Touch is one of the world's top retailers of frozen fruits, both conventional and organic. The company recently invested in a new plant in Virginia and operates packaging and freezing facilities in both Canada and the United States.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Frozen Fruits and Vegetables Market based on the below-mentioned segments:

United States Frozen Fruits and Vegetables Market, By Product Type

- Frozen Fruits

- Frozen Vegetables

United States Frozen Fruits and Vegetables Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Independent Retailers

- Convenience Stores

- Online

- Others

Need help to buy this report?