United States Frozen Pizza Market Size, Share, and COVID-19 Impact Analysis, By Toppings (Margherita, Chicken, Pepperoni, Sicilian, Bacon, and Breakfast), By Crust (Thin, Regular/Restaurant Style, and Gluten-free), and United States Frozen Pizza Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesUnited States Frozen Pizza Market Insights Forecasts to 2033

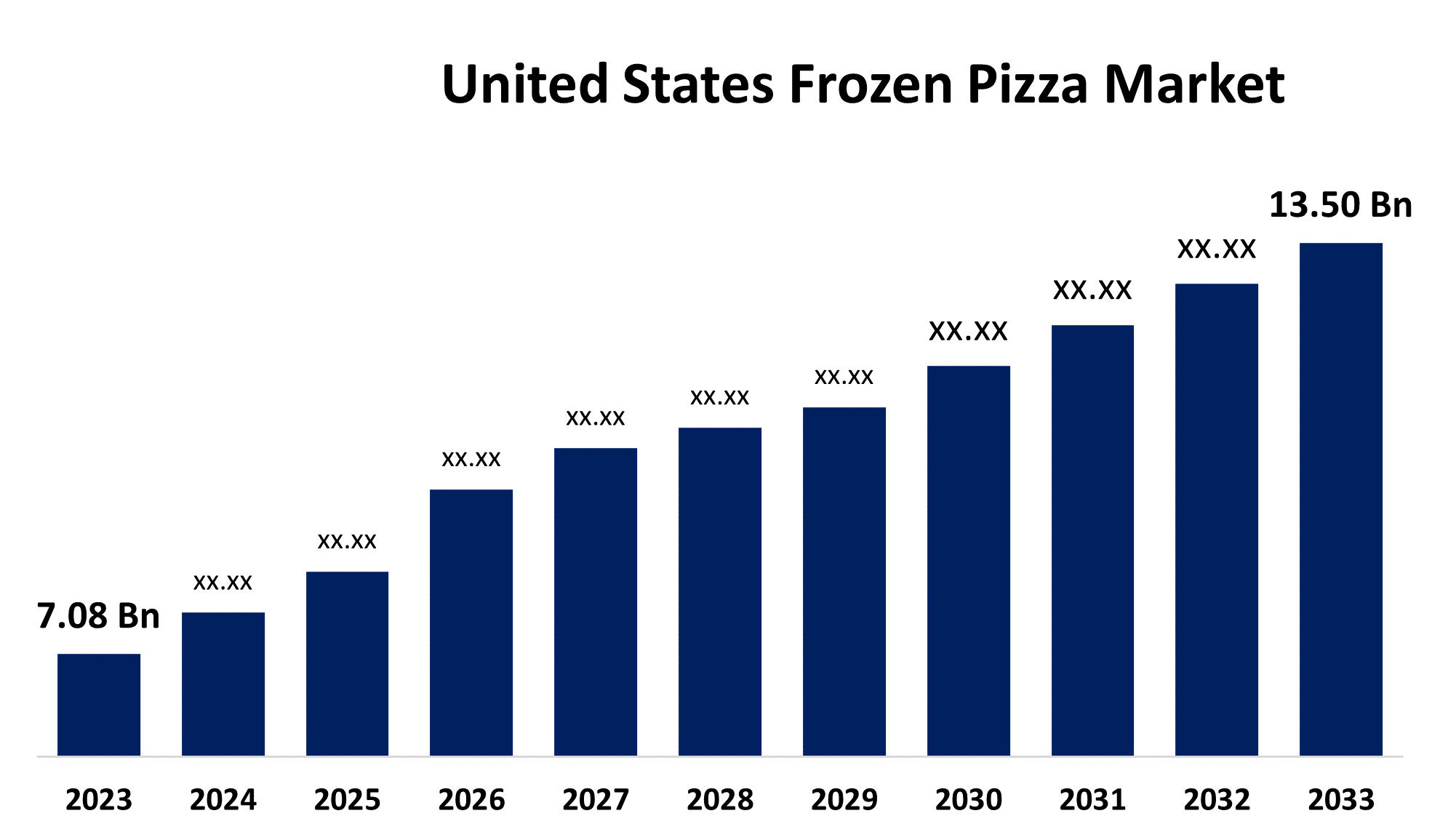

- The United States Frozen Pizza Market Size was valued at USD 7.08 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.67% from 2023 to 2033

- The United States Frozen Pizza Market Size is Expected to reach USD 13.50 Billion by 2033

Get more details on this report -

The United States Frozen Pizza Market Size is anticipated to exceed USD 13.50 Billion by 2033, growing at a CAGR of 6.67% from 2023 to 2033.

Market Overview

Pizzas that have been prepared, cooked, and frozen for later consumption are known as frozen pizzas. Usually, a pre-baked crust is used, and sauce, cheese, and other toppings are added. In the US, there is a vast array of items available in the frozen pizza industry, including specialty pizzas, classic pizzas, and healthier options like organic or gluten-free pizzas. Pizza bits or rolls, family-sized pizzas, and individual-sized pizzas are among the various shapes and sizes of these pizzas. The growth has been fueled by consumers' need to look for convenient food options due to their busy lifestyles. Additional drivers of the growth include rising living standards and more discretionary cash. There are various varieties of frozen pizzas available. These consist of deep-dish, stuffed, rising, classic/thick, extra-thin, and ordinary thin crusts. The popularity of gluten-free frozen pizzas has been attributed to increased health consciousness among consumers and the prevalence of gluten allergies. Homeowners' increasing desire to create an indoor environment outdoors has increased demand for the product. There are numerous variations of frozen pizza, including regular thin crust, ultra-thin crust, deep dish, classic/thick crust, packed crust, and rising crust. The rise in health consciousness among consumers and the frequency of gluten intolerance has contributed to the popularity of gluten-free frozen pizzas.

Report Coverage

This research report categorizes the market for the United States frozen pizza market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the frozen pizza market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the frozen pizza market.

United States Frozen Pizza Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 7.08 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.67% |

| 2033 Value Projection: | USD 13.50 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Toppings, By Crust |

| Companies covered:: | Amy’s Kitchen, Inc., Schwan’s Consumer Brands, Inc., Bellisio Foods, Inc., Hansen Foods, LLC, Ajinomoto Foods North America, Frozen Specialties Inc., Richelieu Foods, Inc., K.T.’s Kitchens Inc., Champion Foods, LLC, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The food and beverage business has experienced significant development, and one of the main factor contributing to the market's bright outlook is the busy schedules of Americans who work. The demand for frozen pizza is rising as a result of customers' preference for ready-to-eat (RTE) and convenience foods due to their busy lifestyles. Moreover, several product developments are fostering market expansion, including the creation of whole wheat and multigrain varieties with low or no chemical preservatives, fat, or trans-fat. To satisfy the needs of customers who are lactose intolerant, product makers are also creating frozen pizzas that are free of gluten and dairy. Further drivers that are expected to propel the industry include customers' increasing purchasing power and the growing appeal of fast food, particularly among millennials.

Restraining Factors

As frozen pizzas are frequently linked to high sodium, saturated fat, and preservative content, they might turn off health-conscious consumers. The frozen pizza sector is being challenged by well-known pizzerias that offer fresh pizza delivery services. Some customers might decide not to buy frozen pizza because they believe it to be of worse quality than fresh pizza.

Market Segmentation

The United States frozen pizza market share is classified into toppings and crust.

- The chicken segment is expected to hold the largest market share through the forecast period.

The United States frozen pizza market is segmented by toppings into margherita, chicken, pepperoni, sicilian, bacon, and breakfast. Among them, the chicken segment is expected to hold the largest market share through the forecast period. Because it offers a fresh flavor alternative and boosts the meal's protein content, chicken topping is more popular than other conventional toppings. One might create unique flavor combinations by seasoning chicken in a variety of ways, making it a versatile topping. On top of that, chicken is regarded as a healthier lean protein option compared to some other toppings like pepperoni or sausage. The rise in fast-casual dining establishments and the movement toward healthier eating have also contributed to the popularity of chicken topping. Many now consider chicken topping to be a healthier option than typical toppings as a result of the popularity of these trends.

- The regular/restaurant style segment dominates the market with the largest market share over the predicted period.

The United States frozen pizza market is segmented by crust into thin, regular/restaurant style, and gluten-free. Among them, the regular/restaurant style segment dominates the market with the largest market share over the predicted period. Due to its traditional flavor, sizable serving size, adaptable toppings, ease of use, and social element, frozen pizza, whether regular or restaurant-style, is highly favored by customers. The most delicious meal option is regular pizza, which has had its classic flavor enhanced throughout the years in pizzerias and restaurants.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States frozen pizza market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amy's Kitchen, Inc.

- Schwan's Consumer Brands, Inc.

- Bellisio Foods, Inc.

- Hansen Foods, LLC

- Ajinomoto Foods North America

- Frozen Specialties Inc.

- Richelieu Foods, Inc.

- K.T.'s Kitchens Inc.

- Champion Foods, LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2022, To expand its selection of products available for home delivery, Schwan's Consumer Brands, Inc. introduced five additional frozen pies and pizzas.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Frozen Pizza Market based on the below-mentioned segments:

United States Frozen Pizza Market, By Toppings

- Margherita

- Chicken

- Pepperoni

- Sicilian

- Bacon

- Breakfast

United States Frozen Pizza Market, By Crust

- Thin

- Regular/Restaurant Style

- Gluten-free

Need help to buy this report?