United States Fundus Camera Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Mydriatic Fundus Cameras, Non-Mydriatic Fundus Cameras, Hybrid Fundus Cameras, and ROP Fundus Cameras), By Portability (Handheld and Tabletop), By Application (Diabetic Retinopathy, Age-Related Macular Degeneration, Retinal Vascular Disorders, and Others), By End User (Hospitals, Ophthalmology Centers, and Others), and United States Fundus Camera Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Fundus Camera Market Insights Forecasts to 2033

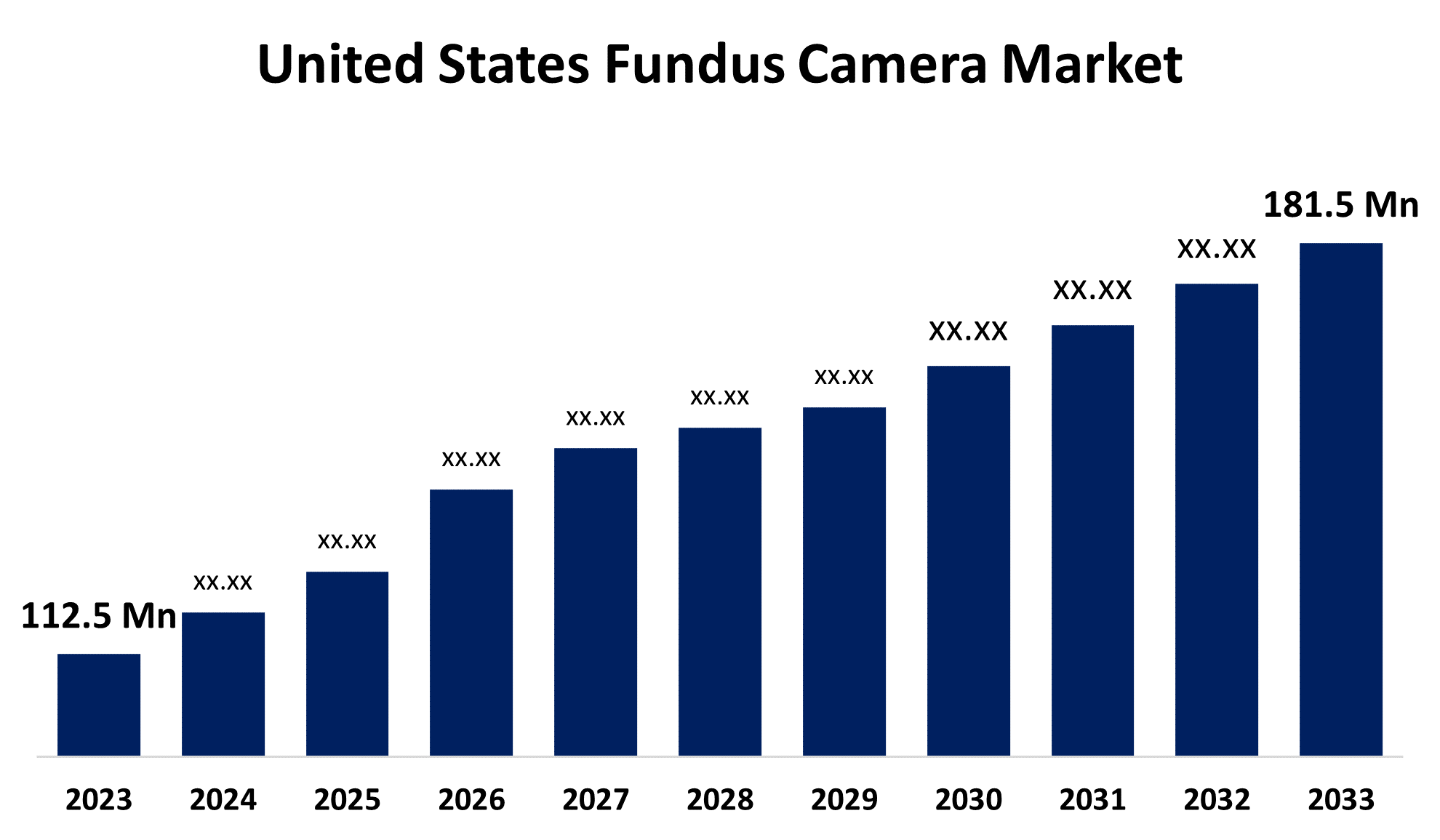

- The U.S. Fundus Camera Market Size was valued at USD 112.5 Million in 2023.

- The Market Size is Growing at a CAGR of 4.90% from 2023 to 2033

- The U.S. Fundus Camera Market Size is Expected to reach USD 181.5 Million by 2033

Get more details on this report -

The United States Fundus Camera Market is anticipated to exceed USD 181.5 Million by 2033, growing at a CAGR of 4.90% from 2023 to 2033. The growing diabetic retinopathy screening procedures are driving the growth of the fundus camera market in the US.

Market Overview

Fundus cameras are specialist medical devices that are used to capture images of the retina, optic disc, macula, and blood vessels in the back of the eye. It is a type of low-power, specialized microscope that has a camera connected to it. The anterior portion of the eye is also photographed using this instrument. Fundus photography has an impact on the screening and diagnosis of several treatable and avoidable causes of blindness, including retinopathy of prematurity, glaucoma, age-related macular degeneration, and diabetic retinopathy. The fundus camera aids the ophthalmologist in capturing color images of the inside surface of the eye to record the existence of conditions and track changes in those conditions over time. There is a substantial trend in the integration of AI with fundoscopy, as there are ongoing efforts to investigate the potential of AI-assisted diabetic retinopathy diagnosis based on fundus images.

Report Coverage

This research report categorizes the market for the US fundus camera market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States fundus camera market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US fundus camera market.

United States Fundus Camera Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 112.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.90% |

| 2033 Value Projection: | USD 181.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 209 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Portability, By Application, By End User |

| Companies covered:: | Topcon Corp, Nikon Corp, Canon Inc, Carl Zeiss AG, Visionix USA Inc, NIDEK CO LTD, Kowa Co Ltd, CenterVue SpA, Volk Optical Inc, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

According to the Medscape article, proliferative diabetic retinopathy affects around 700,000 people in the US each year, with an incidence of 65,000 cases. Among those 40 years of age or older, the prevalence of diabetic retinopathy in the United States is 28.5%. Thus, the increasing incidences of diabetic retinopathy in the country are responsible for driving the market. In addition, the government's support of the visually impaired population, the introduction of novel products, and the rise in eye-related disorders are the factors responsible for driving the growth of the fundus camera market.

Restraining Factors

The biased fundus photography leads to inaccurate clinical diagnosis, which is expected to restrain the market for fundus camera.

Market Segmentation

The United States Fundus Camera Market share is classified into product type, portability, application, and end user.

- The mydriatic fundus cameras segment dominates the market with the largest market share in 2023.

The United States Fundus Camera market is segmented by product type into mydriatic fundus cameras, non-mydriatic fundus cameras, hybrid fundus cameras, and ROP fundus cameras. Among these, the mydriatic fundus cameras segment dominates the market with the largest market share in 2023. A mydriatic fundus camera enhances a practitioner's capacity to see and observe intricate retinal anatomy, which helps in eye disease diagnosis and treatment. Technological advancements and innovations are contributing to driving the market.

- The tabletop segment is expected to witness the fastest CAGR growth during the forecast period.

The United States fundus camera market is segmented by portability into handheld and tabletop. Among these, the tabletop segment is expected to witness the fastest CAGR growth during the forecast period. A fundus camera, also known as a retinal camera, enables medical professionals to see the retina in greater detail and record findings. The benefits of fundus cameras, providing patient-friendly photography by eliminating the need for strong lights and dilating drops are propelling the market.

- The diabetic retinopathy segment accounted for the largest market share in 2023.

The United States fundus camera market is segmented by application into diabetic retinopathy, age-related macular degeneration, retinal vascular disorders, and others. Among these, the diabetic retinopathy segment accounted for the largest market share in 2023. Fundus cameras are used for the detection and screening of various causes of treatable and preventable blindness, notably diabetic retinopathy.

- The hospitals segment dominates the US fundus camera market with the largest market share in 2023.

Based on the end user, the U.S. fundus camera market is divided into hospitals, ophthalmology centers, and others. Among these, the hospitals segment dominates the US fundus camera market with the largest market share in 2023. Various anomalies of the central nervous system are diagnosed by fundus photography. The introduction of multiple cutting-edge solutions to optimize hospital usage is responsible for driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. fundus camera market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Topcon Corp

- Nikon Corp

- Canon Inc

- Carl Zeiss AG

- Visionix USA Inc

- NIDEK CO LTD

- Kowa Co Ltd

- CenterVue SpA

- Volk Optical Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Optomed USA launched Optomed Aurora AEYE, a handheld AI fundus camera designed to instantly detect more than mild diabetic retinopathy. The device enables on-the-spot eye screenings for diabetic patients in primary care settings before being referred to an eye care professional.

- In June 2021, Coburn Technologies, a leading provider of innovative, end-to-end customer solutions to the world’s ophthalmic lens processing industries and eye care professionals, introduced the HFC-1 Non-Mydriatic Fundus Camera, a new retinal camera manufactured by Huvitz, Co. Ltd. with highly accurate autodetection technology for sharp, quick and reliable retinal imaging and measurements.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Fundus Camera Market based on the below-mentioned segments:

US Fundus Camera Market, By Product Type

- Mydriatic Fundus Cameras

- Non-Mydriatic Fundus Cameras

- Hybrid Fundus Cameras

- ROP Fundus Cameras

US Fundus Camera Market, By Portability

- Handheld

- Tabletop

US Fundus Camera Market, By Application

- Diabetic Retinopathy

- Age-Related Macular Degeneration

- Retinal Vascular Disorders

- Others

US Fundus Camera Market, By End User

- Hospitals

- Ophthalmology Centers

- Others

Need help to buy this report?