United States Furnace Filters Market Size, Share, and COVID-19 Impact Analysis, By MERV (1-7 MERV, 8 MERV, 11 MERV, 13 MERV, 14-16 MERV, and Above 17 MERV), By Filter Type (Electrostatic Filters, Fiber Glass Filters, Activated Carbon Filters, and Others), By Filter Thickness (1 Inch Filter, 2 Inch Filter, 4 Inch Filter, and Others), By Distribution Channel (Wholesale Stores, Retail Stores, Online Stores, and Others), By End-use (Residential and Commercial), and U.S. Furnace Filters Market Insights, Industry Trend, Forecasts to 2033.

Industry: Advanced MaterialsUnited States Furnace Filters Market Insights Forecasts to 2033

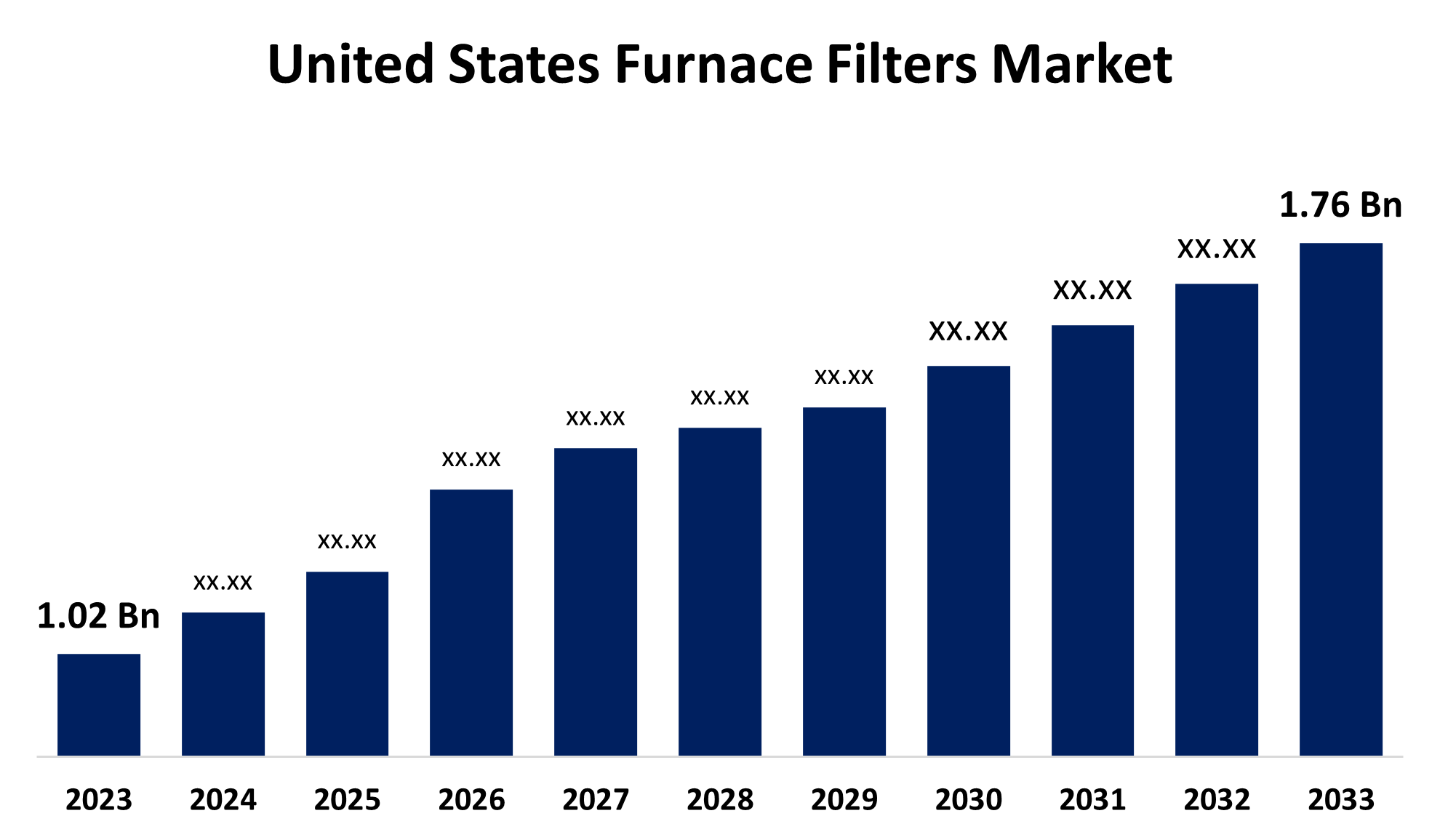

- The United States Furnace Filters Market Size Was Estimated at USD 1.02 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.61% from 2023 to 2033

- The USA Furnace Filters Market Size is Expected to Reach USD 1.76 Billion by 2033

Get more details on this report -

The United States Furnace Filters Market Size is expected to reach USD 1.76 billion by 2033, growing at a CAGR of 5.61% from 2023 to 2033.

Market Overview

The industry that produces, distributes, and sells filters, particularly for furnaces used in HVAC (heating, ventilation, and air conditioning) systems is referred to as the U.S. furnace filters market. By capturing dust, dirt, and other airborne particles, these filters promise better indoor air and support the upkeep of heating systems' performance. Furnace filters come in a variety of sizes and filter ratings to accommodate different kinds of furnaces. They are usually constructed from a variety of materials, including fiberglass, pleated paper, cotton, and synthetic textiles. The market is expanding due to the rising demand for high-efficiency filters, specifically MERV-rated filters, which can capture allergens and small particles to improve indoor air quality. In addition, growing consumer awareness of the health advantages of cleaner air has increased worries about respiratory disorders and airborne infections. Furthermore, technological developments, consumer awareness, and environmental concerns are driving notable growth trends in the U.S. furnace filter market.

Report Coverage

This research report categorizes the market for the U.S. furnace filters market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US furnace filters market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA furnace filters market.

United States Furnace Filters Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.02 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.61% |

| 2033 Value Projection: | USD 1.76 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Filter Type, By Filter Thickness, By Distribution Channel, By End-use |

| Companies covered:: | 3M, Honeywell International Inc., Carrier, Lennox International Inc., Good Filter Company, Filtration Manufacturing Inc., DAIKIN INDUSTRIES Ltd., Trane Technologies plc, Aprilaire, Nordic Pure, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growing consumer consciousness of the significance of indoor air quality is driving the furnace filter market in the United States. Additionally, the demand for sophisticated filters that enhance the quality of the air in homes and businesses is further fueled by the growing incidence of respiratory diseases like allergies and asthma. In addition, customers are also being encouraged to purchase high-performance filters to preserve system efficiency as energy-efficient HVAC systems become more widely used. Furthermore, the growth of subscription-based services for filter replacements offers manufacturers an opportunity to build enduring relationships with customers and offer convenience, capitalizing on the expanding e-commerce and direct-to-consumer business model trends.

Restraining Factors

The USA furnace filters market faces challenges due to the total cost of ownership being increased by the need for regular maintenance or replacement of certain filters. Customers looking for low-maintenance, more cheap choices may find this to be a major obstacle. In addition, the high initial cost of high-end filters, especially those with MERV and HEPA ratings, is a major barrier to the U.S. furnace filter market. Furthermore, these filters offer better filtering, their higher price points may put off budget-conscious buyers, particularly in the home market.

Market Segmentation

The U.S. furnace filters market share is classified into the MERV, filter type, filter thickness, distribution channel, and end-use.

- The 11 MERV segment accounted for the largest share of 34.72% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the MERV, the U.S. furnace filters market is divided into 1-7 MERV, 8 MERV, 11 MERV, 13 MERV, 14-16 MERV, and Above 17 MERV. Among these, the 11 MERV segment accounted for the largest share of 34.72% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to MERV 11 filters offering medium-efficiency filtration, catching at least 85% of particles in the 3.0–10.0 micrometer range. In addition, they also capture finer particles, such as fine dust, pet hair, and some germs. These filters are perfect for household use, particularly for homeowners with respiratory or allergy issues.

- The electrostatic filters segment accounted for the highest share of 27.58% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the filter type, the U.S. furnace filters market is divided into electrostatic filters, fiberglass filters, activated carbon filters, and others. Among these, the electrostatic filters segment accounted for the highest share of 27.58% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing because electrostatic filters are reusable and more effective than conventional disposable filters, they are becoming more and more popular. Additionally, electrostatic filters' primary benefit is their reusable and clean nature, which lowers waste and makes them more eco-friendly than disposable alternatives.

- The 1-inch filter segment accounted for the largest share of 40.59% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the filter thickness, the U.S. furnace filters market is divided into 1-inch filter, 2-inch filter, 4-inch filter, and others. Among these, the 1-inch filter segment accounted for the largest share of 40.59% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is expanding due to the most popular and extensively utilized filters are 1-inch ones, particularly in home HVAC systems. These filters are small and simple to install in a range of furnace types. In addition, since they are usually less costly than thicker filters, they are an affordable choice for homeowners who value cost above long-term effectiveness.

- The retail store segment accounted for the largest share of 44.28% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the U.S. furnace filters market is divided into wholesale stores, retail stores, online stores, and others. Among these, the retail store segment accounted for the largest share of 44.28% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is attributed to the United States, stores are frequently used to sell furnace filters, making it simple for customers to buy replacement filters for their HVAC systems. In addition, these shops give clients the option to buy filters in person, which enables them to choose a superior product after speaking with the staff or examining the product packaging.

- The residential segment accounted for the highest share of 78.32% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the U.S. furnace filters market is divided into residential and commercial. Among these, the residential segment accounted for the highest share of 78.32% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is ascribed to furnace filters are commonly utilized in many residences to maximize the efficiency of HVAC systems and enhance indoor air quality. In addition, in homes with allergy sufferers, HEPA or furnace filters with higher MERV ratings are frequently used to capture dust, pollen, and pet dander.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. furnace filters market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, business strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- Honeywell International, Inc.

- Carrier

- Lennox International, Inc.

- Good Filter Company

- Filtration Manufacturing, Inc.

- DAIKIN INDUSTRIES, Ltd.

- Trane Technologies plc

- Aprilaire

- Nordic Pure

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, Northeast Air Solutions was acquired by American Air Filter (AAF International), a division of DAIKIN INDUSTRIES, Ltd., to improve customer value and fortify commercial ties. The purpose of the acquisitions was to increase access to cutting-edge filtration technology and expertise by broadening its already wide network throughout the United States and Canada.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. furnace filters market based on the below-mentioned segments:

U.S. Furnace Filters Market, By MERV

- 1-7 MERV

- 8 MERV

- 11 MERV

- 13 MERV

- 14-16 MERV

- Above 17 MERV

U.S. Furnace Filters Market, By Filter Type

- Electrostatic Filters

- Fiber Glass Filters

- Activated Carbon Filters

- Others

U.S. Furnace Filters Market, By Filter Thickness

- 1 Inch Filter

- 2 Inch Filter

- 4 Inch Filter

- Others

U.S. Furnace Filters Market, By Distribution Channel

- Wholesale Stores

- Retail Stores

- Online Stores

- Others

U.S. Furnace Filters Market, By End-use

- Residential

- Commercial

Need help to buy this report?