United States Gas Detection Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product (Fixed and Portable), By Technology (Semiconductor and Catalytic), and United States Gas Detection Equipment Market Insights, Industry Trend, Forecasts to 2033

Industry: Semiconductors & ElectronicsUnited States Gas Detection Equipment Market Insights Forecasts to 2033

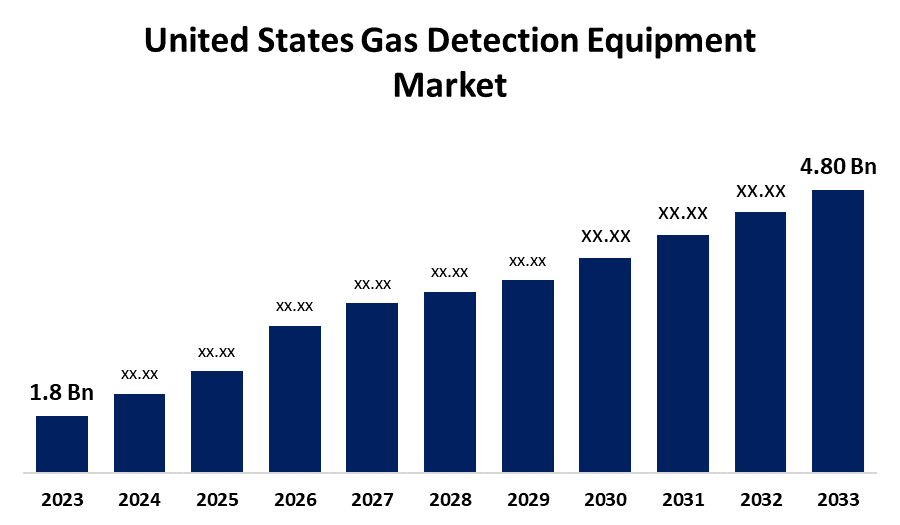

- The U.S. Gas Detection Equipment Market Size Was Valued at USD 1.8 Billion in 2023

- The United States Gas Detection Equipment Market Size is Growing at a CAGR of 10.31% from 2023 to 2033

- The USA Gas Detection Equipment Market Size is Expected to Reach USD 4.80 Billion By 2033

Get more details on this report -

The USA Gas Detection Equipment Market Size is Anticipated to Exceed USD 4.80 Billion By 2033, Growing at a CAGR of 10.31% from 2023 to 2033. The U.S. gas detection equipment market is growing with increased safety regulations, evolved sensor technologies, and the surging demand across industrial sectors with a promise to provide real-time monitoring, occupational safety, and environmental conservation.

Market Overview

The U.S. gas detection equipment market is the industry dedicated to the creation, production, and sale of equipment that detects and monitors harmful gases in industrial, commercial, and residential environments. The equipment maintains workplace safety, environmental protection, and regulatory compliance by detecting toxic, flammable, and oxygen-deficient gases in real time. Moreover, the US gas detection equipment market is on the cusp of growth driven by mounting workplace safety standards, innovation in IoT-based gas sensors, and escalating demand in oil & gas, manufacturing, and healthcare industries. The trend towards smart, real-time monitoring systems, automation integration, and increasing environmental awareness even more drives the market's growth and technological development. Furthermore, in instance October 2023, Sensata Technologies introduced the Sensata Resonix RGD sensor, the first UL-approved leak detection sensor for several A2L refrigerant gases employed in HVAC products. The product would address the needs of HVAC companies employing hydrofluoroolefin (HFO) refrigerants in place of hydro-fluorocarbon (HFC) refrigerants, as a way of reducing their contribution to global warming.

Report Coverage

This research report categorizes the market for the US gas detection equipment market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. gas detection equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA gas detection equipment market.

United States Gas Detection Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.31% |

| 2033 Value Projection: | USD 4.80 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product, By Technology and COVID-19 Impact Analysis |

| Companies covered:: | Siemens, Fluke Corporation, ABB, Honeywell International Inc., Teledyne Technologies Incorporated, Thermo Fisher Scientific, Inc., General Electric Company, Sensata Technologies, Lynred, Opgal Optronics Industries Limited, Airtest Technologies, Inc. and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The USA gas detection equipment market is bolstered by industrial automation growth, increased gas leak incidents, and heightened investments in occupational safety. Developments in wireless and artificial intelligence-based gas sensors, increases in renewable energy initiatives, and implementation of multi-gas detection systems also fuel demand in the oil & gas, chemicals, and manufacturing sectors. Moreover, AirTest Technologies Inc. produces and markets air monitoring equipment worldwide. The company provides different industries, such as oil & gas, food & beverages, healthcare, and automotive. AirTest Technologies has created sensors meant for commercial and industrial buildings. The products of the company for gas detection equipment use optical gas sensors. AirTest Technologies Inc. specializes in providing innovative wireless gas detection equipment through R&D efforts

Restraining Factors

The U.S. gas detection equipment market is held back by factors like high upfront investment, maintenance difficulties, low alarm rates, and poor uptake in small industries, discouraging large-scale adoption despite stricter safety measures.

Market Segmentation

The U.S. United States gas detection equipment market share is classified into product and technology.

- The portable segment accounted for the largest share of the US gas detection equipment market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of product, the United States gas detection equipment market is divided into fixed and portable. Among these, the portable segment accounted for the largest share of the United States gas detection equipment market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is driven by its versatility, simplicity, and increasing demand across industries such as oil & gas, mining, and manufacturing. The devices are suited for real-time monitoring, the safety of workers, and meeting rigorous regulatory standards, driving their universal adoption.

- The catalytic segment accounted for a substantial share of the U.S. gas detection equipment market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of technology, the U.S. gas detection equipment market is divided into semiconductor and catalytic. Among these, the catalytic segment accounted for a substantial share of the U.S. Gas Detection Equipment market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is driven by its excellent reliability, affordability, and broad application in the detection of combustible gases. Widely employed in oil & gas, chemical, and industrial plants, catalytic gas detectors are used to accurately and effectively detect gas leaks, providing workplace safety and compliance with regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA gas detection equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens

- Fluke Corporation

- ABB

- Honeywell International Inc.

- Teledyne Technologies Incorporated

- Thermo Fisher Scientific, Inc.

- General Electric Company

- Sensata Technologies

- Lynred

- Opgal Optronics Industries Limited

- Airtest Technologies, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Teledyne Gas and Flame Detection launched an IR sensor for its innovative OLCT 100 XPIR (explosion-proof IR) fixed gas detector that would provide effective and accurate methane detection measurements to the utility, industrial, and laboratory markets. The product launch is likely to combat the environmental and health problems that are posed by methane in these markets, in addition to the growing requirement for a lower alarm threshold

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US gas detection equipment market based on the below-mentioned segments:

United States Gas Detection Equipment Market, By Product

- Fixed

- Portable

United States Gas Detection Equipment Market, By Technology

- Semiconductor

- Catalytic

Need help to buy this report?