United States General Anesthesia Drugs Market Size, Share, and COVID-19 Impact Analysis, By Route of Administration (Inhalational and Intravenous), By End User (Hospitals and Ambulatory Surgery Centers), and United States General Anesthesia Drugs Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States General Anesthesia Drugs Market Insights Forecasts to 2033

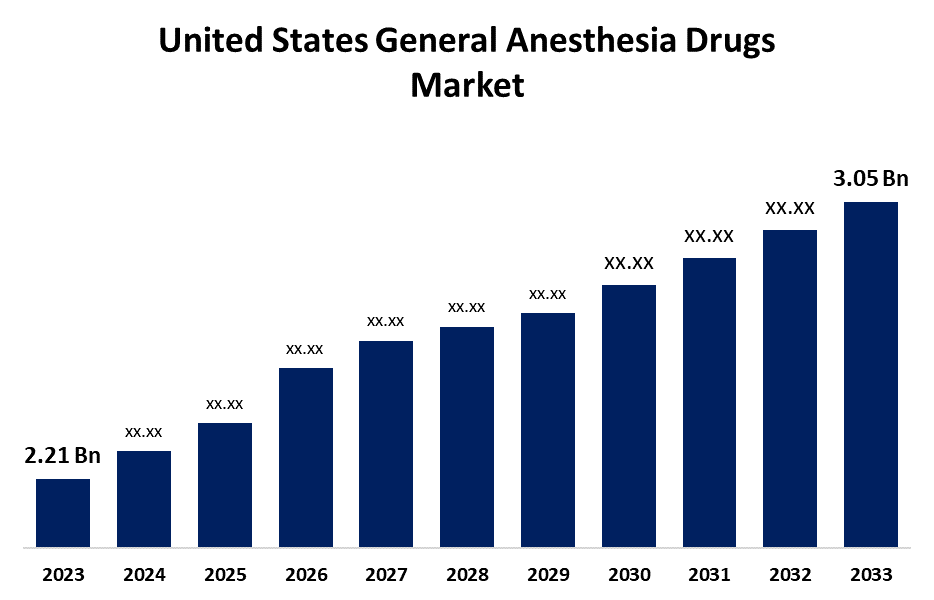

- The U.S. General Anesthesia Drugs Market Size was valued at USD 2.21 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.27% from 2023 to 2033

- The U.S. General Anesthesia Drugs Market Size is Expected to reach USD 3.05 Billion by 2033

Get more details on this report -

The United States General Anesthesia Drugs Market Size is anticipated to Exceed USD 3.05 Billion by 2033, Growing at a CAGR of 3.27% from 2023 to 2033. The Growing incidence of cancer, Growing geriatric population, and increasing number of emergency surgeries are driving the Growth of the general anesthesia drugs Market in the US.

Market Overview

General anesthesia drugs are used during surgical procedures to induce unconsciousness in patients by blocking the transmission of sensory, motor, and sympathetic nerves at the brain’s level. This leaves patients feeling unconscious, devoid of feeling, and unable to control reflexive movements or painful stimuli. The main objective of general anesthesia is to render the patient unconscious and painless during surgical procedures. The growing number of elderly patients in the country is responsible for an increasing number of surgical procedures for long-term conditions such as cancer, heart disease, and lung disorders. In addition, open surgeries including plastic surgery, orthopedics, obstetrics & gynecology, and other specialties are anticipated to rise. It therefore presents a chance for different producers to provide surgeons with cutting-edge anesthetic medications so they can carry out such procedures more effectively. The advancements in targeted drugs and drug delivery technology are supporting the market growth. Further, there is an upsurge in the number of chronic diseases, increasing product approvals, and the presence of general anesthesia drug manufacturers in the country. The increasing prioritization of developing innovative aesthetic drugs is upsurging market growth.

Report Coverage

This research report categorizes the market for the US general anesthesia drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States general anesthesia drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US general anesthesia drugs market.

United States General Anesthesia Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.21 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.27% |

| 2033 Value Projection: | USD 3.05 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Route of Administration, By End User |

| Companies covered:: | Baxter International Inc., Pfizer Inc., AbbVie, Par Pharmaceutical, Viatris/Mylan, Novartis AG, Abbott Laboratories, AstraZeneca plc, Gilead Sciences, Inc., Heritage Pharmaceuticals Inc., Akorn, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

As more people develop cancer, more surgeries will be performed since, in many cases, surgery is the only way to cure a tumor—especially if the cancer is localized. General anesthesia is frequently used for surgical operations to treat cancer. Thus, the rising incidence of cancer is expected to propel the market expansion. The proportion of geriatric patients is responsible for an increasing number of surgical procedures for treating chronic diseases which leads to the demand for general anesthesia drugs in complex procedures. In addition, the growing number of emergency surgeries in the country is responsible for driving the market growth for general anesthetics.

Restraining Factors

The serious adverse effects and the risks associated with the use of general anesthesia may hamper the market.

Market Segmentation

The United States General Anesthesia Drugs Market share is classified into route of administration and end user.

- The intravenous segment dominates the market with the largest market share during the forecast period.

The United States general anesthesia drugs market is segmented by route of administration into inhalational and intravenous. Among these, the intravenous segment dominates the market with the largest market share during the forecast period. Intravenous general anesthesia is more cost-effective than other segments. It produces less cardiovascular depression and offers better postoperative analgesia.

- The hospitals segment dominates the US general anesthesia drugs market with the largest market share during the forecast period.

Based on the end user, the U.S. general anesthesia drugs market is divided into hospitals and ambulatory surgery centers. Among these, the hospitals segment dominates the US general anesthesia drugs market with the largest market share during the forecast period. There is a massive patient pool in the hospitals due to increasing cases of chronic diseases. The growing number of surgeries in the country is responsible for accelerating the market demand in the hospitals segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. general anesthesia drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Baxter International Inc.

- Pfizer Inc.

- AbbVie

- Par Pharmaceutical

- Viatris/Mylan

- Novartis AG

- Abbott Laboratories

- AstraZeneca plc

- Gilead Sciences, Inc.

- Heritage Pharmaceuticals Inc.

- Akorn

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Fresenius Kabi announced it has introduced +RFID smart labels for Diprivan (Propofol) Injectable Emulsion, USP, 200 mg per 20 mL in single-dose vials, sold in the United States.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States General Anesthesia Drugs Market based on the below-mentioned segments:

US General Anesthesia Drugs Market, By Route of Administration

- Inhalational

- Intravenous

US General Anesthesia Drugs Market, By End User

- Hospitals

- Ambulatory Surgery Centers

Need help to buy this report?