United States Geosynthetics Market Size, Share, and COVID-19 Impact Analysis, By Product (Geotextiles, Geogrids, Geomembranes, Geonets, Geocells, Geofoams, Geosynthetic Clay Liners, and Others), By Application (Waste Management, Water Management, Transportation Infrastructure, and Civil Construction), and United States Geosynthetics Market Insights, Industry Trend, Forecasts to 2033

Industry: Construction & ManufacturingUnited States Geosynthetics Market Insights Forecasts to 2033

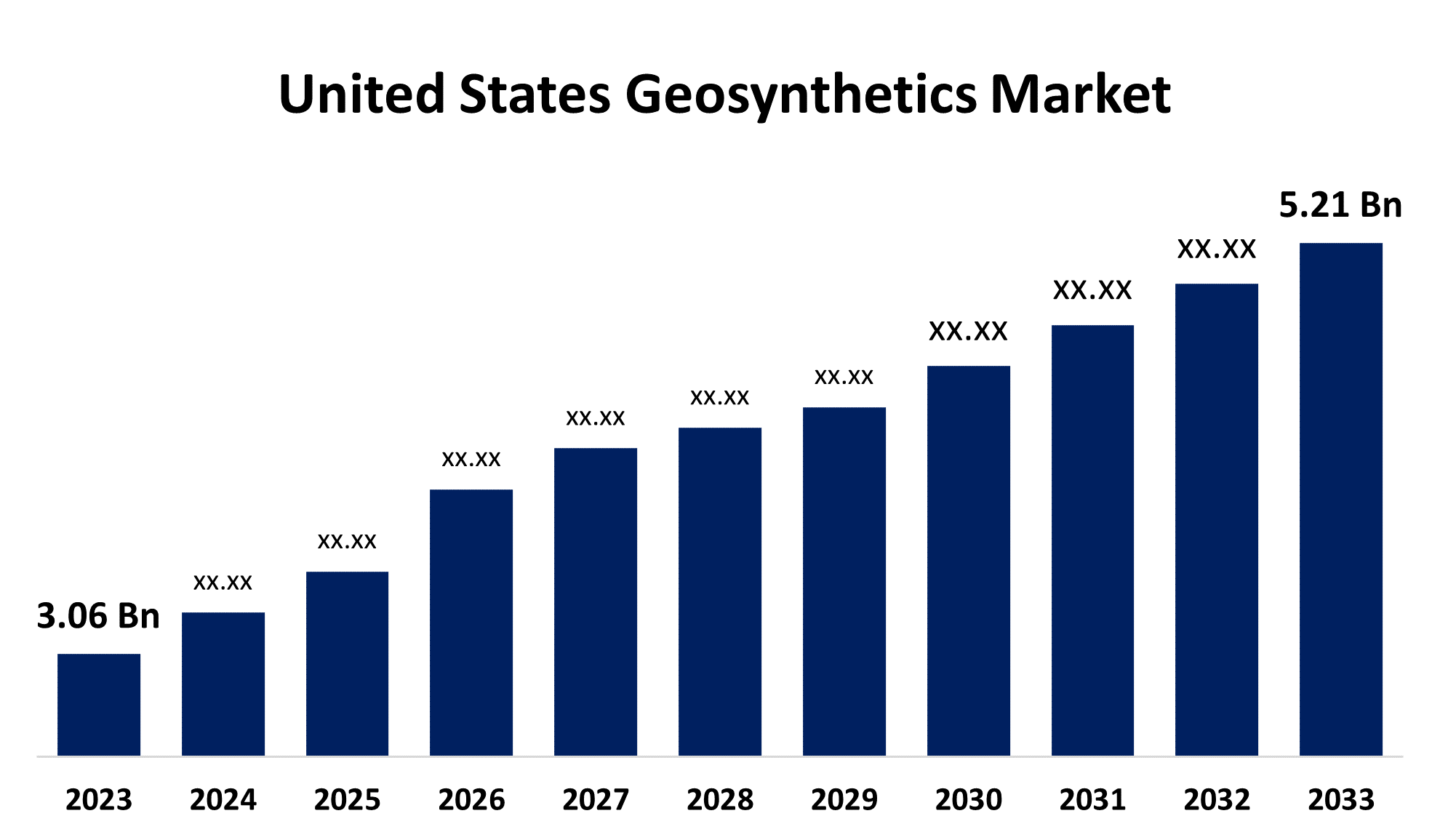

- The U.S. Geosynthetics Market Size was valued at USD 3.06 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.47% from 2023 to 2033

- The U.S. Geosynthetics Market Size is Expected to reach USD 5.21 Billion by 2033

Get more details on this report -

The U.S. Geosynthetics is anticipated to exceed USD 5.21 Billion by 2033, growing at a CAGR of 5.47% from 2023 to 2033.

Market Overview

The term "geosynthetics" describes synthetic materials made of polymers, including polyester, polypropylene, and polyethylene. Geosynthetics are mostly used in construction and civil engineering projects to improve the overall longevity and performance of facilities. A variety of purposes are provided by geosynthetics, including containment, drainage, strengthening, and filtration. These materials offer affordable solutions for a range of geotechnical, environmental, and transportation engineering applications. Road and pavement stabilization, separation, and foundation reinforcement are applications for geosynthetics. Moreover, these items are used in road foundations, structural drainage, and subsurface drainage systems for dewatering. Geotextiles are used in the reinforcement of new roads, parking lots, and industrial buildings. Sustainable development, little earthwork, a reduced carbon impact, and faster building are all required when geosynthetics are used. The geosynthetics market is anticipated to continue to be driven by the expansion of the construction sector, which includes the United States. This will help to propel the U.S. market further. Due to constrained oil supply conditions and rising shale gas drilling activity, the United States is anticipated to consume a large portion of the global shale gas market in the future. The market is anticipated to benefit from the growing use of geosynthetic materials, such as geomembranes, in waste management procedures to provide seepage control.

Report Coverage

This research report categorizes the market for the United States geosynthetics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the geosynthetics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the geosynthetics market.

United States Geosynthetics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.06 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.47% |

| 2033 Value Projection: | USD 5.21 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 194 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application |

| Companies covered:: | GSE Environmental, SKAPS Industries, Tensar International Corporation, Strata Systems, Inc., AGRU AMERICA, INC, Berry Global, Inc., Owens Corning, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expansion of the construction sector will be aided by the government's growing spending on infrastructure projects including roads, bridges, airports, dams, and trains, among others. The largest contributor to the US economy is the building industry. For instance, the US President announced in March 2021 an infrastructure package worth over USD 2 trillion aimed at reviving the country's industries, clean energy, water systems, and other public services. The need for geosynthetics is fueled by the rise in infrastructure projects, such as those involving bridges, railroads, and motorways. The use of geosynthetics is influenced by stringent environmental laws about soil erosion prevention and waste management.

Restraining Factors

The lack of awareness and comprehension regarding geosynthetics among contractors and end users impedes the expansion of the market. Some prospective customers might be discouraged by the comparatively large initial investment needed for geosynthetic installation. Consumer confidence is negatively impacted by the market's difficulties due to the availability of low-quality or counterfeit geosynthetic goods.

Market Segmentation

The United States geosynthetics market share is classified into product and application.

- The geotextiles segment is expected to hold the largest market share through the forecast period.

The United States geosynthetics market is segmented by product into geotextiles, geogrids, geomembranes, geonets, geocells, geofoams, geosynthetic clay liners, and others. Among them, the geotextiles segment is expected to hold the largest market share through the forecast period. Market expansion is anticipated by increasing product use in building applications to improve soil stabilization, such as highways, railroads, landfills, drainage systems, and harbors. When building roads, embankments, pipelines, and earth retaining structures, geotextiles are typically utilized to improve the soil.

- The waste management segment dominates the market with the largest market share over the predicted period.

The United States geosynthetics market is segmented by application into waste management, water management, transportation infrastructure, and civil construction. Among them, the waste management segment dominates the market with the largest market share over the predicted period. In waste management, geosynthetics serve a variety of purposes, including filtration, drainage, separation, barrier, and reinforcement. It covers the appropriate handling of garbage from homes, businesses, and industries during collection, transportation, treatment, and disposal. To prevent contaminated gas and liquid from seeping into rivers, aquifers, groundwater, and other freshwater sources, geosynthetics are crucial. Throughout the projection period, there will likely be a greater need for waste management activities due to population growth, urbanization, and industrialization.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States geosynthetics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GSE Environmental

- SKAPS Industries

- Tensar International Corporation

- Strata Systems, Inc.

- AGRU AMERICA, INC

- Berry Global, Inc.

- Owens Corning

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, A prominent worldwide supplier of geosynthetic solutions, TenCate Geosynthetics, recently announced the introduction of several new products intended to improve sustainability and performance in geotechnical applications.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Geosynthetics Market based on the below-mentioned segments:

United States Geosynthetics Market, By Product

- Geotextiles

- Geogrids

- Geomembranes

- Geonets

- Geocells

- Geofoams

- Geosynthetic Clay Liners

- Others

United States Geosynthetics Market, By Application

- Waste Management

- Water Management

- Transportation Infrastructure

- Civil Construction

Need help to buy this report?