United States Geotextile Market Size, Share, and COVID-19 Impact Analysis, By Material (Natural and Synthetic), By Product (Woven, Non-Woven, and Knitted), By Application (Separation & Stabilization, Erosion Control, Drainage Systems, Reinforcement, Lining Systems, and Others), and U.S. Geotextile Market Insights, Industry Trend, Forecasts to 2033.

Industry: Advanced MaterialsU.S. Geotextile Market Insights Forecasts to 2033

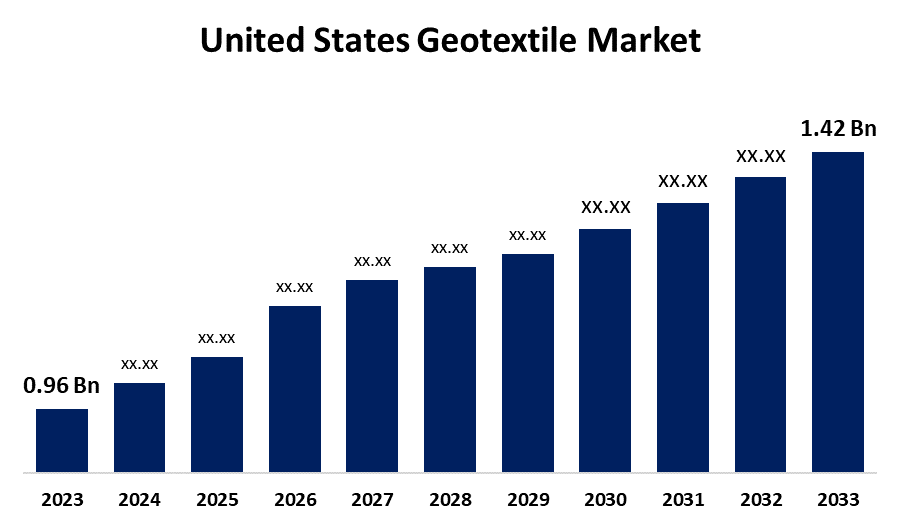

- The United States Geotextile Market Size Was Estimated at USD 0.96 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.99% from 2023 to 2033

- The USA Geotextile Market Size is Expected to Reach USD 1.42 Billion by 2033

Get more details on this report -

The US Geotextile Market Size is Expected to reach USD 1.42 Billion by 2033, Growing at a CAGR of 3.99% from 2023 to 2033

Market Overview

The market for geotextiles in the United States is the area of the civil engineering and construction sector that is dedicated to the usage of geotextiles, which are specialty textile materials made for geotechnical purposes. These materials, which can be manufactured from natural or synthetic fibers, have a variety of uses, including erosion control, drainage, filtration, soil stability, and reinforcing. The United States geotextile market is expanding since geotextiles are strong, affordable, and can extend the life of structures, they are frequently utilized in infrastructure projects including landfills, road construction, and environmental protection initiatives. In addition, growing infrastructure projects and an increased need for good roads will propel the U.S. geotextiles market's expansion. Additionally, geotextiles are frequently utilized in harbor roads, landfills, and drainage projects to enhance soil stabilization. The rise of the U.S. building industry and the widespread use of drainage systems propel market expansion and encourage the creation of smart and contemporary cities.

Report Coverage

This research report categorizes the market for the U.S. geotextile market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US geotextile market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA geotextile market.

United States Geotextile Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.96 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.99% |

| 2033 Value Projection: | USD 1.42 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Material, By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | GSE Environmental, TYPAR Geosynthetics, HUESKER International, Terrafix Geosynthetics, Belton Industries, AGRU AMERICA, INC., SKAPS Industries, Propex Operating Company, LLC, and Others key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The geotextile market has expanded because geotextiles reduce the demand for natural resources like stone and gravel in building projects, they promote sustainability. They also aid in preventing soil erosion and encouraging effective water management. There is more demand for geotextiles as sustainable building methods gain attention. In addition, advanced geotextile materials, like high-performance non-woven fabrics and eco-friendly geotextiles, have expanded the variety of applications and versatility of geotextiles across several industries. Their increasing use can be attributed to these improvements. Furthermore, in the agro-industry, geotextiles boost agricultural productivity, stabilize soil, reduce pests and weeds, protect crops from external variables, and conserve soil and water. Additionally, their function in waste management is growing, as they act as barriers in landfills to keep contaminants out and support environmental laws.

Restraining Factors

The USA geotextile market faces challenges due to geotextiles, made from synthetic and natural fibers, can be affected by fluctuations in demand and supply, as the price of crude oil, which is derived from these materials, can restrain market growth. In addition, the US market for geotextiles is very competitive, with many suppliers and producers. This competitive environment may present difficulties for businesses in the sector.

Market Segmentation

The U.S. geotextile market share is classified into material, product, and application.

- The synthetic segment accounted for the largest share of 88.05% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the material, the U.S. geotextile market is divided into natural and synthetic. Among these, the synthetic segment accounted for the largest share of 88.05% in 2023 and is expected to grow at a significant CAGR during the forecast period. This market segment is driven by increasing demand for infrastructure projects including roads and drainage systems, as well as by their high strength-to-weight ratio, resistance to environmental variables, and ease of installation. In addition, polypropylene and polyester are instances of synthetic polymers that are frequently utilized in technical applications such as slit fences, asphalt overlays, lining systems, and drainage systems.

- The non-woven segment accounted for the highest share of 60.16% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the product, the U.S. geotextile market is categorized into woven, non-woven, and knitted. Among these, the non-woven segment accounted for the highest share of 60.16% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing due to bridges, railroads, roads, drainage systems, airport buildings, filtration, and soil reinforcement projects all using non-woven materials more and more. In addition, the country's rapid infrastructure development will have a favorable effect on market expansion.

- The separation & stabilization segment accounted for the largest share of 23.87% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the U.S. geotextile market is divided into separation & stabilization, erosion control, drainage systems, reinforcement, lining systems, and others. Among these, the separation & stabilization segment accounted for the largest share of 23.87% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is expanding owing to geotextiles enhancing the base material and separating fine subgrade dirt from it. Additionally, the requirement for base support, railroad tracks, and road building is growing. In addition, because they prevent soil mixing, increase load distribution, and improve structural integrity, geotextiles are becoming more and more popular in infrastructure development and building projects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. geotextile market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GSE Environmental

- TYPAR Geosynthetics

- HUESKER International

- Terrafix Geosynthetics

- Belton Industries

- AGRU AMERICA, INC.

- SKAPS Industries

- Propex Operating Company, LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. geotextile market based on the below-mentioned segments:

U.S. Geotextile Market, By Material

- Natural

- Synthetic

U.S. Geotextile Market, By Product

- Woven

- Non-Woven

- Knitted

U.S. Geotextile Market, By Application

- Separation & Stabilization

- Erosion Control

- Drainage Systems

- Reinforcement

- Lining Systems

- Others

Need help to buy this report?