United States Graphene Market Size, Share, and COVID-19 Impact Analysis, By Product (Graphene Oxide, Graphene Nanoplatelets (GNP), and Others), By End-use Industry (Electronics, Aerospace & Defense, Energy, Automotive, and Others), and United States Graphene Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsUnited States Graphene Market Insights Forecasts to 2033

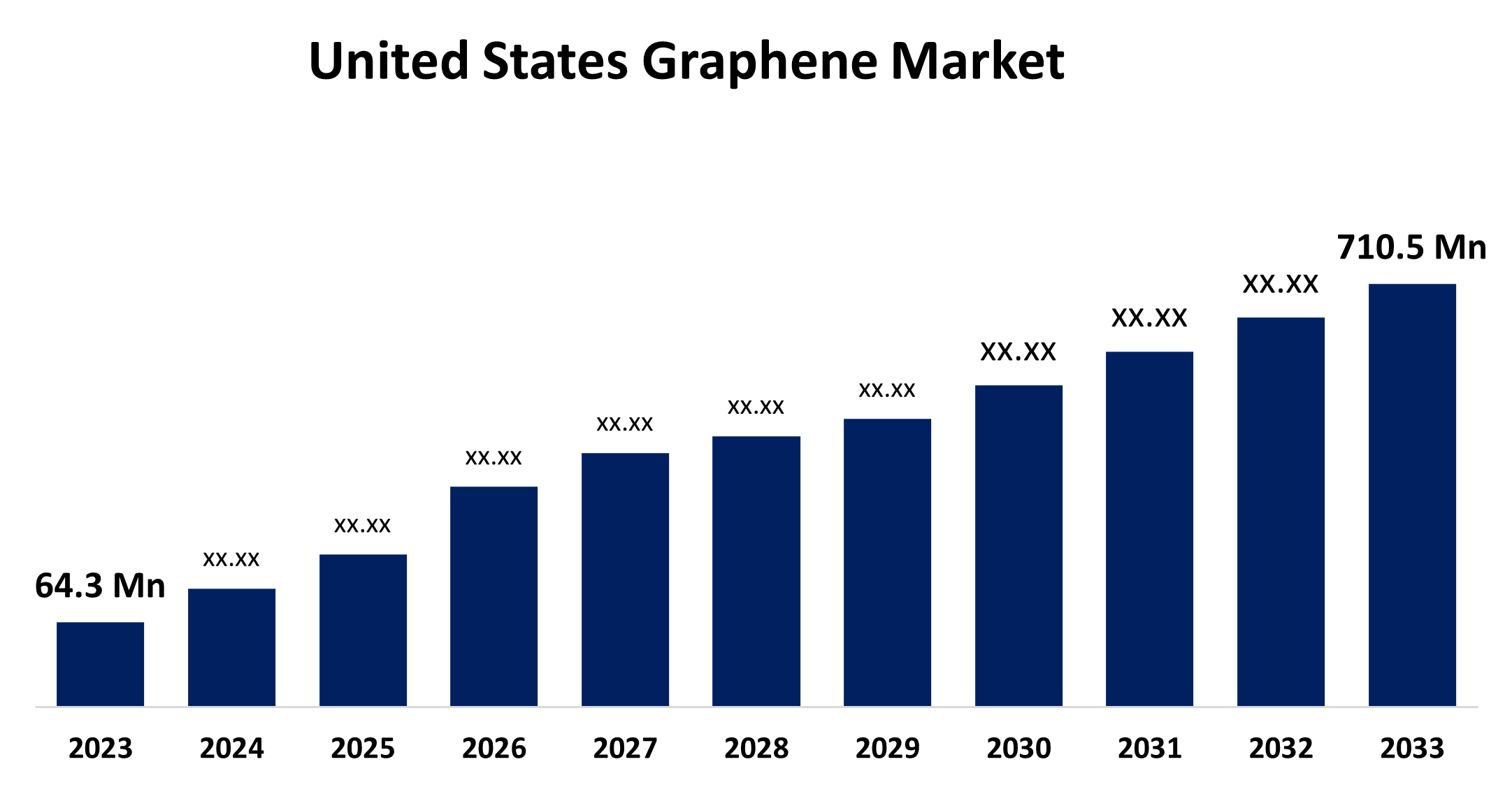

- The United States Graphene Market Size was valued at USD 64.3 Million in 2023.

- The Market is Growing at a CAGR of 27.16% from 2023 to 2033

- The U.S Graphene Market Size is Expected to reach USD 710.5 Million by 2033

Get more details on this report -

The United States Graphene Market is anticipated to exceed USD 710.5 million by 2033, growing at a CAGR of 27.16% from 2023 to 2033. The growing demand for lightweight and high-performance materials is driving the growth of the graphene market in the United States.

Market Overview

Graphene is an allotrope of carbon consisting of a single layer of atoms arranged in a hexagonal lattice nanostructure and is extracted from graphite. It is one of the most important elements in nature made up of carbon. It's calculated that the carbon material is 200 times more resistant than steel and five times lighter than aluminum. The use of graphene in metal complexes offers improved catalytic performance and mechanical properties, making it a promising material for various applications such as energy, construction, health, and electronics sectors. Due to the lightweight and high conductivity properties of graphene, it is useful for manufacturing batteries for drones. Graphene is also used in the lighting sector due to its resistant property, consuming less energy than LED lights. The use of graphene applied to construction promises to improve the insulation of buildings with the additional benefit of toughness and sustainability. The oxidized derivative of graphene called graphene oxide is used in biotechnology and medicine for cancer treatment, drug delivery, and cellular imaging. The application of graphene nanomaterials in the medical field aids the diagnosis, treatment, and prevention techniques. The widespread adaptability of graphene facilitates innovation and development in various sectors such as energy, construction, health, and electronics.

Report Coverage

This research report categorizes the market for the US graphene market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the graphene market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the graphene market.

United States Graphene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 64.3 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 27.16% |

| 2033 Value Projection: | USD 710.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-use Industry |

| Companies covered:: | Graphenea, Graphite Central, NeoGraf Solutions, ACS Material, XG Sciences, Grolltex Inc., U.S. Graphene Group, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Graphene is 200 times stronger than steel with wear-resistant properties. The energy absorbing property of graphene withstands high loads thus worthy against strong materials, including diamond. It also possesses good chemical properties and encourages the development of new and enhanced materials. The chemically modified graphene particles are injected in the treatment of cancer. All these properties of graphene allow its usage in multiple areas which is expected to augment the market growth of graphene.

Restraining Factors

The ecological hazards are caused by the release of particles of graphene into air, water, and soil. The environmental influence on material causes structural, chemical, and physical changes in the material. Thus, environmental concerns and changes in graphene nanoplatelets restrain the market.

Market Segmentation

The United States graphene market share is classified into product and end-use industry.

- The graphene oxide segment dominates the market with the largest revenue share through the forecast period.

The United States graphene market is segmented by product into graphene oxide, graphene nanoplatelets (GNP), and others. Among these, the graphene oxide segment dominates the market with the largest revenue share through the forecast period. Graphene oxide is used as electrode material for capacitors, batteries, and solar cells. It is also used with different polymers and materials to enhance the properties of composite materials, such as elasticity, conductivity, and tensile strength. The rising usage of graphene oxide in various end-use industries is anticipated to fuel the market’s demand for graphene in the graphene oxide segment.

- The electronics segment dominates the market with the largest revenue share through the forecast period.

The United States graphene market is segmented by end-use industry into electronics, aerospace & defense, energy, automotive, and others. Among these, the electronics segment dominates the market with the largest revenue share through the forecast period. Graphene is used for the development of semiconductors as graphene-based devices have low manufacturing costs. As such, they are increasingly used in IoT networks, wearable healthcare monitoring systems, electric vehicles, etc due to their high permeability and strength, as well as lightweight properties.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US graphene market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Graphenea

- Graphite Central

- NeoGraf Solutions

- ACS Material

- XG Sciences

- Grolltex Inc.

- U.S. Graphene Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent developments

- In February 2024, Panasonic Energy Co., Ltd., a Panasonic Group Company, announced it has signed a binding off-take agreement with the leading battery materials and technology company NOVONIX Limited ("NOVONIX"; Queensland, Australia) for the supply of synthetic graphite, the main component of the anodes of lithium-ion batteries used in electric vehicles (EVs).

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Graphene Market based on the below-mentioned segments:

United States Graphene Market, By Product

- Graphene Oxide

- Graphene Nanoplatelets (GNP)

- Others

United States Graphene Market, By End-use Industry

- Electronics

- Aerospace & Defense

- Energy

- Automotive

- Others

Need help to buy this report?