United States Guacamole Market Size, Share, and COVID-19 Impact Analysis, By Form (Frozen, Dried, and Ready-to-Make), By Packaging (Stand-up Pouches, Glass Bottles, and Plastic Containers), By End-User (Food Service, Households, and Food Processing), and United States Guacamole Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesUnited States Guacamole Market Insights Forecasts to 2033

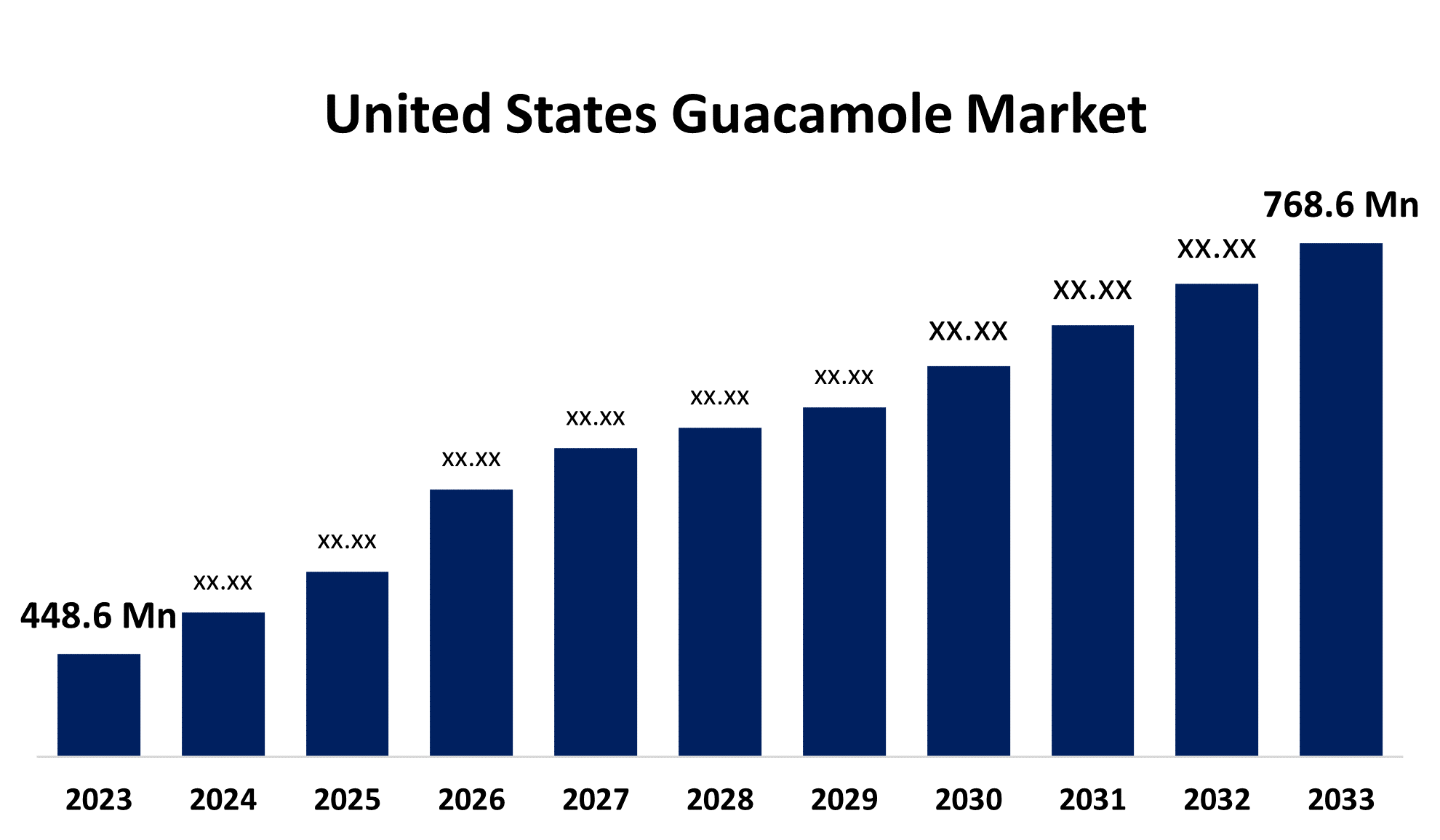

- The US Guacamole Market Size was valued at USD 448.6 Million in 2023.

- The Market Size is Growing at a CAGR of 5.53% from 2023 to 2033

- The US Guacamole Market Size is Expected to Reach USD 768.6 Million by 2033

Get more details on this report -

The United States Guacamole Market is anticipated to exceed USD 768.6 Million by 2033, growing at a CAGR of 5.53% from 2023 to 2033.

Market Overview

A dip made primarily of avocados and flavored with diced tomatoes, onions, chili peppers, and other ingredients is called guacamole. It is a good source of potassium, dietary fiber, unsaturated fats, minerals, and vitamins C, B, E, and K. It assists in reducing nerve damage and muscular weakness, lowering harmful cholesterol levels, and strengthening blood vessels, tendons, and ligaments. As a result, it's used in the US to make salad dressings, patties, and sandwiches. The expanding popularity of avocados, which are regarded as a superfood because of their high quantity of beneficial fats, vitamins, and minerals, is contributing to the rising demand for guacamole. The growing popularity of plant-based diets and the emphasis on wholesome eating have also fueled market expansion. In addition, the foodservice industry which includes cafés, restaurants, and fast-food chains has contributed significantly to the spread of guacamole's popularity by adding it to a variety of menu items, such as salads, sandwiches, and tacos and burritos. The guacamole market in the United States offers a wide range of goods, from frozen and shelf-stable varieties to fresh and chilled varieties. These items are convenient and simple to use, meeting a variety of consumer needs and preferences. Additionally, a variety of flavors and formulas are available on the market, including mild, spicy, and flavored versions with extra components like tomatoes, onions, and cilantro. The industry has grown even more as a result of the availability of organic and preservative-free guacamole products, which appeal to consumers looking for clean-label options who are health-conscious.

Report Coverage

This research report categorizes the market for the United States guacamole market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States guacamole market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States guacamole market.

United States Guacamole Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 448.6 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.53% |

| 2033 Value Projection: | USD 768.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Form, By Packaging, By End-User |

| Companies covered:: | Sabra Dipping Company, LLC (PepsiCo, Inc.), Wholly Guacamole, Fresh Is Best Salsa Company, Calavo Growers, Inc., Yucatan Foods, L.P., Herdez Guacamole, La Mexicana Salsa & Guacamole, Ortega’s Products, Inc., Garden Fresh Gourmet (Campbell Soup Company), Wawa, Inc., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A major factor propelling the guacamole market in the United States is the growing consciousness among consumers regarding the health advantages linked to avocados. Another important factor driving market expansion is the growing appeal of Tex-Mex and Mexican cuisine in the US. Guacamole is a staple of these cuisines, which are renowned for their vivid meals and strong flavors. The guacamole market is also largely driven by convenience and adaptability. Food products that are quick and simple to use and might expedite meal preparation are becoming more and more popular among consumers. This need is satisfied by guacamole, which comes in ready-to-eat forms and is a quick and adaptable choice for meals, snacks, and appetizers.

Restraining Factors

The market's availability and guacamole prices might change according to seasonal variations in avocado supply. Tariffs, transportation expenses, and meteorological conditions are a few of the variables that might cause swings in avocado prices. Guacamole's affordability for customers might be impacted by this volatility.

Market Segmentation

The United States guacamole market share is classified into form, packaging, and end-user.

- The ready-to-make segment is expected to hold the largest market share through the forecast period.

The United States guacamole market is segmented by form into frozen, dried, and ready-to-make. Among them, the ready-to-make segment is expected to hold the largest market share through the forecast period. Ready-to-make guacamole is becoming more and more popular due to its simplicity and convenience of preparation. This market is mostly targeted at people who like making guacamole at home using fresh ingredients.

- The stand-up pouches segment dominates the market with the largest market share over the predicted period.

The United States guacamole market is segmented by packaging into stand-up pouches, glass bottles, and plastic containers. Among them, the stand-up pouches segment dominates the market with the largest market share over the predicted period. Consumer convenience is increased by stand-up purses' lightweight, flexible, and easy-to-store design. These bags are recommended over glass jars or containers since they are indestructible and lower the possibility of damage occurring during storage or transit.

- The food service segment dominates the market with the largest market share over the predicted period.

The United States guacamole market is segmented by end-user into food service, households, and food processing. Among them, the food service segment dominates the market with the largest market share over the predicted period. The food service industry has seen a rise in guacamole consumption due to the growing demand for fast food and rapid-service restaurants. The hotel sector, where guacamole is served as a side dish or condiment with a range of dishes, also demonstrates the great demand for the product.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States guacamole market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sabra Dipping Company, LLC (PepsiCo, Inc.)

- Wholly Guacamole

- Fresh Is Best Salsa Company

- Calavo Growers, Inc.

- Yucatan Foods, L.P.

- Herdez Guacamole

- La Mexicana Salsa & Guacamole

- Ortega’s Products, Inc.

- Garden Fresh Gourmet (Campbell Soup Company)

- Wawa, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2022, Major manufacturer of fresh avocados and avocado products, Calavo Growers Inc., declared that it would reorganize its business to implement Project Uno integration initiatives, enhance customer service, and boost productivity and cost savings.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Guacamole Market based on the below-mentioned segments:

United States Guacamole Market, By Form

- Frozen

- Dried

- Ready-to-Make

United States Guacamole Market, By Packaging

- Stand-up pouches

- Glass Bottles

- Plastic Containers

United States Guacamole Market, By End-User

- Food Service

- Households

- Food Processing

Need help to buy this report?