United States Hardware Stores Retail Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Door Hardware, Building Materials, Kitchen & Toilet Products, Others), By Distribution Channel (Offline, Online), and United States Hardware Stores Retail Market Insights Forecasts to 2033

Industry: Consumer GoodsUnited States Hardware Stores Retail Market Insights Forecasts to 2033

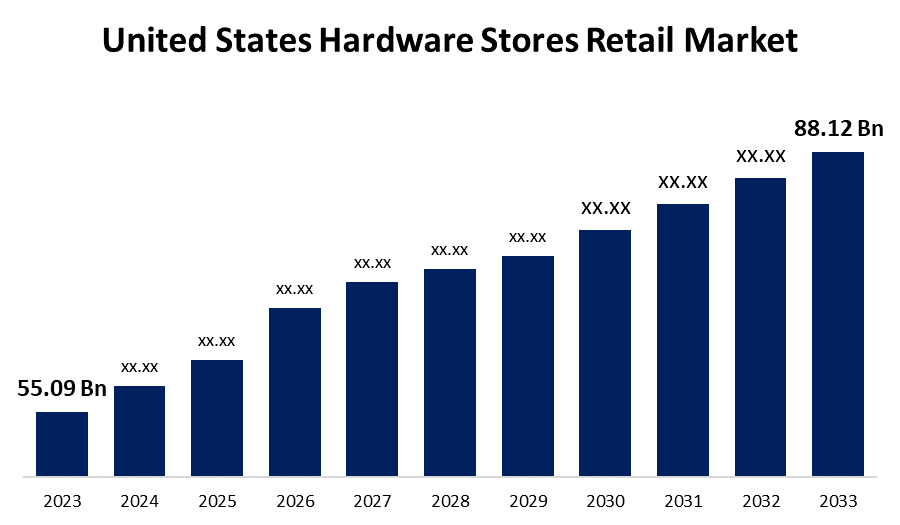

- The United States Hardware Stores Retail Market Size was valued at USD 55.09 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.81% from 2023 to 2033.

- The United States Hardware Stores Retail Market Size is Expected to Reach USD 88.12 Billion by 2033.

Get more details on this report -

The United States Hardware Stores Retail Market Size is expected to reach USD 88.12 Billion by 2033, at a CAGR of 4.81% during the forecast period 2023 to 2033.

Market Overview

Hardware retailers (in a number of countries, "shops"), sometimes known as DIY stores, sell household hardware for door, including building materials, kitchen& toilet products, power tools, hand tools, keys, locks, hinges, chains, plumbing work supplies, electrical supplies, cleaning products, housewares, tools, utensils, paint, and lawn and garden products directly to consumers for use at home or in business. The hardware store retail market in the United States is a vital part of the larger home improvement business. The key cause for the increase in demand for hardware merchants is the growing popularity of home appliances in renovation projects. This is being driven by a growing demand for practical storage cupboards, shifting appliance preferences, trends in hardwood floors and backsplashes, and a desire for more efficient linkages to outdoor spaces. Furthermore, the growing presence of the e-commerce sector, as well as the noteworthy increase in online sales, all contribute considerably to increased product demand. Changing trends in home design, a surge in do-it-yourself (DIY) initiatives, and a growing awareness of sustainable and energy-efficient house solutions can all help to drive the hardware industry forward.

Report Coverage

This research report categorizes the market for United States hardware stores retail market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States hardware stores retail market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States hardware stores retail market.

United States Hardware Stores Retail Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 55.09 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.81% |

| 023 – 2033 Value Projection: | USD 88.12 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Home Depot Inc., Lowe’s Companies Inc., Menard Inc., Ace Hardware, True Value Hardware, Lumber, Handy Andy Home Improvement Centers Inc., Hippo Hardware and Trading Company, Orchard Supply Hardware, Harbor Freight Tools, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The increase in renovation and home improvement activities has the potential to boost the hardware sector. As more people maintenance or rebuild their houses, there is always a greater demand for various hardware products like tools, fasteners, building materials, and other associated supplies. This increased demand can benefit the hardware market by increasing sales and potentially driving growth for enterprises in the industry. Economic variables such as low mortgage rates and a healthy housing market may encourage homeowners to engage in home improvement projects, hence boosting the hardware industry.

Restraining Factors

The hardware retail stores often experience the seasonal demand such factors hamper the market growth in United States.

Market Segment

- In 2023, the building materials segment accounted for the largest revenue share over the forecast period.

Based on the product, the United States hardware stores retail market is segmented into door hardware, building materials, kitchen & toilet products, and others. Among these, the building materials segment has the largest revenue share over the forecast period. Home remodeling and repair, construction, hardware retailing, new home construction, and telecommunications all require products from due to this building materials segment is dominating in the forecast period.

- In 2023, the offline segment accounted for the largest revenue share over the forecast period.

On the basis of distribution channel, the United States hardware stores retail market is segmented offline, and online. Among these, the offline segment has the largest revenue share over the forecast period. In the offline retail stores market consumer can check quality of the product and this will help them to buy a quality product due to such factors offline segment is dominating in the United States hardware stores retail market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States hardware stores retail market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Home Depot Inc.

- Lowe's Companies Inc.

- Menard Inc.

- Ace Hardware

- True Value Hardware

- Lumber

- Handy Andy Home Improvement Centers Inc.

- Hippo Hardware and Trading Company

- Orchard Supply Hardware

- Harbor Freight Tools

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2023, Lowe announced the continuation of its multi-year agreement with the NFL for the current season. The relationship will begin with a complete marketing campaign that includes a national television ad, a revised roster of Lowe's Home Team players, and the launch of a limited-edition DIY W.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States hardware stores retail market based on the below-mentioned segments:

United States Hardware Stores Retail Market, By Product

- Door Hardware

- Building Materials

- Kitchen & Toilet Products

- Others

United States Hardware Stores Retail Market, By Distribution Channel

- Offline

- Online

Need help to buy this report?