United States Health and Medical Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Provider (Public, Private, and Standalone Health Insurers), By Plan Type (Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, and Others), By Demographics (Minor, Adults, and Senior Citizen), By Provider Type (Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), and Exclusive Provider Organizations (EPOs)), and United States Health and Medical Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Health and Medical Insurance Market Insights Forecasts to 2033

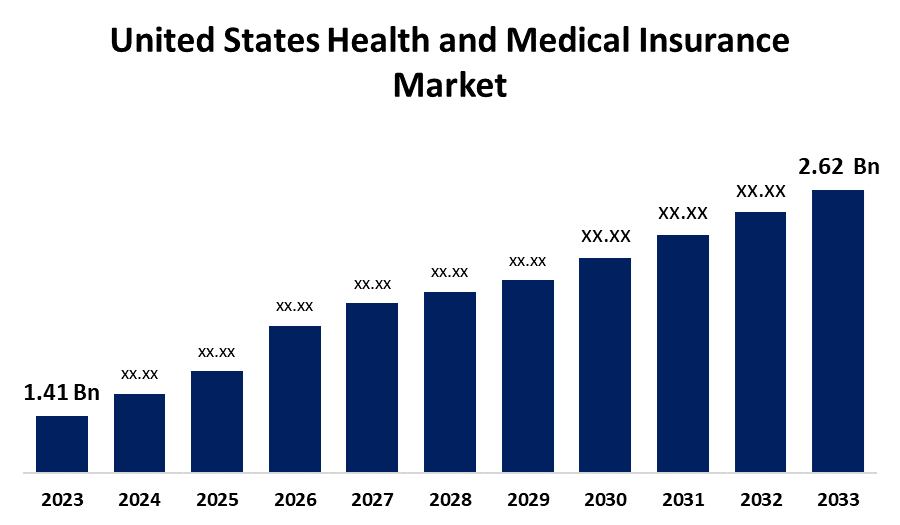

- The United States Health and Medical Insurance Market Size was valued at USD 1.41 Billion in 2023.

- The Market is Growing at a CAGR of 6.39% from 2023 to 2033

- The U.S. Health and Medical Insurance Market Size is expected to reach USD 2.62 Billion by 2033

Get more details on this report -

The United States Health and Medical Insurance Market Size is anticipated to exceed USD 2.62 Billion by 2033, Growing at a CAGR of 6.39% from 2023 to 2033. The growing government-subsidized health insurance schemes and aging population with increasing healthcare costs are driving the growth of the health and medical insurance market in the United States.

Market Overview

Health and medical insurance covers medical expenses paid during treatment of any disease, injury, or other mental & physical impairment. They assist in covering medical costs through social insurance, privately purchased insurance, social insurance, or a social welfare program funded by the government. It serves as payment for healthcare benefits in exchange for a payroll tax or a monthly, semi-annual, or annual premium. Until the policy’s term and coverage expire, the insurer must pay the policyholder’s medical bills. The coverage may differ for a number of reasons, depending on the factors, such as illnesses, age group, government policies, etc. Different health insurance offers varying degrees of financial protection, and the range of coverage might differ significantly. The implementation of innovative digital health strategies, including cloud, EHRs, machine learning, AI, and cybersecurity are leveraging market opportunities for the health and insurance market. The trends in mergers and acquisitions of health and medical insurance companies for streamlined services provide market expansion of health and medical insurance.

Report Coverage

This research report categorizes the market for the US health and medical insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the health and medical insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the health and medical insurance market.

United States Health and Medical Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.41 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.39% |

| 2033 Value Projection: | USD 2.62 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Insurance Provider, By Plan Type, By Demographics, By Provider Type |

| Companies covered:: | HCSC Group, UnitedHealth Group, Cigna Group, Centene Corporation, Elevance Health, and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing prevalence of chronic diseases and rising treatment costs are significantly responsible for driving the market demand for health and medical insurance. The growing government-subsidized health insurance schemes and aging population with increasing healthcare costs are driving the US health and medical insurance market. In addition, the growing awareness about preventive healthcare services and treatment is also responsible for driving the market. An increase in the number of offerings with evolved healthcare policies is enhancing the market growth for health and medical insurance.

Restraining Factors

The increasing costs of insurance with limited medical insurance plan coverage are restraining the market. Further, the growing regulatory complexity is hampering the market growth.

Market Segmentation

The United States Health and Medical Insurance Market share is classified into insurance provider, plan type, demographics, and provider type.

- The private segment is anticipated to grow at the fastest CAGR during the forecast period.

The United States health and medical insurance market is segmented by insurance providers into public, private, and standalone health insurers. Among these, the private segment is anticipated to grow at the fastest CAGR during the forecast period. Private health insurance provides a wide range of customized insurance plans as per client requirements. It also provides innovative insurance policies and introduces new features with the shifting market demands. The extensive networks of private insurance with healthcare providers are driving the market demand.

- The medical insurance segment is expected to grow fastest in the global health insurance market during the forecast period.

The United States health and medical insurance market is segmented by plan type into medical insurance, critical illness insurance, family floater health insurance, and others. Among these, the medical insurance segment is expected to grow fastest in the global health insurance market during the forecast period. Many healthcare services, including doctor visits, hospital stays, surgeries, prescription medication, and preventive care are covered by medical insurance. The increased importance of preventative care and early diagnosis and treatment are driving the market growth.

- The adults segment accounted for the largest share of the United States health and medical insurance market during the forecast period.

Based on the demographics, the United States health and medical insurance market is divided into minor, adults, and senior citizen. Among these, the adults segment accounted for the largest share of the United States health and medical insurance market during the forecast period. Adults are eligible for employer-sponsored health insurance plans. The tailored health insurance products are provided to adults that include individual policies, family plans, and plans with adult-specific benefits such as maternity coverage or preventive care.

- The preferred provider organizations (PPOs) segment dominates the market with the largest market share during the forecast period.

The United States health and medical insurance market is segmented by provider type into preferred provider organizations (PPOs), point of service (POS), health maintenance organizations (HMOs), and exclusive provider organizations (EPOs). Among these, the preferred provider organizations (PPOs) segment dominates the market with the largest market share during the forecast period. PPOs typically cover both in-network and out-of-network healthcare services, offering their members the freedom to visit any hospital, specialist, or healthcare provider of their choice. PPOs provide policyholders with significant flexibility in terms of healthcare provider selection.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US health and medical insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- HCSC Group

- UnitedHealth Group

- Cigna Group

- Centene Corporation

- Elevance Health

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Health Care Service Corporation (“HCSC”) announced that it has signed a definitive agreement with The Cigna Group (“Cigna”) to acquire its Medicare Advantage, Medicare Supplemental Benefits, Medicare Part D and CareAllies businesses for a purchase price of $3.3 billion.

- In January 2024, Elevance Health announced that it has entered into an agreement to acquire Paragon Healthcare, Inc., a company specializing in life-saving and life-giving infusible and injectable therapies.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Health and Medical Insurance Market based on the below-mentioned segments:

United States Health and Medical Insurance Market, By Insurance Provider

- Public

- Private

- Standalone Health Insurers

United States Health and Medical Insurance Market, By Plan Type

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

United States Health and Medical Insurance Market, By Demographics

- Minor

- Adults

- Senior Citizen

United States Health and Medical Insurance Market, By Provider Type

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

Need help to buy this report?