United States Healthcare Environmental Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Janitorial/ Core Cleaning Services, Infection Control & Prevention Consultation Services, Enhanced Cleaning Technology, Front-of-House Cleaning & Brand Experience, and Other Services), By Facility Type (Acute-Care Facilities, Acute Hospitals, Military Treatment Facility, Children’s Hospital, Ambulatory Surgery Centers (ASC), Academic Medical Centers (AMC), Post-Acute Facilities, Long-Term Acute Facility, Skilled Nursing Facility, Non-Acute Care Facilities, Physician Office & Clinics, and Others), and United States Healthcare Environmental Services Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Healthcare Environmental Services Market Insights Forecasts to 2033

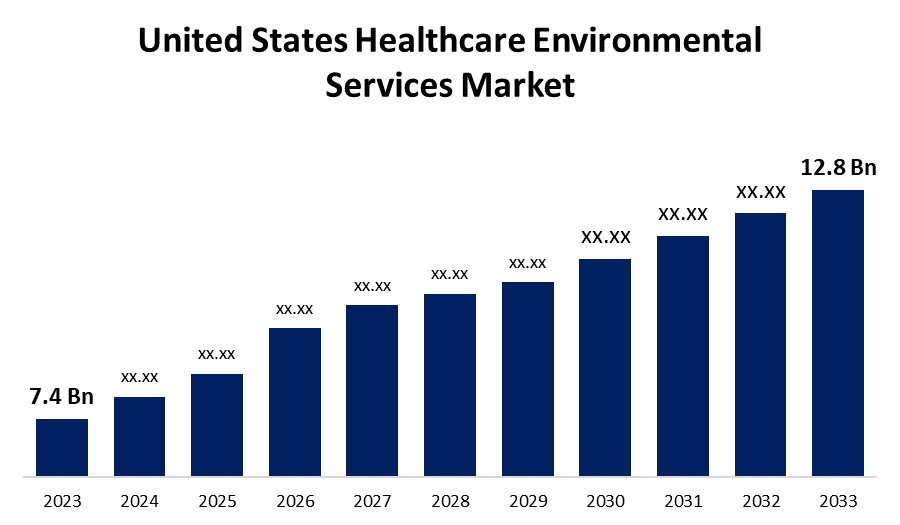

- The U.S. Healthcare Environmental Services Market Size was valued at USD 7.4 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.63% from 2023 to 2033

- The U.S. Healthcare Environmental Services Market Size is expected to reach USD 12.8 Billion by 2033

Get more details on this report -

The United States Healthcare Environmental Services Market is anticipated to exceed USD 12.8 Billion by 2033, growing at a CAGR of 5.63% from 2023 to 2033. The growing prevalence of hospital-acquired infections are driving the growth of the healthcare environmental services market in the US.

Market Overview

Healthcare environmental services are the services for keeping hospitals, clinics, nursing homes, and outpatient centers safe, hygienic, and clean. These services are essential for maintaining patient safety, worker safety, and regulatory compliance as well as preventing the spread of infections. It is critical for the well-being and recovery of patients as well as the safety of healthcare workers. The market for healthcare environment services is seeing a significant amount of mergers and acquisitions (M&A) activity in addition to a highly active group of strategic acquirers supported by sponsors. These developments offer new niche products and services as well as increased market shares. Furthermore, the growing investments in R&D together with technological innovation are propelling market expansion. Businesses are also benefiting from new trends like automation and digital transformation. Moreover, regulations and regulatory frameworks that promote the use of healthcare environmental services solutions are increasing their application. The growing emphasis on hygiene & control practices and the demand to restrict the infection spread is promoting market growth.

Report Coverage

This research report categorizes the market for the US healthcare environmental services market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States healthcare environmental services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US healthcare environmental services market.

United States Healthcare Environmental Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 7.4 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.63% |

| 023 – 2033 Value Projection: | USD 12.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Facility Type |

| Companies covered:: | Hospital Housekeeping Systems, Inc., Aramark Corporation, ABM Industries Incorporated, OctoClean Franchising Systems, Inc., Xanitos, Inc., Jani-King International, Inc., AVI Foodsystems, Inc., Healthcare Services Group, Inc., Bravo Building Services, Corvus Janitorial Systems, ServiceMaster Clean, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The need for environmental services has increased significantly due to the growing need for ICUs and hospital beds, the growth of isolation facilities, consumer awareness of the importance of maintaining cleanliness and hygiene within healthcare facilities, and preventive healthcare. In addition, the government's requirements to reduce hospital-acquired infections and the widespread adoption of stringent methods to limit the spread of diseases are expected to drive the market.

Restraining Factors

The number of illnesses linked to healthcare that result in avoidable fatalities is probably going to rise as a result of environmental service providers' noncompliance with established norms. This results in restraining the market for healthcare environmental services.

Market Segmentation

The United States Healthcare Environmental Services Market share is classified into type and facility type.

- The janitorial/ core cleaning services segment dominates the market with the largest market share in 2023.

The United States healthcare environmental services market is segmented by type into janitorial/ core cleaning services, infection control & prevention consultation services, enhanced cleaning technology, front-of-house cleaning & brand experience, and other services. Among these, the janitorial/ core cleaning services segment dominates the market with the largest market share in 2023. Due to the labor-intensive nature of cleaning and the preference for hiring a professional to do it, these services are in high demand. The increasing demand for the prevention of COVID-19 infection spread among patients is responsible for driving the adoption.

- The acute-care facilities segment is anticipated to grow at the fastest CAGR during the forecast period.

Based on the facility type, the U.S. healthcare environmental services market is divided into acute-care facilities, acute hospitals, military treatment facility, children’s hospital, ambulatory surgery centers (ASC), academic medical centers (AMC), post-acute facilities, long-term acute facility, skilled nursing facility, non-acute care facilities, physician office & clinics, and others. Among these, the acute-care facilities segment is anticipated to grow at the fastest CAGR during the forecast period. Acute care facilities, which include all sorts of hospitals, are where outsourcing services have been used the most. Stricter infection control procedures have been implemented as a result of the increase in HAIs in various healthcare settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. healthcare environmental services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hospital Housekeeping Systems, Inc.

- Aramark Corporation

- ABM Industries Incorporated

- OctoClean Franchising Systems, Inc.

- Xanitos, Inc.

- Jani-King International, Inc.

- AVI Foodsystems, Inc.

- Healthcare Services Group, Inc.

- Bravo Building Services

- Corvus Janitorial Systems

- ServiceMaster Clean

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Healthcare Environmental Services Market based on the below-mentioned segments:

US Healthcare Environmental Services Market, By Type

- Janitorial/ Core Cleaning Services

- Infection Control & Prevention Consultation Services

- Enhanced Cleaning Technology

- Front-of-House Cleaning & Brand Experience

- Other Services

US Healthcare Environmental Services Market, By Facility Type

- Acute-Care Facilities

- Acute Hospitals

- Military Treatment Facility

- Children’s Hospital

- Ambulatory Surgery Centers (ASC)

- Academic Medical Centers (AMC)

- Post-Acute Facilities

- Long-Term Acute Facility

- Skilled Nursing Facility

- Non-Acute Care Facilities

- Physician Office & Clinics

- Others

Need help to buy this report?