United States Hearing Aids Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Hearing Devices and Hearing Implants), By Patient Type (Adult and Pediatric), By Distribution Channel (OTC (Over the Counter), Medical Channel, and Private Practices), and United States Hearing Aids Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Hearing Aids Market Insights Forecasts to 2033

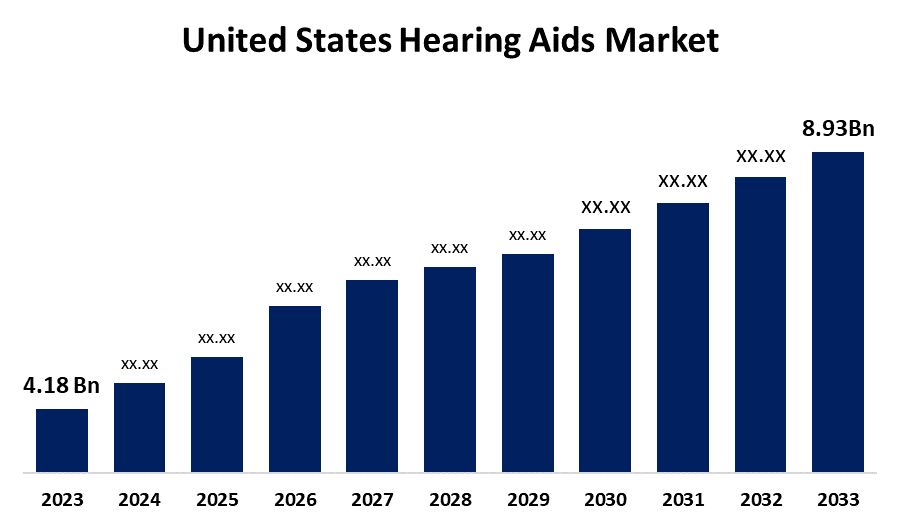

- The U.S. Hearing Aids Market Size Was Valued at USD 4.18 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.89% from 2023 to 2033

- The U.S. Hearing Aids Market Size is expected to reach USD 8.93 Billion by 2033

Get more details on this report -

The United States Hearing Aids Market Size is anticipated to exceed USD 8.93 Billion by 2033, Growing at a CAGR of 7.89% from 2023 to 2033. The Growing rate of hearing impairment and initiatives by government and key market players are driving the growth of the hearing aids market in the US.

Market Overview

Hearing aids are devices that are worn in or behind the ears of patients with hearing loss to improve their auditory capacity. A wide range of products and services pertaining to implants and hearing aids make up the hearing aid market. Audiologists and other hearing healthcare providers offer services like fitting, programming, and testing of implants and hearing aids. One in five men and one in eight women in the United States report having hearing problems, according to the Hearing Loss Association of America (HLAA). Technologically sophisticated items are being developed and introduced by leading market participants in response to the growing demand for hearing devices among patients. Furthermore, AI is paving the way for the creation of built-in smart services for patients, like active noise reduction and adaptive sound. Furthermore, these businesses are creating Bluetooth-enabled hearing aids that are smaller, more stylish, and equipped with GPS tracking among many other useful functions.

Report Coverage

This research report categorizes the market for the US hearing aids market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States hearing aids market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US hearing aids market.

United States Hearing Aids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.18 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.89% |

| 2033 Value Projection: | USD 8.93 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By Patient Type, By Distribution Channel, Medical Channel |

| Companies covered:: | Starkey Laboratories, Inc., Cochlear Ltd., Eargo, Inc., Amplifon S.p.A., GN Store Nord, MED-EL, WS Audiology A/S, Earlens Corporation, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As per the report of National Institute on Deafness and Other Communication Disorders, 48 million Americans, or around 14–15% of the population, have some form of hearing impairment. Thus, the increased rate of hearing impairment among the US population especially in developed regions is driving the market demand. New Jersey Human Services announced in July 2021 a new state budget that included an improved reimbursement rate for the Hearing Aid Assistance to the Aged and Disabled (HAAD) program. The growing initiatives by the government and market players for the improvement in reimbursement scenarios for enhancing patients’ access to assistive equipment for hearing aids are driving the market growth.

Restraining Factors

The decreased rate of adoption of these devices among patients is ascribed to the absence of suitable reimbursement schemes. Further, the high cost and challenges of wearing these hearing aids are restraining the adoption which leads to restraining the market.

Market Segmentation

The United States Hearing Aids Market share is classified into product type, patient type, and distribution channel.

- The hearing devices segment dominated the market with the largest market share in 2023.

The United States hearing aids market is segmented by product type into hearing devices and hearing implants. Among these, the hearing devices segment dominated the market with the largest market share in 2023. People with less severe hearing loss and fair speech understanding are best suited for hearing devices, which don't require surgery. The growing prevalence of aural loss in the general population and adoption of these devices with increased focus on lowering the costs by the government leads to drive the market.

- The adult segment is expected to hold the largest market share through the forecast period.

The United States hearing aids market is segmented by patient type into adult and pediatric. Among these, the adult segment is expected to hold the largest market share through the forecast period. The National Institute of Deafness and Other Communication Disorders (NIDCD) estimates that 28.8 million elderly people in the United States could take advantage of wearing hearing aids. The increasing geriatric population in the US is responsible for driving the market growth.

- The medical channel segment dominates the US hearing aids market during the forecast period.

Based on the distribution channel, the U.S. hearing aids market is divided into OTC (over the counter), medical channel, and private practices. Among these, the medical channel segment dominates the US hearing aids market during the forecast period. The huge market players are putting more and more emphasis on opening and purchasing additional retail locations. The growing number of company-owned retail stores is responsible for propelling the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. hearing aids market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Starkey Laboratories, Inc.

- Cochlear Ltd.

- Eargo, Inc.

- Amplifon S.p.A.

- GN Store Nord

- MED-EL

- WS Audiology A/S

- Earlens Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2022, Eargo, Inc., a medical device company on a mission to improve the quality of life for people with hearing loss, and NationsBenefits, (a leading provider of supplemental benefits, flex cards, and member engagement solutions for health plans announced a strategic partnership.

- In November 2022, Hearing aid innovator Signia announced its new Styletto AX hearing aid and two new capabilities for its Augmented Xperience (AX) platform — My WellBeing and CallControl — are available to military veterans through the U.S. Department of Veterans Affairs (VA) audiologists, as well as audiologists within the U.S. Department of Defense (DoD), for active military members and the Indian Health Service (IHS) for Native Americans.

- In October 2022, Lexie Hearing announced the launch of the Lexie B2 Hearing Aids, Powered by Bose, adding a third hearing aid model to its suite of audiologist-quality hearing aid products.

- In September 2022, Styletto AX features the world’s first SLIM-RIC hearing aid with a slim and stylish design that breaks down stigma. Styletto AX — along with all hearing aids on the Augmented Xperience platform — features My WellBeing, a new capability.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Hearing Aids Market based on the below-mentioned segments:

US Hearing Aids Market, By Product Type

- Hearing Devices

- Hearing Implants

US Hearing Aids Market, By Patient Type

- Adult

- Pediatric

US Hearing Aids Market, By Distribution Channel

- OTC (Over the Counter)

- Medical Channel

- Private Practices

Need help to buy this report?