United States Herbicide Market Size, Share, and COVID-19 Impact Analysis, By Type (Synthetic and Bioherbicides), By Crop Type (Grains & Cereals, Pulses & Oilseeds, Fruits & Vegetables, and Turfs & Ornamentals), and United States Herbicide Market Insights Forecasts to 2033

Industry: AgricultureUnited States Herbicide Market Insights Forecasts to 2033

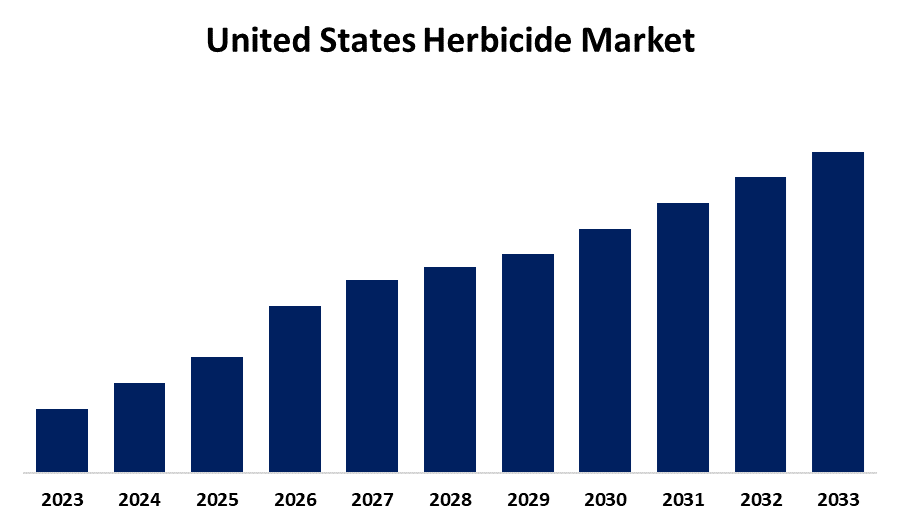

- The Market is growing at a CAGR of 6.4% from 2023 to 2033

- The US Herbicide Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The US Herbicide Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 6.4% from 2023 to 2033.

Market Overview

Herbicides are chemical substances used to prevent, destroy, or inhibit the growth of unwanted plants or weeds. These agrochemicals play a crucial role in agriculture, enabling farmers to enhance crop yields and manage weed resistance effectively. In the United States, government initiatives significantly influence the herbicide market. The Environmental Protection Agency (EPA) regulates the registration and use of herbicides, ensuring safety for human health and the environment. Additionally, various agricultural programs promote sustainable farming practices, which often include integrated weed management strategies that utilize herbicides responsibly. Several driving factors contribute to the growth of the herbicide market. The increasing demand for food production due to a rising population necessitates effective weed control measures. Advancements in herbicide formulations and application technologies also enhance effectiveness and reduce environmental impact. Furthermore, the growing trend towards herbicide-resistant crops has led to higher herbicide usage, as farmers seek to maximize efficiency and minimize crop loss. Increased awareness of the importance of weed management in sustainable agriculture further supports market expansion, making herbicides an essential component of modern farming practices.

Report Coverage

This research report categorizes the market for United States herbicide market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States herbicide market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States herbicide market.

United States Herbicide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.4% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Crop Type and COVID-19 Impact Analysis |

| Companies covered:: | Bayer AG, Corteva Agriscience (formerly Dow AgroSciences), Syngenta, BASF, FMC Corporation, Nufarm, Monsanto (subsidiary of Bayer) and Others Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States herbicide market is driven by several key factors. The rising demand for food production due to population growth necessitates effective weed management to ensure high crop yields. Advancements in herbicide formulations and application technologies improve efficacy and minimize environmental impact. Additionally, the adoption of herbicide-resistant crop varieties has increased herbicide usage, allowing for more efficient weed control. The growing awareness of sustainable agricultural practices further supports the need for herbicides, as they play a crucial role in integrated weed management strategies. These elements collectively contribute to the market's robust expansion.

Restraining Factors

Restraining factors in the United States herbicide market include regulatory challenges, rising concerns over environmental and health impacts, the development of herbicide-resistant weed species, and increasing consumer demand for organic farming practices.

Market Segment

The U.S. herbicide market share is classified into type and crop type.

- The synthetic segment is expected to hold the largest market share through the forecast period.

The US herbicide market is by type into synthetic and bioherbicides. Among these, the synthetic segment is expected to hold the largest market share through the forecast period. This is attributed to the synthetic herbicides affect plant disease in several mechanisms. Synthetic herbicides are in demand due to their effectiveness and inexpensiveness. Synthetic herbicides include glyphosate, atrazine, paraquat, 2,4-dichlorophenoxyacetic acid, and others. Glyphosate and 2,4-dichlorophenoxyacetic acid are the most used herbicides due to their low cost, efficiency, plant development, and use in weed control.

- The grains & cereals segment is expected to hold the largest market share through the forecast period.

The US herbicide market is segmented by crop type into grains & cereals, pulses & oilseeds, fruits & vegetables, and turfs & ornamentals. Among these, the grains & cereals segment is expected to hold the largest market share through the forecast period. This is attributed to the large acreage devoted to the cultivation of these crops as well as the growing consumption of staple foods. For grains and cereals, weed management is usually needed more often, so in general, herbicide applications are higher compared to other products like pulses, oilseeds, fruits, and vegetables. In addition to this, development in the

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States herbicide market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bayer AG

- Corteva Agriscience (formerly Dow AgroSciences)

- Syngenta

- BASF

- FMC Corporation

- Nufarm

- Monsanto (subsidiary of Bayer)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States herbicide market based on the below-mentioned segments:

United States Herbicide Market, By Type

- Synthetic

- Bioherbicides

United States Herbicide Market, By Crop Type

- Grains & Cereals

- Pulses & Oilseeds

- Fruits & Vegetables

- Turfs & Ornamentals

Need help to buy this report?