United States High Performance Polymers Market Size, Share, and COVID-19 Impact Analysis, By Type (Polyaryletherketones, Aromatic Polyamides, Fluoropolymers, Sulfone Polymers, Liquid Crystalline Polymer, Resins, Others), By Application (Seal Rings, Thrust Washers, Bearings & Gears, Flexible Risers, Insulation Material, Nanocomposites, Phthalonitrile adhesives, Others), By End User (Automotive, Construction, Aerospace, Oil & Gas Industry, Electronic, Textile, Medical), and Others and United States High Performance Polymers Market Insights Forecasts to 2033

Industry: Chemicals & MaterialsUnited States High Performance Polymers Market Insights Forecasts to 2033

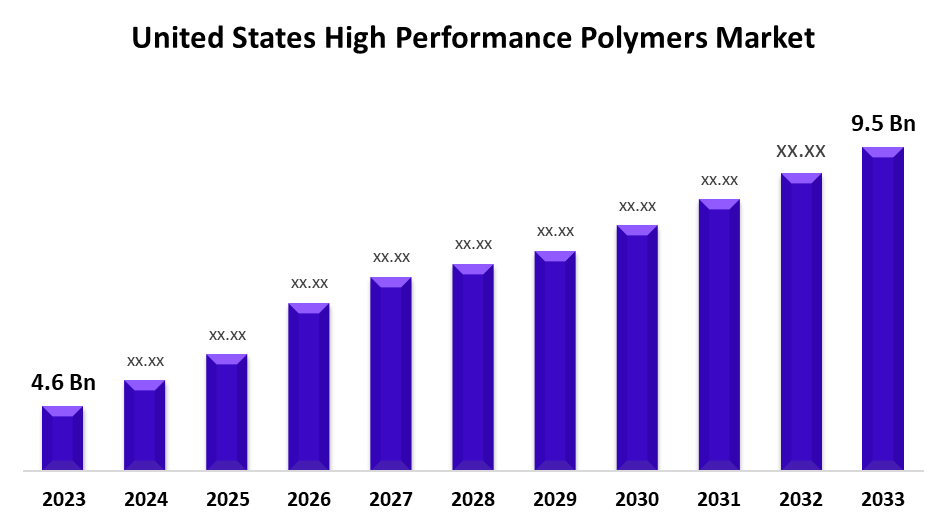

- The United States High Performance Polymers Market Size was valued at USD 4.6 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.5% from 2023 to 2033.

- The United States High Performance Polymers Market Size is Expected to Reach USD 9.5 Billion by 2033.

Get more details on this report -

The United States High Performance Polymers Market Size is expected to reach USD 9.5 Billion by 2033, at a CAGR of 7.5% during the forecast period 2023 to 2033.

Market Overview

High performance polymers have been reported to have more significant potential for use in more challenging areas such as aerospace, defense, energy, electronics, and automotive compared to commodities and traditional polymers. These polymers have higher operating temperatures in extreme conditions, excellent mechanical strength, dimensional stability, thermal degradation resistance, environmental stability, gas barriers, solvent resistance, and electrical properties even at high temperatures. They are usually much more difficult to supply and significantly more expensive, owing entirely to more advanced complicated monomers. However, as the polymer's problem grows, so does the resulting polymer. PolyEtherEtherKetone (PEEK) is one of these high-performance polymers. With over 300 participants, it is a PAEK (Poly Aryl Ether Ketones) own circle of polymer relatives. However, only a few are commercialized. The aromatic PEEK polymer is composed of repeating ether, ether, and ketone linkages separated by aryl groups.

Report Coverage

This research report categorizes the market for United States high performance polymers market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States high performance polymers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States high performance polymers market.

United States High Performance Polymers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.5% |

| 2033 Value Projection: | USD 9.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By End User |

| Companies covered:: | BASF SE, Celanese Corporation, E. I. Dupont De Nemours and Company, Amyris, Triton System, TRI Austin, Allegheny Performance Plastic, Dow Chemicals Company, Exxon Mobil, Nifco America Corp, InnoSense LLC, Material Science Corporation, Tetramer Technologies and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

High performance polymers have high applicability in construction sector due to their ability to withstand high temperature and pressure. As a result, they are used as building insulation, and as nanocomposites and phthalonitrile adhesives, they improve the bonding strength of structures at high temperatures. The construction sector in developed economies such as the United States has grown significantly due to an increase in residential construction. Increased residential unit issuance and healthcare construction spending will boost overall construction activity in the United States, resulting in increased use of high-performance polymers in the construction sector. This will help the high performance polymers industry in the United States grow. Boeing, one of the world's largest commercial aircraft manufacturers, has a hub in the United States. Due to an increase in air traffic, demand for commercial aircrafts has increased, resulting in an increase in the delivery rate of such aircrafts.

Restraining Factors

Exploration and drilling for oil have a negative impact on land and marine ecosystems because seismic techniques used to explore for oil beneath the ocean floor harm fish and marine mammals, and drilling an oil well on land frequently necessitates clearing an area of vegetation. As a result, in order to address such environmental concerns, the U.S government has implemented new policies.

Market Segment

- In 2023, the polyaryletherketones segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States high performance polymers market is segmented into polyaryletherketones, aromatic polyamides, fluoropolymers, sulfone polymers, liquid crystalline polymer, resins,and others. Among these, the polyaryletherketones segment has the largest revenue share over the forecast period. Polyaryletherketones have high chemical, mechanical, and anti-corrosive properties, making them ideal for use in industries such as automotive, aerospace, and oil and gas. The rapid growth in these sectors in the United States as a result of increased demand has influenced the use of polyaryletherketones.

- In 2022, the bearings & gears segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States high performance polymers market is segmented into seal rings, thrust washers, bearings & gears, flexible risers, insulation material, nanocomposites, phthalonitrile adhesives, and others. Among these, the bearings & gears segment has the largest revenue share over the forecast period. High-performance polymers such as polyaryletherketones and aromatic polymers and polyamides have high thermal stability and excellent chemical resistance at high temperatures, which is why they are commonly used in bearings and gearing applications in industries such as oil and gas. The rise in crude oil production in the United States as a result of rising demand in the oil market has boosted the use of high performance polymers in drilling components such as bearings and gears.

- In 2022, the automotive segment accounted for the largest revenue share over the forecast period.

Based on the end user, the United States high performance polymers market is segmented into automotive, construction, aerospace, oil & gas industry, electronic, textile, and medical. Among these, the automotive segment has the largest revenue share over the forecast period. High performance polymers have become an efficient substitute for metal in the automotive sector because they reduce body weight and provide better fuel economy. As a result of these advantages, high performance polymers are widely used in automotive segments such as heavy trucks. The increased production of heavy commercial vehicles in the United States due to rising demand from various end users has boosted the use of high performance polymers in the automotive sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States high performance polymers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Celanese Corporation

- E. I. Dupont De Nemours and Company

- Amyris

- Triton System

- TRI Austin

- Allegheny Performance Plastic

- Dow Chemicals Company

- Exxon Mobil

- Nifco America Corp

- InnoSense LLC

- Material Science Corporation

- Tetramer Technologies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2021, ExxonMobil Chemical Company acquired Materia, Inc. in California to develop a new class of materials for use in a variety of applications such as wind turbine blades, electric vehicle parts, sustainable construction, and anti-corrosive coatings.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States high performance polymers market based on the below-mentioned segments:

United States High Performance Polymers Market, By Type

- Polyaryletherketones

- Aromatic Polyamides

- Fluoropolymers

- Sulfone Polymers

- Liquid Crystalline Polymer

- Resins

- Others

United States High Performance Polymers Market, By Application

- Seal Rings

- Thrust Washers

- Bearings & Gears

- Flexible Risers

- Insulation Material

- Nanocomposites

- Phthalonitrile adhesives

- Others

United States High Performance Polymers Market, By End User

- Automotive

- Construction

- Aerospace

- Oil & Gas Industry

- Electronic

- Textile

- Medical

Need help to buy this report?