United States Home Fitness Equipment Market Size, Share, and COVID-19 Impact Analysis, By Equipment Type (Cardiovascular Training Equipment, Strength Training Equipment, and Others), By Sales Channel (Online and Offline), and United States Home Fitness Equipment Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited States Home Fitness Equipment Market Insights Forecasts to 2033

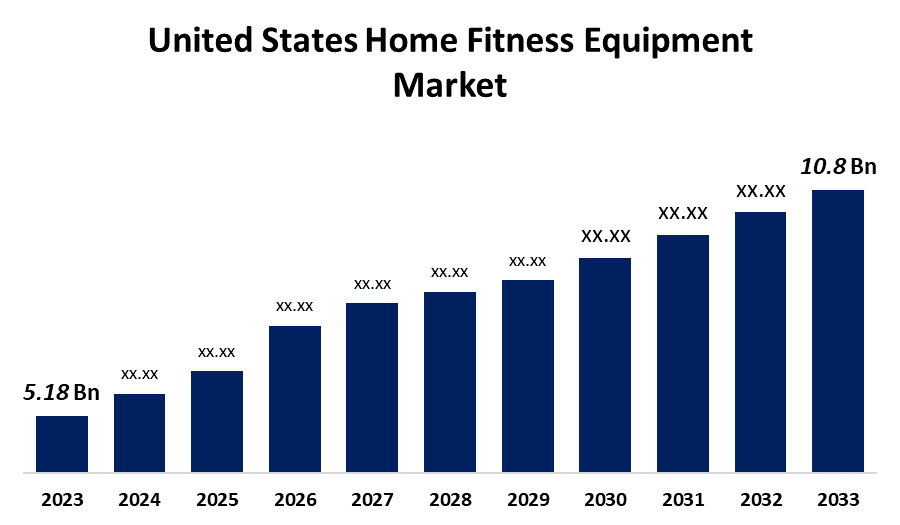

- The U.S. Home Fitness Equipment Market Size was valued at USD 5.18 Billion in 2023.

- The Market is growing at a CAGR of 7.40% from 2023 to 2033

- The U.S. Home Fitness Equipment Market Size is expected to reach USD 10.8 Billion by 2033

Get more details on this report -

The United States Home Fitness Equipment Market is anticipated to exceed USD 10.8 Billion by 2033, growing at a CAGR of 7.40% from 2023 to 2033. The growing residential infrastructural settings and the introduction of innovative exercise equipment by manufacturers are driving the growth of the home fitness equipment market in the US.

Market Overview

Home fitness equipment is any device or apparatus used during physical activity to boost the body’s strength or conditioning effects. There is a growing interest in health and well-being as well as a growth in the number of people doing at-home workouts. Innovations like sensor-integrated dumbbells and smart treadmills encourage consumer preferences toward sophisticated and technologically advanced fitness products. Growing health concerns about obesity and chronic illnesses are driving more people to incorporate fitness into their daily routines, which is fueling the market's rise. Additionally, by providing convenient and customized workout options, the industry has been greatly enhanced by the adoption of digital technologies and fitness applications. There has been increased consumer demand for virtual body workout applications, like Apple Fitness Plus, Peloton, and Nike Training Club due to the increased popularity of virtual workouts during the pandemic in 2020. People could now personalize their workouts owing to the move to digital platforms, which raised consumer demand for virtual training sessions and workouts as well as for home fitness equipment

Report Coverage

This research report categorizes the market for the US home fitness equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States home fitness equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US home fitness equipment market.

United States Home Fitness Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.18 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 7.40% |

| 2033 Value Projection: | USD 10.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Equipment Type, By Sales Channel, and COVID-19 Impact Analysis |

| Companies covered:: | Core Health & Fitness, LLC, Icon Health & Fitness, Inc., Hoist Fitness Systems, Johnson Health Tech Co., Ltd., Body Craft Inc., BodyEnergy Technology Co., Ltd., Rogue Fitness, Life Fitness, Inc., TRUE Fitness Technology Inc., Torque Fitness, and Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There are rising residential infrastructural settings due to consumer inclination towards home gym setups are driving the market. The demand for muscle-building products like dumbbells and barbells is expected to drive the expansion of the home fitness equipment market in the United States. The introduction of performance-tracking technology-based workout products is also driving the market. Furthermore, the growing consumer expenditure on domestic products powered by IoT technology encourages businesses to provide cutting-edge fitness equipment significantly contributing to market growth.

Restraining Factors

Digital workout products are predicted to become less popular among lower- and middle-class Americans due to their increased cost, which is anticipated to hinder the U.S. market's growth for home fitness equipment.

Market Segmentation

The United States Home Fitness Equipment Market share is classified into equipment type and sales channel.

- The cardiovascular training equipment segment dominates the market with the largest market share during the forecast period.

The United States home fitness equipment market is segmented by equipment type into cardiovascular training equipment, strength training equipment, and others. Among these, the cardiovascular training equipment segment dominates the market with the largest market share during the forecast period. There is a substantial need for cardiovascular workout equipment among US citizens to preserve their cardiovascular health, including rowers, treadmills, stationary bikes, and other items. The rising awareness of these equipment as alternatives to outdoor riding and jogging is propelling the market.

- The online segment dominates the US home fitness equipment market during the forecast period.

Based on the sales channel, the U.S. home fitness equipment market is divided into online and offline. Among these, the online segment dominates the US home fitness equipment market during the forecast period. Pop-up advertising methods were employed by prominent businesses including Rogue Inc., TRUE Technology Inc., and others to enhance online sales by driving more users to their websites and boosting online segment growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. home fitness equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Core Health & Fitness, LLC

- Icon Health & Fitness, Inc.

- Hoist Fitness Systems

- Johnson Health Tech Co., Ltd.

- Body Craft Inc.

- BodyEnergy Technology Co., Ltd.

- Rogue Fitness

- Life Fitness, Inc.

- TRUE Fitness Technology Inc.

- Torque Fitness

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2021, Life Fitness unveiled Life Fitness Connect, a free-to-download mobile app for Apple and Android devices with advanced workout tracking capabilities and on-demand classes to help exercisers stay motivated on-and-off Life Fitness and Cybex equipment.

- In August 2021, Peleton Rolled out a redesigned $2,500 treadmill with new safety features.

- In July 2021, iFIT Health & Fitness Inc. (“iFIT”), a global leader in connected fitness software, content, and equipment, announced it had acquired Sweat, a leading platform for women's health and fitness.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Home Fitness Equipment Market based on the below-mentioned segments:

US Home Fitness Equipment Market, By Equipment Type

- Cardiovascular Training Equipment

- Strength Training Equipment

- Others

US Home Fitness Equipment Market, By Sales Channel

- Online

- Offline

Need help to buy this report?