United States Home Infusion Therapy Market Size, Share, and COVID-19 Impact Analysis, By Product (Infusion Pumps, Needleless Connectors), By Application (Anti-Infective, Endocrinology), and United States Home Infusion Therapy Market Insights Forecasts to 2033

Industry: HealthcareUnited States Home Infusion Therapy Market Insights Forecasts to 2033

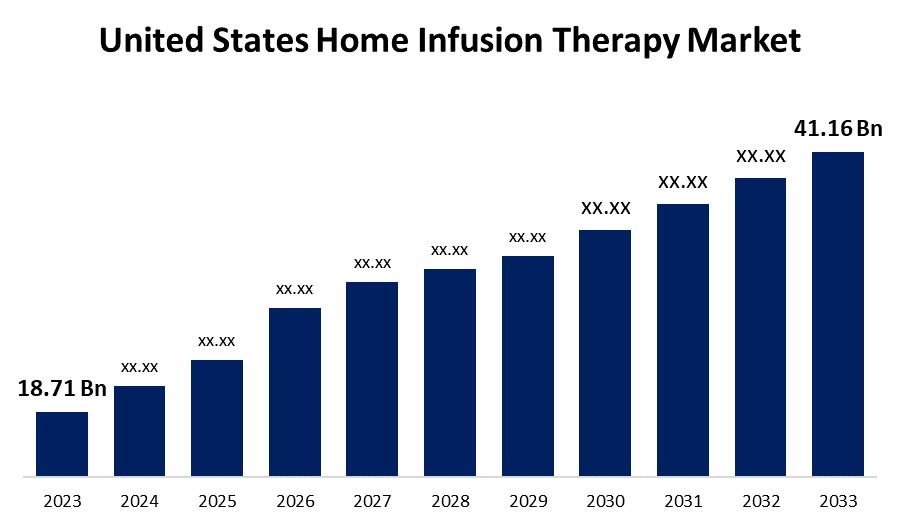

- The United States Home Infusion Therapy Market Size was valued at USD 18.71 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.2% from 2023 to 2033.

- The United States Home Infusion Therapy Market Size is Expected to Reach USD 41.16 Billion by 2033.

Get more details on this report -

The United States Home Infusion Therapy Market Size is expected to reach USD 41.16 Billion by 2033, at a CAGR of 8.2% during the forecast period 2023 to 2033.

Market Overview

Home infusion therapy is the administration of medications to a patient via an intravenous or subcutaneous route at their home. It has been proven to be a safe and effective alternative to hospital-based patient care. In addition, home infusion therapy is expected to be one of the home healthcare industry's fastest growing segments. The availability and capabilities of care professionals, professional education, transparency about the quality of care, remote patient management, technological innovation in intravenous devices, and the increased prevalence of chronic illnesses are expected to drive the market forward. Furthermore, many home infusion service providers, including Option Care Health Inc., are collaborating with hospitals to help patients transition to home care settings for treatment. Furthermore, home infusion service providers are establishing a strong network with pharmacies in order to develop a personalized development care strategy and provide tailored medications and supplies to patients requiring infusion therapies at home. These factors have a positive effect on demand for home infusion supplies and services, particularly in developed countries.

Report Coverage

This research report categorizes the market for United States home infusion therapy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States home infusion therapy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States home infusion therapy market.

United States Home Infusion Therapy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 18.71 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.2% |

| 2033 Value Projection: | USD 41.16 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, and COVID-19 Impact Analysis. |

| Companies covered:: | Option Care Health Inc., Optum Inc., CareCentrix Inc., CVS Health, KabaFusion, Promptcare Respiratory, Baxter, InfuSystem Holdings, Inc., Moog Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The burden of chronic diseases is rapidly increasing in United States. Chronic immune deficiencies, cancer, diabetes, and congestive heart failure, among others, have all seen a significant increase in prevalence. According to the World Health Organization (WHO), chronic diseases affect more than 133 million Americans, or more than 40% of the country's total population. This is expected to result in a large patient pool suffering from chronic diseases, as well as patients receiving infusion therapy in home settings. Growing awareness of the benefits of home treatment modality, as well as rapid technological advancements in home-use devices, are two additional factors that are likely to fuel demand for United States home infusion therapy market over the forecast period. The rising prevalence of hospital-acquired infections is one of the major factors driving the United States home infusion therapy market. Moreover, hospital-acquired infections are on the rise as a result of longer inpatient hospital stays, and they have now become one of the most serious safety concerns for healthcare providers.

Restraining Factors

One of the major factors likely hampering the United States home infusion therapy market growth is the lack of reimbursement policies in many developing countries. United States have higher out-of-pocket healthcare expenditures with established reimbursement structures. This has limited the number of patients receiving home infusion therapy in United States. This, combined with a scarcity of public and private house infusion providers in U.S, a shortage of trained medical personnel, and other limited resources, is expected to limit the adoption of these services.

Market Segment

- In 2023, the infusion pumps segment accounted for the largest revenue share over the forecast period.

Based on the product, the United States home infusion therapy market is segmented into infusion pumps, and needleless connectors. Among these, the infusion pumps segment has the largest revenue share over the forecast period. This can be attributed to their increased use and efficiency in delivering nutrition, medications, and other necessary fluids in the appropriate amounts. Furthermore, modernized infusion pumps include alert systems to reduce the risk of adverse drug interactions or when pump parameters are incorrectly set. These factors are expected to drive segment growth in the coming years, thereby boosting market growth over the forecast period.

- In 2023, the anti-infective segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States home infusion therapy market is segmented into anti-infective and endocrinology. Among these, the anti-infective segment has the largest revenue share over the forecast period. It is widely used as an antifungal, antibiotic, and antiviral agent in home care. Furthermore, growing efforts to reduce hospital stays are increasing demand for anti-infective therapy, boost market growth during forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States home infusion therapy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Option Care Health Inc.

- Optum Inc.

- CareCentrix Inc.

- CVS Health

- KabaFusion

- Promptcare Respiratory

- Baxter

- InfuSystem Holdings, Inc.

- Moog Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2022, Medtronic plc has introduced an Extended infusion set with double the wear time. This set has a wear time of up to 7 days.

- In September 2022, CarepathRx and Orlando Health have signed a multiyear infusion management service agreement to provide high-quality home infusion services. This new service is both convenient and affordable for patients.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States home infusion therapy market based on the below-mentioned segments:

United States Home Infusion Therapy Market, By Product

- Infusion Pumps

- Needleless Connectors

United States Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

Need help to buy this report?