United States Homeowner’s Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Comprehensive Coverage and Dwelling Coverage), By End User (Landlords and Tenants), By Distribution Channel (Independent Advisors and Affiliated Agents), and United States Homeowner’s Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited States Homeowner’s Insurance Market Insights Forecasts to 2033

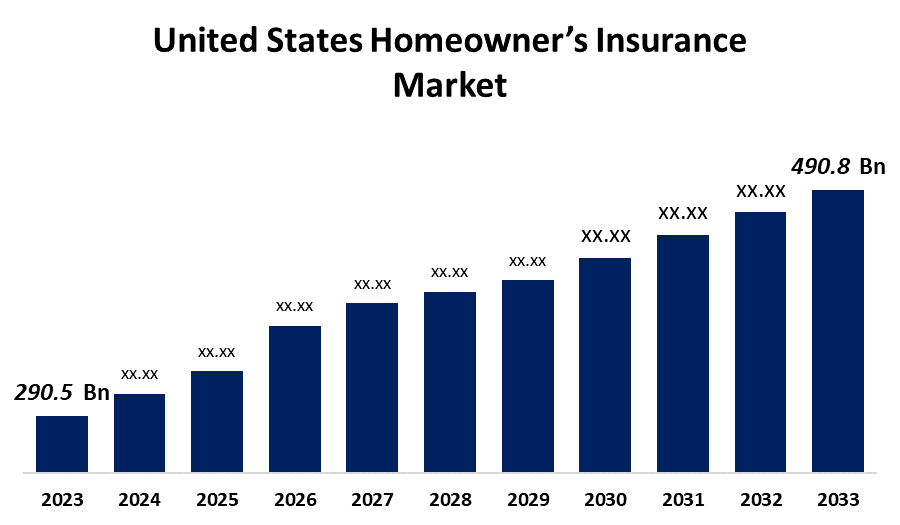

- The United States Homeowner’s Insurance Market Size was valued at USD 290.5 billion in 2023.

- The Market is growing at a CAGR of 5.38% from 2023 to 2033

- The U.S. Homeowner’s Insurance Market Size is Expected to Reach USD 490.8 billion by 2033

Get more details on this report -

The United States Homeowner’s Insurance Market is anticipated to exceed USD 490.8 billion by 2033, growing at a CAGR of 5.38% from 2023 to 2033. The growing number of regulations mandating house insurance and increasing disposal income are driving the growth of the homeowner’s insurance market in the United States.

Market Overview

Homeowner’s insurance is a property insurance guard against losses and damage to a person’s home, belongings, and other assets. A package policy insurance covers home and belongings, providing coveraging for both property damage and liability, or the legal duty, to compensate third parties for any harm or injury that policyholders or their families may cause. The loss or theft of personal belongings as well as the inside and outside of the house, are often featured by homeowner’s insurance policies. Actual cash value, replacement cost, and extended replacement costs are three fundamental levels of coverage. Homeowners are becoming aware of the significance of insuring their assets with the rising property values. Further, the risk of natural disasters, theft, and other incidents is encouraging people to consider purchasing home insurance. With the increasing awareness about insurance by the government, insurance companies are increasingly developing new risk assessment tools and technologies that leverage market growth in homeowners insurance.

Report Coverage

This research report categorizes the market for the US homeowner’s insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the homeowner’s insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the homeowner’s insurance market.

United States Homeowner’s Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 290.5 billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 5.38% |

| 2033 Value Projection: | USD 490.8 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Coverage, By End User, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Lemonade, USAA, Allstate, Amica, State Farm, Nationwide, Liberty Mutual, American Family, Progressive, Farmers Inurance,and others Key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing number of legislation mandating house insurance for all residents creates a wealth of opportunity for the market expansion of homeowners insurance. The rising income and job instability might cause people are contribute to driving the market demand. Furthermore, the development of new risk assessment tools and technologies for mitigating risks and preventing losses is driving the market.

Restraining Factors

Financial instability or a liquidity constraint may lead to hamper the market demand for homeowners insurance.

Market Segmentation

The United States Homeowner’s Insurance Market share is classified into coverage, end user, and distribution channel.

- The comprehensive coverage segment dominates the market with the largest market share in 2023.

The United States homeowner’s insurance market is segmented by coverage into comprehensive coverage and dwelling coverage. Among these, the comprehensive coverage segment dominates the market with the largest market share in 2023. Comprehensive coverage provides complete defense for the possessions and assets of a homeowner. When a covered disaster, such as a fire or severe weather, damages or destroys a home or other personal property, a comprehensive house insurance policy usually pays for repairs or replacements.

- The landlords segment accounted for the largest share of the United States homeowner’s insurance market in 2023.

Based on the end user, the United States homeowner’s insurance market is divided into landlords and tenants. Among these, the landlords segment accounted for the largest share of the United States homeowner’s insurance market in 2023. Landlords segment frequently includes coverage for damage to renters' belongings, liability insurance against mishaps on the rental property, and loss of rental income if a covered catastrophe renders the property uninhabitable.

- The independent advisors segment dominated the market with the largest market share during the forecast period.

The United States homeowner’s insurance market is segmented by distribution channel into independent advisors, and affiliated agents. Among these, the independent advisors segment dominated the market with the largest market share during the forecast period. Independent advisors offer insightful information and guidance on the policies and coverages that best suit the needs and financial situation of the homeowner. In addition, they assist in understanding the details of insurance policies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US homeowner’s insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lemonade

- USAA

- Allstate

- Amica

- State Farm

- Nationwide

- Liberty Mutual

- American Family

- Progressive

- Farmers Inurance

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2021, Porch Group, the Seattle-based home services software company, completed its $100 million acquisition of Homeowners of America Inc.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Homeowner’s Insurance Market based on the below-mentioned segments:

United States Homeowner’s Insurance Market, By Coverage

- Comprehensive Coverage

- Dwelling Coverage

United States Homeowner’s Insurance Market, By End User

- Landlords

- Tenants

United States Homeowner’s Insurance Market, By Distribution Channel

- Independent Advisors

- Affiliated Agents

Need help to buy this report?