United States Hormone Replacement Therapy Market Size, Share, and COVID-19 Impact Analysis, By Product (Estrogen, Progesterone, Thyroid, Growth Hormone, Testosterone), By Route of Administration (Oral, Parenteral), By Disease (Menopause, Growth Hormone Deficiency), By Distribution Channel (Retail pharmacies, Hospital pharmacies, Online pharmacies), and United States Hormone Replacement Therapy Market Insights Forecasts to 2033

Industry: HealthcareUnited States Hormone Replacement Therapy Market Insights Forecasts to 2033

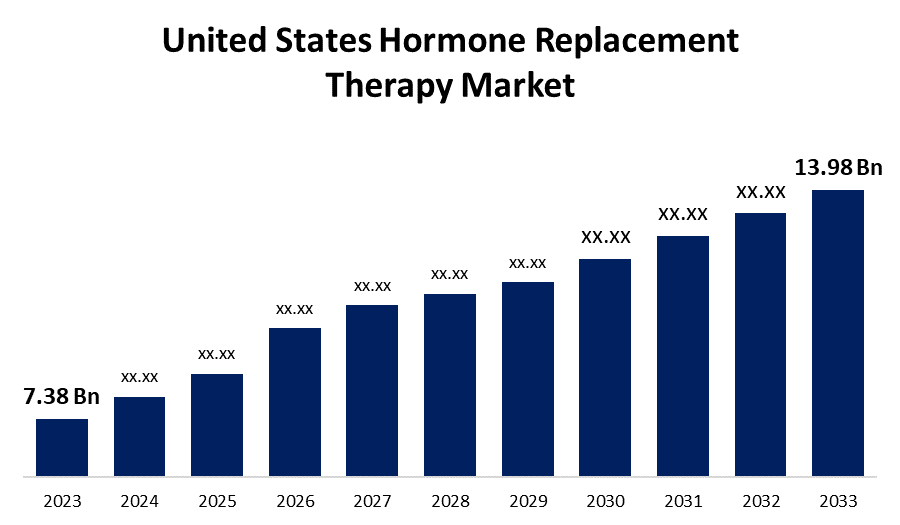

- The United States Hormone Replacement Therapy Market Size was valued at USD 7.38 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.6% from 2023 to 2033.

- The United States Hormone Replacement Therapy Market Size is Expected to Reach USD 13.98 Billion by 2033.

Get more details on this report -

The United States Hormone Replacement Therapy Market Size is Expected to Reach USD 13.98 Billion by 2033, at a CAGR of 6.6% during the forecast period 2023 to 2033.

Market Overview

Hormone replacement therapy (HRT) is a treatment procedure that replaces and replenishes hormone levels in the human body that are below what is needed for normal physiology. These therapies are critical for patients with growth hormone deficiencies, women suffering from menopausal disorders, and geriatric patients with hypogonadism, among other conditions. Hormone replacement therapy is most commonly used to treat menopausal symptoms. In other words, hormone replacement therapy is a medical procedure in which patients receive hormones to replace or supplement naturally occurring hormones that are deficient. In the case of females, this treatment is used to restore hormone levels in women going through menopause, allowing the body to function normally. Hormone replacement therapy (HRT) is the use of hormones to replace natural hormones that the body cannot produce in sufficient quantities. For example, thyroid and human growth hormone patients are typically treated with hormone replacement therapy. Furthermore, HRT was frequently administered to menopausal women to alleviate indications such as night sweats, hot flushes, sleep disruptions, psychological and genito-urinary disorders (urinary frequency and vaginal dryness), and the prevention of osteoporosis.

Report Coverage

This research report categorizes the market for United States hormone replacement therapy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States hormone replacement therapy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States hormone replacement therapy market.

United States Hormone Replacement Therapy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.38 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.6% |

| 2033 Value Projection: | USD 13.98 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Route of Administration, By Disease, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | Eli Lilly and Company, Bayer AG, Pfizer Inc., Viatris, Inc., Noven Pharmaceuticals, Inc., Merck KGaA, Novo Nordisk A/S, F. Hoffmann-La Roche Ltd., ASCEND Therapeutics US, LLC., Abbott Laboratories, Teva Pharmaceutical Industries Ltd., Novartis AG, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The treatment is available in several forms, including skin and buccal patches, injectables, tablets, and others. As the popularity of these products grows in the United States, various manufacturers are focusing on the development of advanced drug delivery systems such as vaginal estrogen drugs and transdermal estrogen patches. Furthermore, one of the key market players' innovations in the United States is the introduction of gel-based formulations for estrogen patches and other products. Menopause is also considered one of the most common gynecological disorders in women. Growth hormone is also considered a rare endocrine disorder in adults, with symptoms including low energy levels, insulin resistance, lipid abnormalities, and a lack of physical activity. As a result, the prevalence of the growth hormone disorder is high in patients with Langerhans cell histiocytosis. The rise in the incidence of hormone deficiency in adults has led to an increase in the use of these therapies in the United States.

Restraining Factors

The rising prevalence of menopause in the United States, as well as new product launches, are some of the factors weighing on market growth. These therapies are available in a variety of forms, including patches, gel, capsules, and injections. However, these products may cause side effects such as elevated cholesterol levels, blood clots, bloating, swelling, and others, which may impede market growth during the forecast period.

Market Segment

- In 2023, the estrogen & progesterone segment accounted for the largest revenue share over the forecast period.

Based on the product, the United States hormone replacement therapy market is segmented into estrogen & progesterone, thyroid, growth hormone, and testosterone. Among these, the estrogen & progesterone segment has the largest revenue share over the forecast period. Estrogen and progesterone replacement therapy has a proven track record of managing menopausal symptoms and can also be used to treat postmenopausal osteoporosis. It is regarded as one of the most effective treatments for addressing these health issues, increasing its popularity and market share. A large body of clinical research and scientific evidence backs up the efficacy and safety of estrogen and progesterone replacement therapies.

- In 2023, the oral segment accounted for the largest revenue share over the forecast period.

Based on the route of administration, the United States hormone replacement therapy market is segmented into oral and parenteral. Among these, the oral segment has the largest revenue share over the forecast period. Factors contributing to this growth include its non-invasive nature, precise and consistent drug dosing, affordability, and patients' strong preference. Oral HRT provides a consistent dosing regimen, making treatment management easier for both patients and healthcare providers. Hormone delivery is consistent and predictable, making it easier to monitor and adjust treatment plans.

- In 2023, the menopause segment accounted for the largest revenue share over the forecast period.

Based on the disease, the United States hormone replacement therapy market is segmented into menopause and growth hormone deficiency. Among these, the menopause segment has the largest revenue share over the forecast period. Menopause is characterized by a variety of symptoms, such as hot flashes, night sweats, mood swings, sleep disturbances, and vaginal dryness. These symptoms can be disruptive to a woman's quality of life. Hormone replacement therapy is an effective method of alleviating these symptoms, resulting in increased comfort and well-being. Thus, the large share of the menopause segment can be attributed to the increased use of hormone replacement therapy for the management of its symptoms, the rising prevalence of menopause, and the increasing availability of various formulations for the treatment of its symptoms.

- In 2023, the hospital pharmacies segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the United States hormone replacement therapy market is segmented into retail pharmacies, hospital pharmacies, and online pharmacies. Among these, the hospital pharmacies segment has the largest revenue share over the forecast period. Hospitals are primary healthcare facilities where patients with a variety of medical conditions, including those requiring HRT, can receive comprehensive care. Furthermore, hospital pharmacies are well-equipped to provide high-quality care and play an important role in the use of hormone replacement therapy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States hormone replacement therapy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eli Lilly and Company

- Bayer AG

- Pfizer Inc.

- Viatris, Inc.

- Noven Pharmaceuticals, Inc.

- Merck KGaA

- Novo Nordisk A/S

- F. Hoffmann-La Roche Ltd.

- ASCEND Therapeutics US, LLC.

- Abbott Laboratories

- Teva Pharmaceutical Industries Ltd.

- Novartis AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2022, Eli Lilly and Company has formed a collaboration with Very Inc, an oncology biopharmaceutical company. This is for the Phase 3 ENABLAR-2 Trial, which will evaluate enobosarm in combination with verzenio. This strategy contributed to characterizing and evaluating the efficacy of enbosarm as a hormone replacement therapy, thereby increasing demand and supply of verzenio and expanding the company's product portfolio.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States hormone replacement therapy market based on the below-mentioned segments:

United States Hormone Replacement Therapy Market, By Product

- Estrogen

- Progesterone

- Thyroid

- Growth Hormone

- Testosterone

United States Hormone Replacement Therapy Market, By Route of Administration

- Oral

- Parenteral

United States Hormone Replacement Therapy Market, By Disease

- Menopause

- Growth Hormone Deficiency

United States Hormone Replacement Therapy Market, By Distribution Channel

- Retail pharmacies

- Hospital pharmacies

- Online pharmacies

Need help to buy this report?