United States Household Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product (Refrigerator, Air Conditioner, Washing Machine, Dishwasher, Water Heater, Cooking Appliance, Vacuum Cleaner, and Other Products), By Distribution Channel (Offline, Specialty Stores, Multi-Branded Stores, Online, and Others), and United States Household Appliances Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited States Household Appliances Market Insights Forecasts to 2033

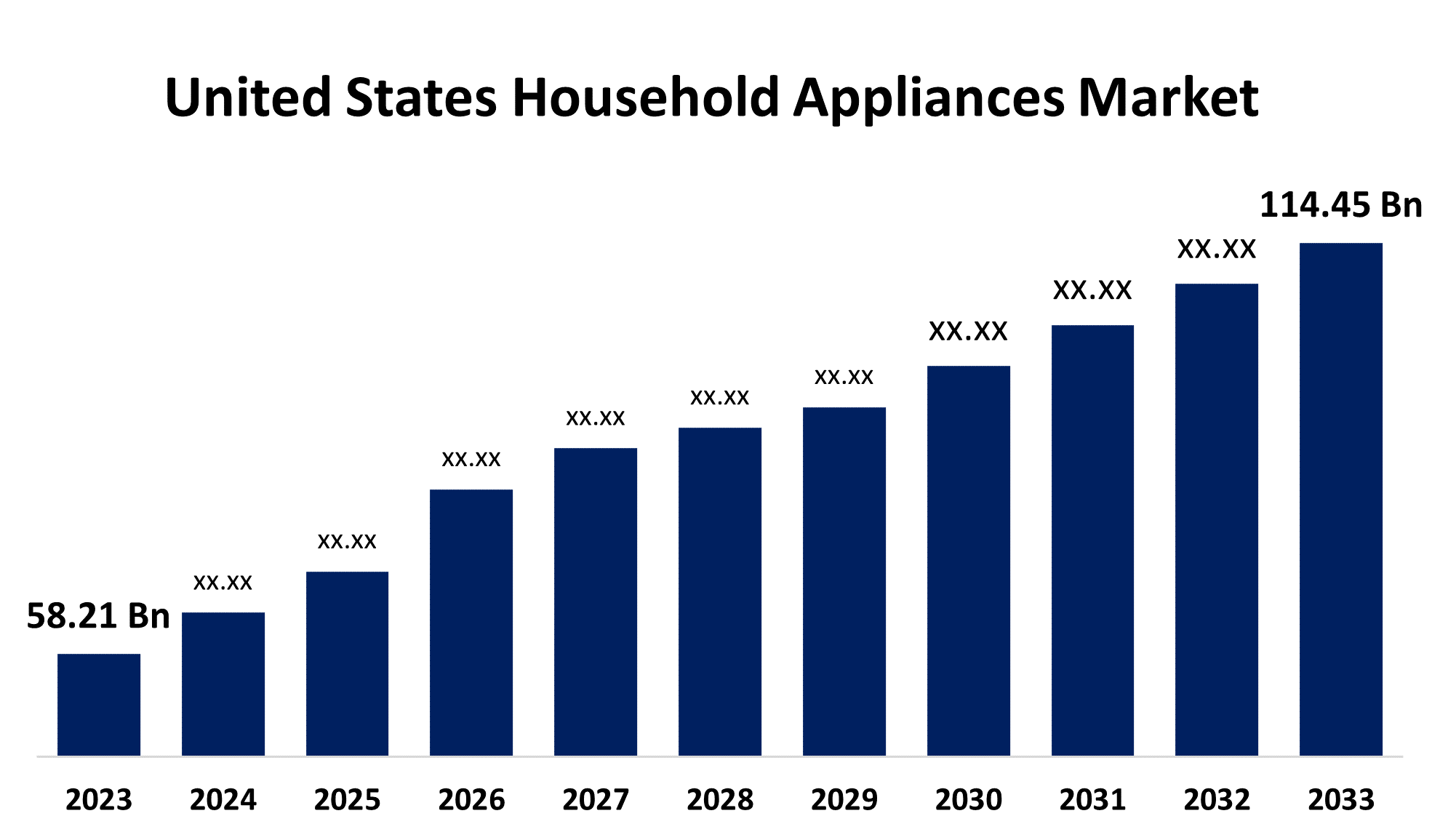

- The United States Household Appliances Market Size was valued at USD 58.21 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.99% from 2023 to 2033

- The United States Household Appliances Market Size is Expected to reach USD 114.45 Billion by 2033

Get more details on this report -

The United States Household Appliances Market is anticipated to exceed USD 114.45 Billion by 2033, growing at a CAGR of 6.99% from 2023 to 2033.

Market Overview

Appliances for the home are gadgets made to help with different domestic chores. They are meant to make domestic duties more manageable, effective, and time-saving. Usually, they run on gas or electricity. To make daily duties easier and enhance the overall quality of life, this equipment is utilized in the kitchen, laundry room, and living areas of the house. Appliances found in homes include air purifiers, dishwashers, washing machines, refrigerators, and more. The industry that includes the manufacturing, distributing, and retailing of different electrical and mechanical appliances used for domestic usage is known as the US household appliances market. From cooking and cleaning to heating and cooling, these gadgets are essential for improving the comfort, ease, and effectiveness of daily tasks. The increase in people's disposable income is anticipated to be a major factor in the market's growth. The market for home appliances is expected to benefit from the fast-paced urbanization that is occurring. Numerous elements, such as product innovation and advancement that result in portfolio extension and product premiumization, have an impact on the market's growth. The growing use of integrated smart home technology, which improves efficiency and convenience, is another important aspect. Rising fuel costs, the rise in nuclear families, and advancements in induction cooking technology have made consumers more reliant on home appliances, which is predicted to have a big effect on market expansion.

Report Coverage

This research report categorizes the market for the United States household appliances market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the household appliances market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the household appliances market.

Driving Factors

Product innovation and advancement leading to portfolio expansion and product premiumization are key factors driving market share. As the home appliance market in the US has become increasingly competitive, companies are continuously investing in research and development to introduce money-saving, energy-efficient, and smart technologies. These innovations cater to the growing needs of the working population, including working women, young people, and professionals, who look for devices with sophisticated features and low energy consumption. The trend towards energy efficiency is particularly significant, as it not only reduces energy expenditure but also has a positive psychological effect by reducing stress and improving mood. Electronics and home appliances, including IT devices, mobile devices, and electrical appliances, are all subject to this trend.

United States Household Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 58.21 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.99% |

| 2033 Value Projection: | USD 114.45 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 216 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Whirlpool Corporation, Frigidaire, GE Appliances, Electrolux, Samsung, Panasonic, Haier, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Restraining Factors

The cost of the final product is significantly influenced by the pricing of the raw materials, which include paints, steel, iron, plastic, glass, electrical equipment, and petroleum products. Due to global pricing fluctuations and the procurement procedure, which involves supplier limitations and transit costs, these materials are susceptible to change.

Market Segmentation

The United States household appliances market share is classified into product and distribution channel.

- The cooking appliance segment is expected to hold the largest market share through the forecast period.

The United States household appliances market is segmented by product into refrigerator, air conditioner, washing machine, dishwasher, water heater, cooking appliance, vacuum cleaner, and other products. Among them, the cooking appliance segment is expected to hold the largest market share through the forecast period. It is anticipated that the demand for cooking appliances in the US real estate market will rise as a result of consumers' desire to save time and effort. The demand for ovens, microwaves, and other culinary appliances in the United States throughout the projection period is expected to be fueled by factors such as growing standards of living and disposable income.

- The offline segment dominates the market with the largest market share over the predicted period.

The United States household appliances market is segmented by distribution channel into offline, specialty stores, multi-branded stores, online, and others. Among them, the offline segment dominates the market with the largest market share over the predicted period. Most consumers select offline stores when buying household appliances because of the exclusive offers made by product experts and the post-purchase services. Home appliances are sold by several businesses in the United States, such as Walmart, Old Navy, and Target. These are probably "experience stores" where patrons are allowed to use the merchandise. These stores offer a wide range of choices to their patrons. To draw in more consumers, several brands have opened experiential retail stores in the US.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States household appliances market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Whirlpool Corporation

- Frigidaire

- GE Appliances

- Electrolux

- Samsung

- Panasonic

- Haier

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2022, L.G. Electronics' groundbreaking creation was honored with multiple accolades. The company was designated the most-awarded brand by USA TODAY/Reviewed for L.G.'s OLED Evo C2 Series, PuriCare AeroTower, DualUp Monitor, Soundbar S95QR, and Washer and Dryer Pair. Four key criteria were taken into consideration when awarding this achievement: value, design, innovation, and technology.

Market Segment

This study forecasts revenue at French, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Household Appliances Market based on the below-mentioned segments:

United States Household Appliances Market, By Product

- Refrigerator

- Air Conditioner

- Washing Machine

- Dishwasher

- Water Heater

- Cooking Appliance

- Vacuum Cleaner

- Other Products

United States Household Appliances Market, By Distribution Channel

- Offline

- Specialty Store

- Multi-Branded Stores

- Online

- Others

Need help to buy this report?