United States HVDC Transmission Market Size, Share, and COVID-19 Impact Analysis, By Transmission Type (Submarine HVDC Transmission System, HVDC Overhead Transmission System, and HVDC Underground Transmission System), By Component (Converter Stations, and Transmission Medium), and United States HVDC Transmission Market Insights, Industry Trend, Forecasts to 2033.

Industry: Energy & PowerUnited States HVDC Transmission Market Insights Forecasts to 2033

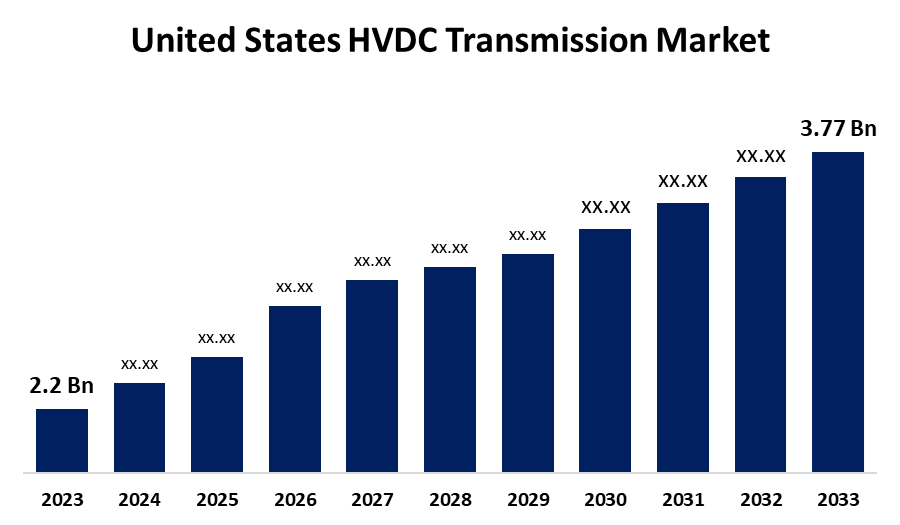

- The U.S. HVDC Transmission Market Size was Valued at USD 2.02 Billion in 2023

- The United States HVDC Transmission Market Size is Growing at a CAGR of 6.44% from 2023 to 2033

- The USA HVDC Transmission Market Size is Expected to Reach USD 3.77 Billion by 2033

Get more details on this report -

The USA HVDC transmission market size is anticipated to exceed USD 3.77 Billion by 2033, growing at a CAGR of 6.44% from 2023 to 2033. The U.S. HVDC transmission market is expanding with increasing renewable energy integration, grid modernization, and long-distance power efficiency. Yet, high expenses, regulatory hurdles, and grid compatibility problems can restrain growth.

Market Overview

The USA high-voltage direct current transmission (HVDC) market involves the construction, installation, and operation of HVDC systems for efficient long-distance transmission of electricity. It involves converter stations, cables, and grid integration technologies that provide power stability, minimize transmission losses, and enable renewable energy integration into the national grid. Moreover, the growth of the U.S. HVDC transmission market depends on the growing adoption of renewable energy, growing electricity demand, and efficient long-distance power transmission. Grid modernization advancements, investments by the government, and carbon reduction objectives also boost growth. The capability of HVDC to improve grid stability, reduce transmission loss, and facilitate offshore wind projects enhances market demand. Cross-regional power distribution and technology breakthroughs in converters and cables are also boosting market growth.

Report Coverage

This research report categorizes the market for the US HVDC transmission market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. HVDC transmission market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA HVDC transmission market.

Driving Factors

United States HVDC Transmission Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.02 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.44% |

| 2033 Value Projection: | USD 3.77 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Companies covered:: | By Component, By Transmission Type and COVID-19 Impact Analysis |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis, |

Get more details on this report -

The US HVDC transmission market is spurred by the expanding demand for efficient long-distance power transmission, mounting renewable energy integration, and development in grid infrastructure. Government initiatives for clean energy, expanding electricity demand, and lower transmission losses render HVDC an attractive option. Moreover, investments in offshore wind farms, cross-regional power exchange, and advancements in converters and high-capacity cables further drive market growth, guaranteeing a robust and secure power network.

Restraining Factors

High upfront investment expenses, complicated installation procedures, and regulatory hurdles hold back the USA HVDC transmission market. Integration problems with the current AC grids and a shortage of skilled personnel also hinder the pace of large-scale adoption and infrastructure development.

Market Segmentation

The U.S. HVDC transmission market share is classified into transmission type, component.

- The HVDC overhead transmission system segment accounted for the largest share of the US HVDC transmission market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of transmission type, the US HVDC transmission market is divided into submarine HVDC transmission system, HVDC overhead transmission system, and HVDC underground transmission system. Among these, the HVDC overhead transmission system segment accounted for the largest share of the US HVDC transmission market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because it is cost-effective, highly efficient in transmitting power over long distances, and easy to install. It is predominantly utilized for bulk power transmission over large areas in support of grid stability and integration of renewable power more effectively than submarine and underground grids.

- The converter stations segment accounted for a substantial share of the U.S. HVDC transmission market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of component, the U.S. HVDC transmission market is divided into converter stations and transmission medium. Among these, the converter stations segment accounted for a substantial share of the U.S. HVDC transmission market in 2023 and is anticipated to grow at a rapid pace during the projected period. The American HVDC transmission market because these are fundamental in AC-DC and DC-AC conversion, facilitating power transmission efficiently. Their high expense, technological nature, and significant role in maintaining grid stability and integrating renewable sources make them the prevailing element above transmission mediums.

Competitive Analysis:

The report offers the appropriate analysis of the key Bulleted List Propertiesorganizations/companies involved within the USA HVDC transmission market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB Ltd

- Siemens Energy AG

- General Electric Company

- Alstom SA

- Toshiba Corporation

- Schneider Electric SE

- LS Electric Co. Ltd

- NKT AS

- Cisco Systems Inc.

- Doble Engineering Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, LS Power announced that these preferred LS Power Grid California, LLC to build, finance, operate, and maintain two new projects to help electric reliability in California, the Metcalf - San Jose B HVDC project and the Newark-Northern Receiving Station HVDC project. CAISO ordered the Metcalf project and Newark project to enhance the electrical grid in and across San Jose, increase reliability, and provide access to profitable, renewable electricity.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. HVDC transmission market based on the below-mentioned segments:

United States HVDC Transmission Market, By Transmission Type

- Submarine HVDC Transmission System

- HVDC Overhead Transmission System

- HVDC Underground Transmission System

United States HVDC Transmission Market, By Component

- Converter Stations

- Transmission Medium

Need help to buy this report?