United States Immunoglobulin Market Size, Share, and COVID-19 Impact Analysis, By Route of Administration (Intravenous and Subcutaneous), By Indication (Primary Immunodeficiency (PI), Secondary Immunodeficiency (SI), Chronic Inflammatory Demyelinating Polyneuropathy (CIDP), Guillian Barre Syndrome, Immune Thrombocytopenic Purpura (ITP), Multifocal Motor Neuropathy (MMN), and Others), By Form (Liquid and Lyophilized), By End User (Hospitals, Clinics, and Homecare), and United States Immunoglobulin Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Immunoglobulin Market Insights Forecasts to 2033

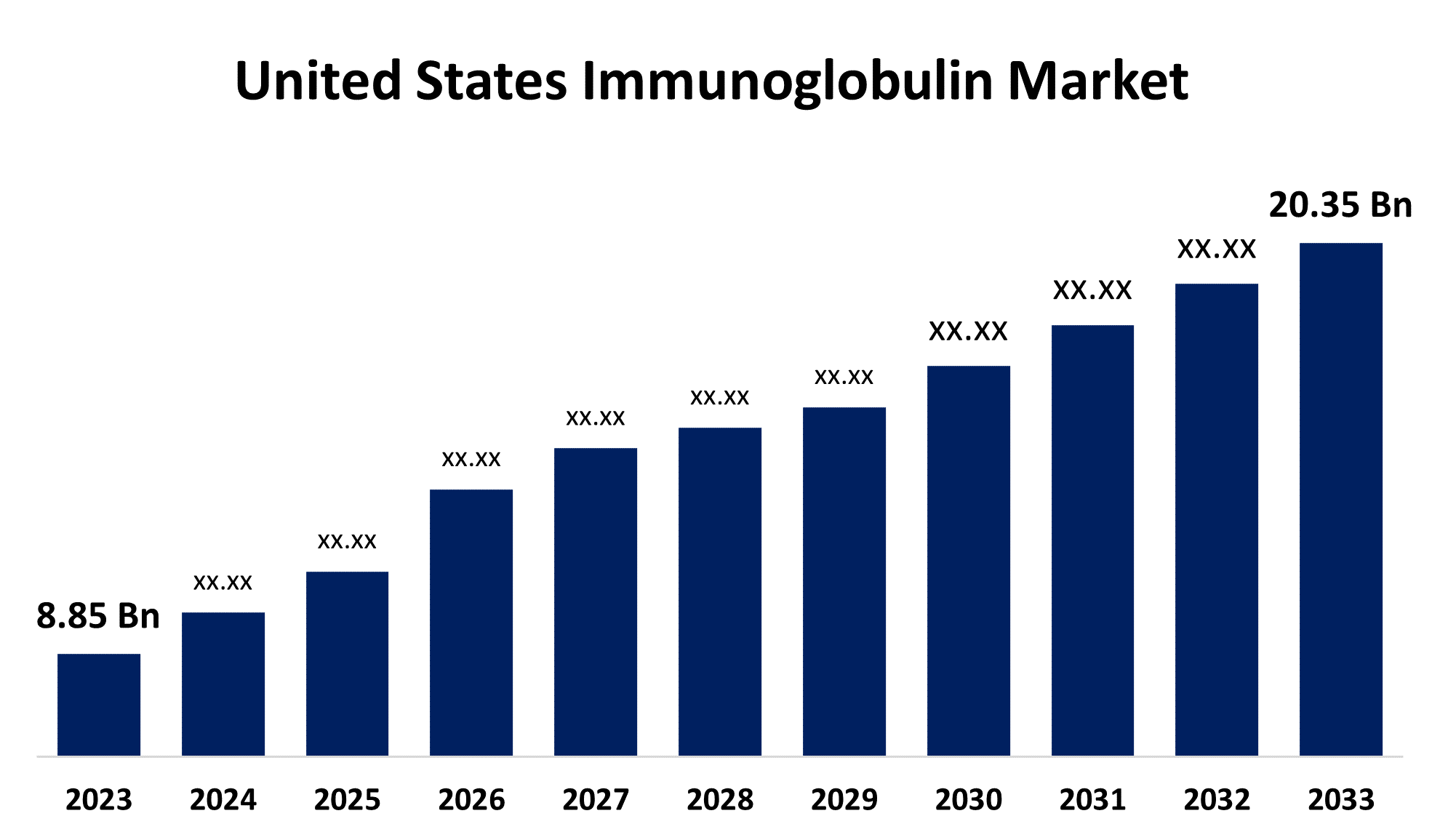

- The United States Immunoglobulin Market Size was valued at USD 8.85 billion in 2023.

- The Market Size is Growing at a CAGR of 8.68% from 2023 to 2033

- The U.S. Immunoglobulin Market Size is Expected to reach USD 20.35 billion by 2033

Get more details on this report -

The United States Immunoglobulin Market is anticipated to exceed USD 20.35 billion by 2033, growing at a CAGR of 8.68% from 2023 to 2033. The growing prevalence of auto-immune disorders and the development of novel therapies using immunoglobulin are driving the growth of the immunoglobulin market in the United States.

Market Overview

Immunoglobulin, a specialized protein, also known as antibodies is produced by the immune system in reaction to the presence of foreign substances including bacteria, viruses, and other pathogens. They play a crucial role in the body’s defense against infection and illnesses. The manufacturing, distribution, and application of immunoglobulin products—also referred to as antibodies—are the main focuses of the immunoglobulin market. These proteins provide passive protection against a range of illnesses and are essential to the immune system. In the US, the number of patients with auto-immune diseases has significantly increased. These disorders include Guillain-Barre syndrome, primary immunodeficiency, and secondary immunodeficiency, among others. The market demand is anticipated to be driven by the growing number of clinical trials demonstrating the effectiveness of employing immunoglobulins for various illnesses. Immunoglobulin products administered subcutaneously have several advantages in terms of clinical outcomes, including reduced risks of systemic side effects and a shorter delivery period. To meet the growing demand from healthcare providers, major businesses are concentrating on approving and launching new SCIg products.

Report Coverage

This research report categorizes the market for the US immunoglobulin market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the immunoglobulin market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the immunoglobulin market.

United States Immunoglobulin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 8.85 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.68% |

| 2033 Value Projection: | USD 20.35 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 216 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Route of Administration, By Indication, By Form, By End User |

| Companies covered:: | CSL, Pfizer, ADMA Biologica, Inc., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As per report by the National Institutes of Health (NIH), autoimmune disorders are considered to be the third most common cause of chronic illness in the US. This has led to the development of novel therapies for treating these chronic diseases. Thus, the rising prevalence of auto-immune disorders is propelling the market demand for immunoglobulin. Furthermore, there is an increasing focus on the development and introduction of novel therapies for treating several conditions using immunoglobulin which leads to drive the market growth.

Restraining Factors

The higher costs of immunoglobulin therapy including medication, hospital administration, and other costs are restraining the US immunoglobulin market.

Market Segmentation

The United States Immunoglobulin Market share is classified into route of administration, indication, form, and end user.

- The intravenous segment dominated the market with the largest market share during the forecast period.

The United States immunoglobulin market is segmented by route of administration into intravenous and subcutaneous. Among these, the intravenous segment dominated the market with the largest market share during the forecast period. Intravenous immunoglobulin is used to boost the immune system's performance, in patients with X-linked agammaglobulinemia and variable immunodeficiency (CVID) that require routine IVIG infusions. It is useful for treating a variety of autoimmune diseases. The high product approvals and launches are driving the market growth.

- The primary immunodeficiency (PI) segment accounted for the largest share of the United States immunoglobulin market in 2023.

Based on the indication, the United States immunoglobulin market is divided into primary immunodeficiency (PI), secondary immunodeficiency (SI), chronic inflammatory demyelinating polyneuropathy (CIDP), Guillian Barre Syndrome, immune thrombocytopenic purpura (ITP), multifocal motor neuropathy (MMN), and others. Among these, the primary immunodeficiency (PI) segment accounted for the largest share of the United States immunoglobulin market in 2023. Primary immunodeficiency is a rare genetic disease affecting approximately 500,000 people in the US according to the healthcare provider website GAMMAKED. The growing prevalence of chronic diseases and the development of immunoglobulin therapies are significantly driving the market growth.

- The liquid segment accounted for the largest share of the United States immunoglobulin market in 2023.

Based on the form, the United States immunoglobulin market is divided into liquid and lyophilized. Among these, the liquid segment accounted for the largest share of the United States immunoglobulin market in 2023. The liquid form of immunoglobulin is cost-effective and requires no further dilution making it more convenient to use. The introduction and adoption of liquid immunoglobulin products for treating various chronic conditions are propelling the market growth.

- The clinics segment is anticipated to grow at the fastest CAGR through the forecast period.

The United States immunoglobulin market is segmented by end user into hospitals, clinics, and homecare. Among these, the clinics segment is anticipated to grow at the fastest CAGR through the forecast period. The clinics segment provides better services and quality of care. The increasing preference of clinics for the treatment is driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US immunoglobulin market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CSL

- Pfizer

- ADMA Biologica, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, The Food and Drug Administration (FDA) expanded the approval of HyQvia (immune globulin [IG] infusion 10% [human] with recombinant human hyaluronidase) to include children 2 to 16 years of age with primary immunodeficiency (PI).

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Immunoglobulin Market based on the below-mentioned segments:

United States Immunoglobulin Market, By Route of Administration

- Intravenous

- Subcutaneous

United States Immunoglobulin Market, By Indication

- Primary Immunodeficiency (PI)

- Secondary Immunodeficiency (SI)

- Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

- Guillian Barre Syndrome

- Immune Thrombocytopenic Purpura (ITP)

- Multifocal Motor Neuropathy (MMN)

- Others

United States Immunoglobulin Market, By Form

- Liquid

- Lyophilized

United States Immunoglobulin Market, By End User

- Hospitals

- Clinics

- Homecare

Need help to buy this report?