United States Injectable Contraceptives Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Subcutaneous Medroxyprogesterone Acetate (MPA) and Intramuscular Depot Medroxyprogesterone Acetate (MPA)), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and United States Injectable Contraceptives Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Injectable Contraceptives Market Insights Forecasts to 2033

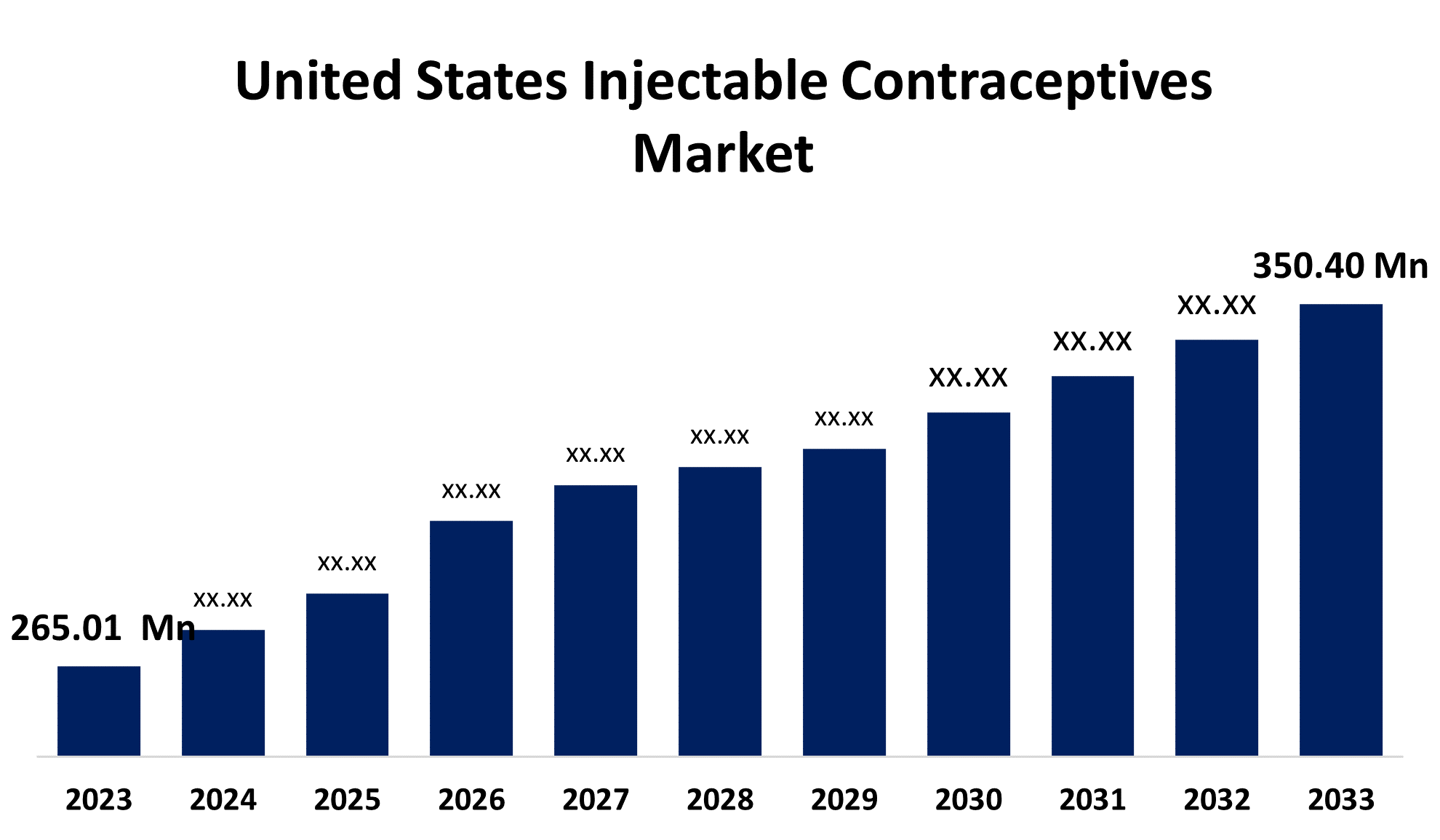

- The United States Injectable Contraceptives Market Size was valued at USD 265.01 Million in 2023.

- The Market Size is Growing at a CAGR of 2.83% from 2023 to 2033

- The U.S. Injectable Contraceptives Market Size is Expected to Reach USD 350.40 Million by 2033

Get more details on this report -

The United States Injectable Contraceptives Market is anticipated to exceed USD 350.40 Million by 2033, growing at a CAGR of 2.83% from 2023 to 2033. The growing awareness about family planning and injectable contraceptive benefits, and the increase in government initiatives are driving the growth of the injectable contraceptives market in the United States.

Market Overview

Injectable contraceptives are a form of birth control administered via injection. It typically comprises synthetic hormones that suppress ovulation, thicken cervical mucus to block sperm from entering the uterus, and thin the lining of the uterus to reduce the likelihood of implantation. These are highly effective forms of birth control that can last for several months with a single injection. The increasing R&D for new and advanced injectable contraceptive products is leveraging market opportunity for injectable contraceptives. Further, the emphasis is on collaboration with other healthcare services for increasing market growth and expansion into new markets. Further, a rise in government initiatives, growth in a number of sexually active women, and increased knowledge of injectable contraceptives and family planning among women and healthcare providers are key drivers of the market in the country.

Report Coverage

This research report categorizes the market for the US injectable contraceptives market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the injectable contraceptives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the injectable contraceptives market.

United States Injectable Contraceptives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 265.01 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.83% |

| 2033 Value Projection: | USD 350.40 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 217 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Viatris Inc. (Mylan N.V.), Pfizer, Inc., Teva Pharmaceutical Industries Ltd., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There is growing awareness about the importance of family planning for achieving reproductive health and well-being. Further, women are seeking advice from healthcare professionals to make educated decisions regarding their reproductive health as they become more knowledgeable about the range of contraceptives available. The rising awareness about the benefits of injectable contraceptives by healthcare providers for preventing unintended pregnancies and managing family planning is likely to drive the market. U.S. government has started several initiatives to increase access to injectable contraceptives. Affordable Care Act (ACA), Medicare, and Medicaid are several healthcare initiatives. These factors are expected to drive the market growth.

Restraining Factors

The adverse effects associated with the use of injectable contraceptives are making women less interested in the use of injectable contraceptives which may hamper the market growth.

Market Segmentation

The United States Injectable Contraceptives Market share is classified into product type and distribution channel.

- The subcutaneous medroxyprogesterone acetate (MPA) segment dominates the market with the largest market share in 2023.

The United States injectable contraceptives market is segmented by product type into subcutaneous medroxyprogesterone acetate (MPA) and intramuscular depot medroxyprogesterone acetate (MPA). Among these, the subcutaneous medroxyprogesterone acetate (MPA) segment dominates the market with the largest market share in 2023. Since subcutaneous medroxyprogesterone acetate (MPA) delivers slower and more effective hormone absorption than DMPA, self-injection of subcutaneous medroxyprogesterone acetate (MPA) is likely to enhance the continuation of contraceptive use.

- The retail pharmacies segment dominated the United States injectable contraceptives market during the forecast period.

Based on the distribution channel, the United States injectable contraceptives market is divided into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, the retail pharmacies segment dominated the United States injectable contraceptives market during the forecast period. Injectable contraceptives are available without a prescription from healthcare providers in the US and are the preferable option over hospital pharmacies and online pharmacies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US injectable contraceptives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Viatris Inc. (Mylan N.V.)

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2018, Mylan N.V. announced the U.S. launch of Medroxyprogesterone Acetate Injectable Suspension USP, 150 mg/mL Single-Dose Vial, a generic version of the brand drug, Pfizer's Depo-Provera.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Injectable Contraceptives Market based on the below-mentioned segments:

United States Injectable Contraceptives Market, By Product Type

- Subcutaneous Medroxyprogesterone Acetate (MPA)

- Intramuscular Depot Medroxyprogesterone Acetate (MPA)

United States Injectable Contraceptives Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Need help to buy this report?