United States Insurance Brokerage Market Size, Share, and COVID-19 Impact Analysis, By Brokerage (Direct Broker, Composite Broker, and Reinsurance Broker), By Insurance (Life and Accident Insurance, Travel Insurance, Health and Medical Insurance, and Others), and United States Insurance Brokerage Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialUnited States Insurance Brokerage Market Insights Forecasts to 2033

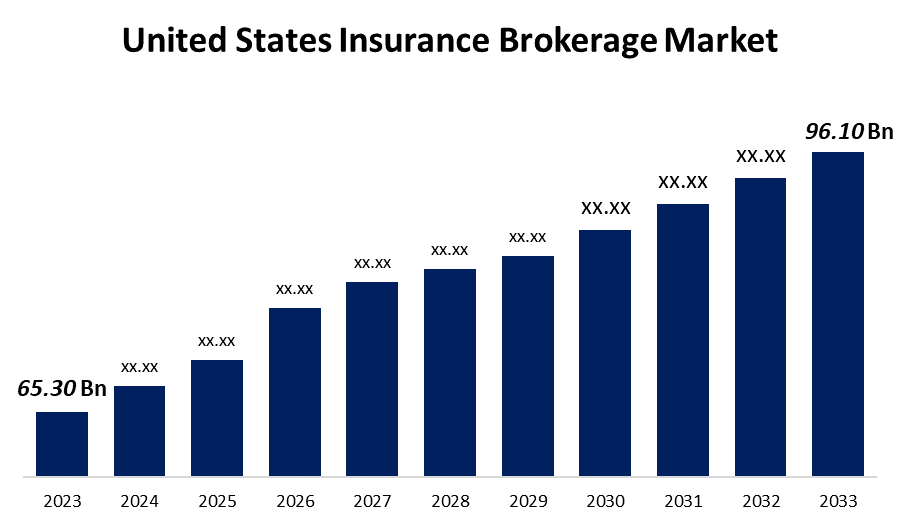

- The United States Insurance Brokerage Market Size was valued at USD 65.30 Billion in 2023.

- The Market is growing at a CAGR of 3.94% from 2023 to 2033

- The United States Insurance Brokerage Market Size is expected to reach USD 96.10 Billion by 2033

Get more details on this report -

United States Insurance Brokerage Market is anticipated to exceed USD 96.10 Billion by 2033, growing at a CAGR of 3.94% from 2023 to 2033.

Market Overview

The brokerage market is a significant and quickly expanding sector within the insurance industry. The organization acts as an intermediary between consumers and insurance companies, simplifying the complex insurance market for individuals and businesses. The growth of the insurance brokerage industry is being driven by the need for risk management, regulatory changes, and increased consumer knowledge of insurance products. Clients have the option to select from a range of services offered by insurance agents. Services provided include risk assessment, policy selection, policy administration, claims assistance, and risk management consulting. Insurance brokers collaborate with their clients to understand their insurance requirements, providing tailored insurance options from multiple providers. Brokers distinguish themselves by offering clients personalized coverage. Market growth is attributed to an increase in demand for insurance policies, integration of IT and analytics solutions, as well as provision of business solutions and services, expansion of business property and casualty insurance brokerage segment, and other factors. Insurance brokerage is a service provided by insurance brokers/insurers in the field of insurance and risk management. It offers various types of insurance services such as travel insurance, life, and accident insurance, health and private medical insurance, professional general liability property and casualty insurance, and more, helping policyholders find an insurance policy that suits their needs.

Report Coverage

This research report categorizes the market for the United States insurance brokerage market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the insurance brokerage market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the insurance brokerage market.

United States Insurance Brokerage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 65.30 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 3.94 |

| 2033 Value Projection: | USD 96.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Brokerage, By Insurance, and COVID-19 Impact Analysis |

| Companies covered:: | Marsh & Mclennan Companies Inc., Aon Plc., Willis Tower Watson Plc., Arthur J. Gallagher & Co., Brown & Brown, Inc., USI Ins, and others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The insurance brokerage business is expanding due to several factors, including the move from physical to digital channels, rising awareness of the need for insurance policies among people, and the integration of IT and analytics solutions by insurance providers. The insurance companies' increasing desire to offer expert solutions and services to end users also has a favorable effect on the market's expansion. Furthermore, during the projection period, promising government initiatives about insurance policies should present lucrative prospects for market expansion. The growth of insurtech companies and online insurance marketplaces is altering the market. Customers might easily compare and purchase insurance products using digital platforms, which puts traditional brokers in competition.

Restraining Factors

The availability of substitute platforms for buying insurance, however, is a significant barrier impeding the market's expansion. The market's expansion is constrained by the growing number of insurance intermediaries, internet platforms, and other third-party websites that offer insurance policies without charging extra commissions.

Market Segmentation

United States insurance brokerage market share is classified into brokerage and insurance.

- The direct broker segment is expected to hold the largest market share through the forecast period.

The United States insurance brokerage market is segmented by brokerage into direct broker, composite broker, and reinsurance broker. Among them, the direct broker segment is expected to hold the largest market share through the forecast period. Because of their competitiveness, clients benefit from the competitors' knowledgeable solutions and services. The government's initiatives regarding insurance policies and the integration of technology into current product and service lines are expected to create lucrative opportunities for the insurance brokerage business over the projected period. The most negative factors impacting this sector are the broad availability of alternative platforms for purchasing insurance policies and the direct sales of insurance plans by clients.

- The health and medical insurance segment dominates the market with the largest market share over the predicted period.

The United States insurance brokerage market is segmented by insurance into life and accident insurance, travel insurance, health and medical insurance, and others. Among them, the health and medical insurance segment dominates the market with the largest market share over the predicted period. The market is expanding as a result of the many advantages it offers the final consumer, including tax advantages, death benefits, guaranteed income, and a high return on investment. In recent years, there has been a significant amount of consolidation in the US insurance brokerage market. For both established and growing insurance brokers, acquisitions have been the primary growth strategy. Midsize and regional brokers have adopted the aggressive inorganic strategy as the fastest path to the top tiers of the market. The primary driver of the purchase rate can be private capital.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States insurance brokerage market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Marsh & Mclennan Companies Inc.

- Aon Plc.

- Willis Tower Watson Plc.

- Arthur J. Gallagher & Co.

- Brown & Brown, Inc.

- USI Ins

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Insurance Brokerageists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, the acquisition of SOLV Risk Solutions, LLC, a renowned independent agency with its headquarters located in Austin, Texas, was announced by Marsh McLennan Agency, a subsidiary of Marsh.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Insurance Brokerage Market based on the below-mentioned segments:

United States Insurance Brokerage Market, By Brokerage

- Direct Broker

- Composite Broker

- Reinsurance Broker

United States Insurance Brokerage Market, By Insurance

- Life and Accident Insurance

- Travel Insurance

- Health and Medical Insurance

- Others

Need help to buy this report?