United States Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Type (Life and Non-Life), By Distribution Channel (Direct, Agency, and Bank), and United States Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited States Insurance Market Insights Forecasts to 2033

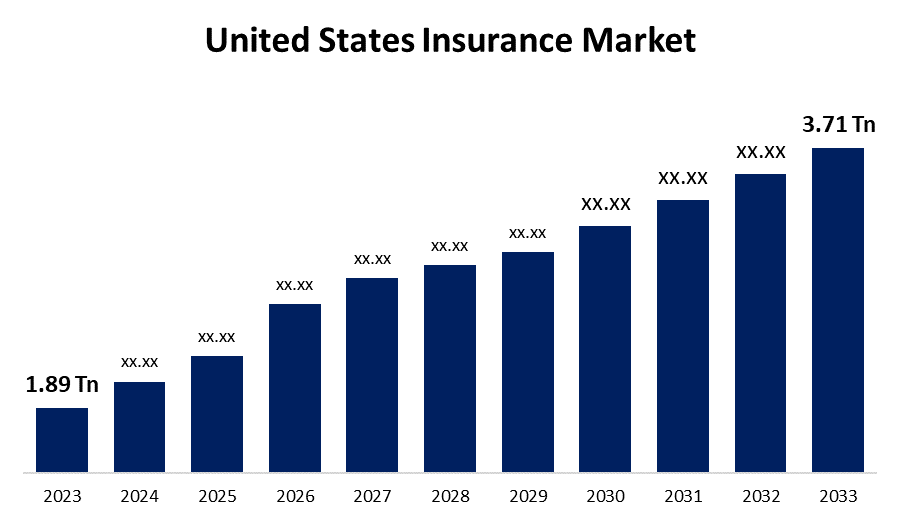

- The United States Insurance Market Size was valued at USD 1.89 Trillion in 2023.

- The Market is growing at a CAGR of 6.98% from 2023 to 2033

- The United States Insurance Market Size is expected to reach USD 3.71 Trillion by 2033

Get more details on this report -

United States Insurance Market is anticipated to exceed USD 3.71 Trillion by 2033, growing at a CAGR of 6.98% from 2023 to 2033.

Market Overview

Insurance is a contract in which, in exchange for the insurance premium, the insurer undertakes to reimburse or indemnify the insured, the policyholder, or a beneficiary for a specified loss or damage to a specified thing such as an item, property, or life from certain perils or risks. In the US, it is customary practice to categorize the insurance market into two categories, namely property and liability insurers and life and health insurers. The insurance industry in the United States is supported by a number of organizations, businesses, and governmental entities. The National Association of Insurance Commissioners offers services to its members, the state insurance departments or divisions, and models for standard state insurance law. The insurance services office is used by many insurance companies; it creates standard policy forms and rates loss costs, then submits these to the state insurance departments or divisions on behalf of member insurers. The benefit of safe data management across numerous interfaces and stakeholders without compromising integrity is offered by blockchain technology. The system delivers lower operating expenses for everything from identity management and underwriting to claims processing, fraud monitoring, and dependable data availability. Smart contracts and decentralized autonomous organizations (DAOs) are two further advantages that blockchain technology can provide for policy administration.

Report Coverage

This research report categorizes the market for the United States insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the insurance market.

United States Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.89 Trillion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.98% |

| 2033 Value Projection: | USD 3.71 Trillion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Insurance Type, By Distribution Channel |

| Companies covered:: | Massachusetts Mutual Life Insurance Company, UnitedHealth Group Incorporated, Berkshire Hathaway Inc., Cigna Corporation, Metlife Inc., Prudential Financial Inc., Aetna Inc., American International Group Inc., State Farm, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The insurance industry is changing to "digital-first" business models that have the potential to provide billion-dollar new opportunities. Insurance companies are using the Internet of Things, advanced analytics, and machine learning to create more detailed individual risk profiles as they place a greater emphasis on usage-based coverage and individualized premiums. Working together, traditional insurance companies and InsurTech companies can create new income streams and models, increase profitability, and save operating costs. With the help of new tech-enabled data sources like wearables, mobile-enabled InsurTech apps, and the Internet of Things, premiums will become much more tailored. Property and Casualty (P&C) insurers will be able to extract reliable and real-time data on individual consumers' loss exposure due to the projected significant growth of the connected devices market over the next five years.

Restraining Factors

Years of increasingly expensive disasters such as floods, hurricanes, wildfires, and similar disasters have increased losses for insurance companies and increased the overall cost of coverage.

Market Segmentation

The United States insurance market share is classified into insurance type and distribution channel.

- The non-life segment is expected to hold the largest market share through the forecast period.

The United States insurance market is segmented by insurance type into life and non-life. Among them, the non-life segment is expected to hold the largest market share through the forecast period. Advanced feature-rich motor insurance is propelling expansion in the non-life insurance market. Innovative features like customizable coverage options, accident-avoidance technologies, and real-time tracking are becoming more and more common in insurance policies.

- The agency segment dominates the market with the largest market share over the predicted period.

The United States insurance market is segmented by distribution channel into direct, agency, and bank. Among them, the agency segment dominates the market with the largest market share over the predicted period. Driven by connections built on trust and individualized services. Through individualized contacts and a thorough grasp of each customer's needs, agents provide customized recommendations and build trust. Agents increase awareness and confidence in their clients by teaching them about insurance options and advantages; this increases client satisfaction and retention rates. The promise of a reliable relationship and the personal touch not only increase market penetration into previously untapped markets but also foster greater client loyalty, thereby solidifying the agency channel's position as a key player in the insurance sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Massachusetts Mutual Life Insurance Company

- UnitedHealth Group Incorporated

- Berkshire Hathaway Inc.

- Cigna Corporation

- Metlife Inc.

- Prudential Financial Inc.

- Aetna Inc.

- American International Group Inc.

- State Farm

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2022, United Health Group achieved health equity and met its goals of improving access to care, lowering costs, and improving health outcomes by investing USD 100 Trillion in the diversity of its health workforce.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Insurance Market based on the below-mentioned segments:

United States Insurance Market, By Insurance Type

- Life

- Non-Life

United States Insurance Market, By Distribution Channel

- Direct

- Agency

- Bank

Need help to buy this report?