United States Integrated Delivery Network Market Size, Share, and COVID-19 Impact Analysis, By Integration Model (Vertical, Horizontal), By Service Type (Acute Care/Hospitals, Primary Care, Long-term Health, Specialty Clinics), Component (Hospital, ASCs, Health Clinic), and United States Integrated Delivery Network Market Insights Forecasts to 2033

Industry: HealthcareUnited States Integrated Delivery Network Market Size Insights Forecasts to 2033

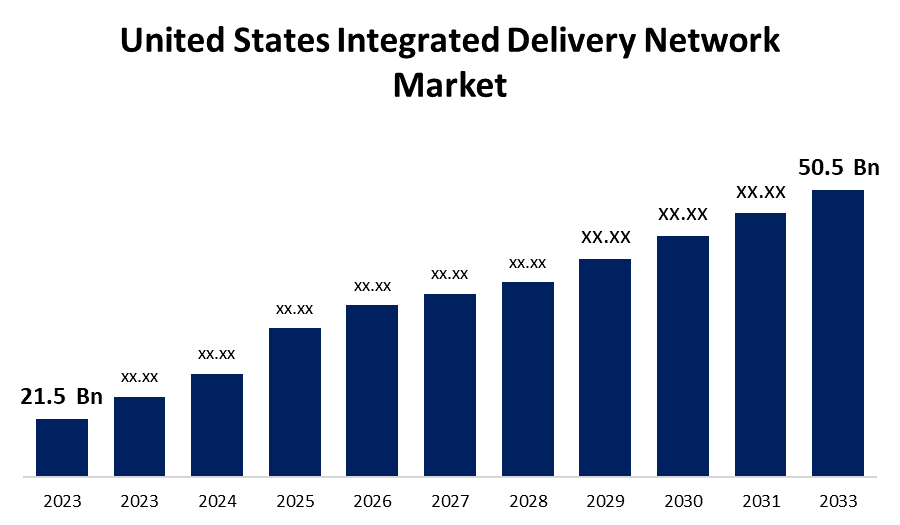

- The United States Integrated Delivery Network Market Size was valued at USD 21.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.9% from 2023 to 2033.

- The United States Integrated Delivery Network Market Size is Expected to Reach USD 50.5 Billion by 2033.

Get more details on this report -

The United States Integrated Delivery Network Market Size is Expected to reach USD 50.5 Billion by 2033, at a CAGR of 8.9% during the Forecast period 2023 to 2033.

Market Overview

Integrated delivery networks (IDNs) are critical components of the United States healthcare system, allowing healthcare providers to collaborate seamlessly. In the United States, an integrated delivery network (IDN) is a collaborative network made up of healthcare facilities, organizations, and healthcare professionals or providers who work together to provide effective, coordinated, and comprehensive healthcare services to people in need. The primary goal of integrated delivery network (IDN) is to provide a consistent and coordinated approach to patient care. This integration enhances care coordination, information sharing, and resource allocation, resulting in better patient outcomes and cost savings. The system typically consists of hospitals, clinics, physician practices, home healthcare agencies, long-term care facilities, and other healthcare entities. The ultimate goal of an integrated delivery network (IDN) system is to ensure that patients in that region have access to a comprehensive healthcare system. Stakeholders consistently work to improve the process across providers and settings. It also seeks to enhance the quality of medical care, patient outcomes, and efficiency.

Report Coverage

This research report categorizes the market for United States integrated delivery network market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States integrated delivery network market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States integrated delivery network market.

United States Integrated Delivery Network Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 21.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.9% |

| 2033 Value Projection: | USD 50.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Integration Model, By Service Type, and COVID-19 Impact Analysis |

| Companies covered:: | HCA Healthcare, Partners Healthcare, CHSPSC, LLC, UNITEDHEALTH GROUP, Providence, UPMC HEALTH PLAN, INC., Trinity Health, TH Medical, CommonSpirit Health, Ascension, Kaiser Foundation Health Plan, Inc., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for integrated delivery networks in the United States is expected to expand as care coordination and integration systems become more widely adopted. Integrated delivery network (IDN) architecture ensures that patients receive seamless and coordinated care by reducing the impact of fragmented healthcare systems. Medical facilities can improve patient outcomes by coordinating services, sharing information, and making care transitions easier. Integrated delivery network (IDN) typically focus on population health management, and the growing emphasis on this aspect of health management is expected to drive market growth over the forecast period. Healthcare institutions began focusing on outpatient settings after the affordable care act, when the federal government began offering larger incentives to care providers for outpatient facilities. As a result, the outpatient setting is increasingly popular. In addition, in response to the growing demand for accountable care and clinical integration, hospitals have transformed into accountable care organizations (ACO). As a result, healthcare costs are reduced and treatment quality improves. This is expected to increase adoption of IDN-provided integrated healthcare services and drive market growth.

Restraining Factors

An integrated delivery system can be defined as combining all required levels of care into a single integrated delivery system, allowing the purchaser and consumer of health care services to receive all necessary services in a single, seamless delivery system, facilitating access to the appropriate level of care at the appropriate time. As a result, restraining factor for integrated delivery systems in behavioral health care is that only a small proportion of people require all of the services offered by an integrated delivery system.

Market Segment

- In 2023, the vertical segment accounted for the largest revenue share over the forecast period.

Based on the integration model, the United States integrated delivery network market is segmented into vertical and horizontal. Among these, the vertical segment has the largest revenue share over the forecast period. Vertical integration integrated delivery networks (IDNs) provide comprehensive care at all stages of life, including end-of-life care and hospice services. These networks typically include a diverse group of medical specialists, including pediatricians, orthopedic surgeons, obstetricians and gynecologists, and other healthcare providers. Additionally, they frequently include assisted living facilities to cater to patients' needs.

- In 2023, the acute care/hospitals segment accounted for the largest revenue share over the forecast period.

Based on the service type, the United States integrated delivery network market is segmented into acute care/hospitals, primary care, long-term health, and specialty clinics. Among these, the acute care/hospitals segment has the largest revenue share over the forecast period. Owing to the presence of a large number of hospitals providing a wide range of disease treatment services, high adoption of acute care/hospital facilities, and an increase in the number of surgeries performed in hospital infrastructure. Acute care/hospital settings provide patients with well-equipped, advanced treatment facilities and trained healthcare professionals all under one roof. This is further supported by favorable reimbursement guidelines for patients who visit hospitals on a regular basis, as opposed to those seeking treatment at primary care facilities.

- In 2023, the hospital segment accounted for the largest revenue share over the forecast period.

Based on the component, the United States integrated delivery network market is segmented into hospital, ASCs, and health clinic. Among these, the hospital segment has the largest revenue share over the forecast period. Hospitals in IDNs frequently specialize in specific clinical areas, providing advanced medical services, surgical procedures, and specialized treatments. Clinical excellence and a reputation for high-quality care are key factors in attracting patients and referring physicians.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States integrated delivery network market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- HCA Healthcare

- Partners Healthcare

- CHSPSC, LLC

- UNITEDHEALTH GROUP

- Providence

- UPMC HEALTH PLAN, INC.

- Trinity Health

- TH Medical

- CommonSpirit Health

- Ascension

- Kaiser Foundation Health Plan, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2023, HCA Healthcare Inc. has announced over USD 300 billion in clinical nurse education and training investments. This investment aims to improve both the quality of care provided to patients and the delivery of treatment.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States integrated delivery network market based on the below-mentioned segments:

United States Integrated Delivery Network Market, By Integration Model

- Vertical

- Horizontal

United States Integrated Delivery Network Market, By Service Type

- Acute Care/Hospitals

- Primary Care

- Long-term Health

- Specialty Clinics

United States Integrated Delivery Network Market, By Component

- Hospital

- ASCs

- Health Clinic

Need help to buy this report?