United States Intravenous Immunoglobulin Market Size, Share, and COVID-19 Impact Analysis, By Application (Primary Immunodeficiency, Chronic Inflammatory, Demyelinating Polyradiculoneuropathy, Congenital AIDS, Chronic Lymphocytic Leukemia, Myasthenia Gravis, Multifocal Motor Neuropathy, Immune Thrombocytopenia, Kawasaki Disease, and Guillain-Barre Syndrome), By Distribution Channel (Hospital Pharmacy, Specialty Pharmacy, and Others), and United States Intravenous Immunoglobulin Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Intravenous Immunoglobulin Market Insights Forecasts to 2033

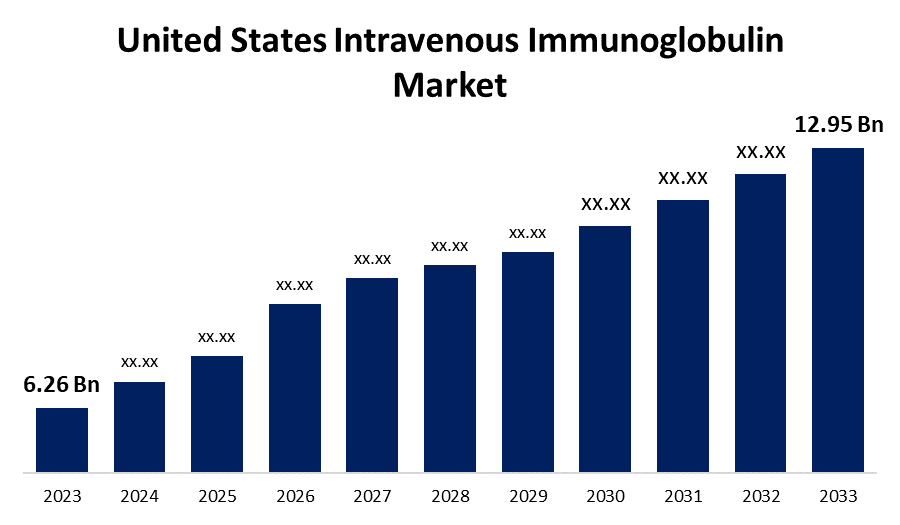

- The U.S. Intravenous Immunoglobulin Market Size was valued at USD 6.26 Billion in 2023.

- The Market is growing at a CAGR of 7.54% from 2023 to 2033

- The U.S. Intravenous Immunoglobulin Market Size is expected to reach USD 12.95 Billion by 2033

Get more details on this report -

The United States Intravenous Immunoglobulin Market is anticipated to exceed USD 12.95 Billion by 2033, growing at a CAGR of 7.54% from 2023 to 2033. The growing demand for immunoglobulin replacement therapies, new product approval for treatment, and adoption of home infusion therapy are driving the growth of the intravenous immunoglobulin market in the US.

Market Overview

Intravenous immunoglobulin (IVIG) therapy is the combination of antibodies (immunoglobulins) to treat health illnesses, such as primary immunodeficiency, immune thrombocytopenic purpura, chronic inflammatory demyelinating polyneuropathy, Kawasaki disease, certain cases of HIV/AIDS, measles, Guillain-Barré syndrome, and some other infections. Immunoglobulins are proteins produced by the immune system of healthy people to prevent infection. It can be injected into a muscle, a vein, or under the skin depending on the formulation. Even though IVIG is made from plasma, a blood product, the chance of getting a blood-borne illness is very minimal due to its great purity. Immunodeficiency and a number of autoimmune, neurological, and hematological illnesses are treated with IVIG replacement therapy. The FDA in the United States has approved the use of IVIG in a variety of disorders. IVIG is becoming more and more preferred because of its efficacy and safety. Further, the introduction of more efficient and cost-effective IVIG therapies is leveraging market opportunities for IVIG therapy in the United States.

Report Coverage

This research report categorizes the market for the US intravenous immunoglobulin market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States intravenous immunoglobulin market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US intravenous immunoglobulin market.

United States Intravenous Immunoglobulin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.26 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.54% |

| 2033 Value Projection: | USD 12.95 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Application, By Distribution Channel |

| Companies covered:: | Biotest AG, Octapharma AG, Pfizer, Inc., China Biologics Products Holdings, Inc., CSL, ADMA Biologics, Inc., LFB Biotechnologies S.A.S, Takeda Pharmaceutical Company Limited, Bio Products Laboratory Ltd., Kedrion S.P.A., Grifols, S.A., and other key comapnies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The growing demand for immunoglobulin replacement therapies for the treatment of a number of autoimmune, neurological, and hematological illnesses is driving the market. The increasing focus on obtaining approval and launching novel products in the market by key market players to cater to the rising number of patients requiring IVIG is expected to drive the market. There is an exponential rise in the use of home infusion therapy that can be attributed to the decreased immunity of immunocompromised patients and the safer delivery of medications at home.

Restraining Factors

The high expense of immunoglobulin treatment prevents the adoption of IVIG resulting in restraining the market. For instance, according to NCBI data from 2021, the average session cost in the United States was approximately USD 9,720. This means that a monthly cost of USD 41,796 would be incurred for 4.3 sessions.

Market Segmentation

The United States Intravenous Immunoglobulin Market share is classified into application and distribution channel.

- The primary immunodeficiency segment dominated the market with the largest market share in 2023.

The United States intravenous immunoglobulin market is segmented by application into primary immunodeficiency, chronic inflammatory, demyelinating polyradiculoneuropathy, congenital aids, chronic lymphocytic leukemia, myasthenia gravis, multifocal motor neuropathy, immune thrombocytopenia, kawasaki disease, and guillain-barre syndrome. Among these, the primary immunodeficiency diseases segment dominated the market with the largest market share in 2023. The prevalence of primary immunodeficiency disease (PIDD) in United States is 1 in 1,200, or around 270,000 cases. The existence of organizations like the Immune Deficiency Foundation, with the goal to improve PIDD diagnosis and treatment via research, education, and advocacy is expected to drive the adoption of IVIG therapy.

- The hospital pharmacy segment dominated the US intravenous immunoglobulin market with the largest revenue share in 2023.

Based on the distribution channel, the U.S. intravenous immunoglobulin market is divided into hospital pharmacy, specialty pharmacy, and others. Among these, the hospital pharmacy segment dominated the US intravenous immunoglobulin market with the largest revenue share in 2023. Hospital pharmacies have a benefit over conventional retail pharmacies as they have access to a patient’s electronic health information and patients do not need a prescription from a doctor to receive the necessary drugs. The accessibility of products in hospitals as well as the existence of a large number of hospitals in the region is driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. intravenous immunoglobulin market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Biotest AG

- Octapharma AG

- Pfizer, Inc.

- China Biologics Products Holdings, Inc.

- CSL

- ADMA Biologics, Inc.

- LFB Biotechnologies S.A.S

- Takeda Pharmaceutical Company Limited

- Bio Products Laboratory Ltd.

- Kedrion S.P.A.

- Grifols, S.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2021, The Food and Drug Administration (FDA) approved Octagam 10% (immune globulin intravenous [human]) for the treatment of adult dermatomyositis, a rare immune-mediated inflammatory disease.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Intravenous Immunoglobulin Market based on the below-mentioned segments:

US Intravenous Immunoglobulin Market, By Application

- Primary Immunodeficiency

- Chronic Inflammatory

- Demyelinating Polyradiculoneuropathy

- Congenital AIDS

- Chronic Lymphocytic Leukemia

- Myasthenia Gravis

- Multifocal Motor Neuropathy

- Immune Thrombocytopenia

- Kawasaki Disease

- Guillain-Barre Syndrome

US Intravenous Immunoglobulin Market, By Distribution Channel

- Hospital Pharmacy

- Specialty Pharmacy

- Others

Need help to buy this report?