United States Investment Banking Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Trading and Related Services, Equity Underwriting/Debt Underwriting, Financial Advisory, and Others), By Industry Vertical (BFSI, Energy and Utilities, IT and Telecom, Healthcare, Manufacturing, Retail, and Consumer Goods, Media and Entertainment, and Others), and United States Investment Banking Market Insights Forecasts 2023 - 2033.

Industry: Banking & FinancialUnited States Investment Banking Market Insights Forecasts to 2033

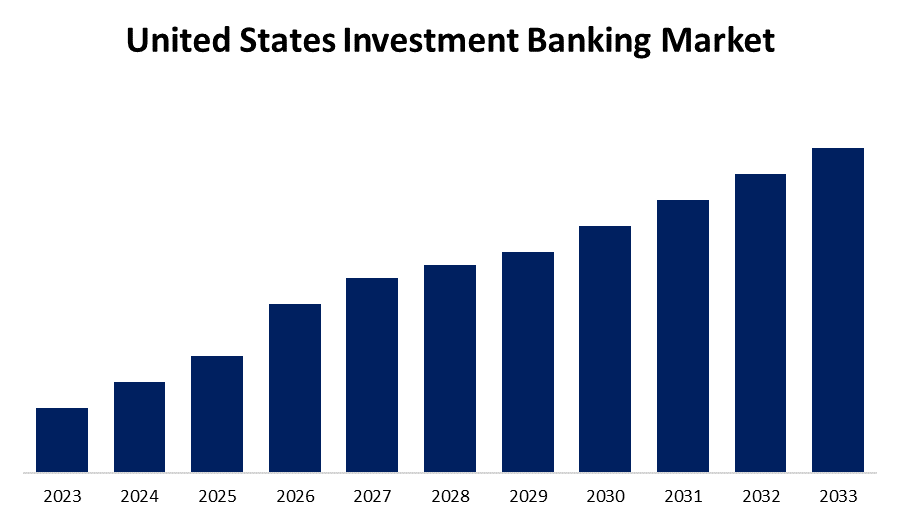

- The Market Size is Growing at a CAGR of 3.99% from 2023 to 2033.

- The United States Investment Banking Market Size is Expected to hold a significant share by 2033.

Get more details on this report -

The United States Investment Banking Market is Anticipated to hold a significant share by 2033, growing at a CAGR of 3.99% from 2023 to 2033.

Market Overview

The term "investment banking" describes a group of financial services that help governments, businesses, and other organizations raise money by selling securities, giving financial advice, and carrying out intricate financial transactions. These services include securities trading, asset management, mergers and acquisitions (M&A) advisory, and underwriting. Investment banks act as middlemen between buyers and sellers, utilizing their knowledge to negotiate terms and maximize profits for their patrons. The US investment banking business is a vibrant, rapidly expanding sector that is always changing in reaction to shifting laws, regulations, and technological breakthroughs. Numerous elements, such as business performance, worldwide financial trends, and economic indicators, have an impact on the market's growth. In-depth research of the US investment banking market is provided in this report, along with important insights into market opportunities, challenges, and emerging trends. The US investment banking market is an essential sector of the financial services sector that helps organizations and corporations raise cash, complete mergers and acquisitions, and carry out other financial operations. Investment banks serve as middlemen between investors and securities issuers, providing specialized services to assist customers in reaching their financial objectives. The US investment banking business draws both domestic and foreign players looking for expansion prospects and financial expertise because of its sophisticated and robust financial ecosystem.

Report Coverage

This research report categorizes the market for the United States investment banking market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States investment banking market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States investment banking market.

United States Investment Banking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.99% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service Type, By Industry Vertical |

| Companies covered:: | Morgan Stanley, J.P Morgan Chase and Co., Goldman Sachs, Credit Suisse, UBS, Bank of America, Evercore, CITI, HSBC, Rothschild & Co., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

A strong economy creates a setting that encourages more investment activities, leading to higher demand for investment banking services. An increase in mergers and acquisitions creates chances for investment banks to offer guidance services and facilitate transactions. Positive outcomes in the stock and bond markets motivate businesses to obtain funds by launching initial public offerings and issuing bonds. Adopting new technology boosts efficiency, reduces expenses, and allows investment banks to serve a wider range of clients. The expertise of investment banks is needed to navigate international financial regulations when expanding operations and conducting cross-border transactions. Moreover, the rising number of mergers and acquisitions (M&A) activities in the US is also a factor contributing to the demand for investment banking.

Restraining Factors

Strict regulatory frameworks demand ample resources and specialized knowledge to guarantee adherence, thereby affecting profitability. Downturns in the economy and fluctuations in the market can decrease interest in investing, impacting the profits made from investment banking services.

Market Segment

The United States Investment Banking Market share is classified into service type and industry verticals.

- The trading and related services segment is witnessing significant growth over the forecast period.

Based on service type, the United States investment banking market is segmented into trading and related services, equity underwriting/debt underwriting, financial advisory, and others. Among these, the trading and related services segment is witnessing significant growth over the forecast period. With the rise of financial activities in growing economies, there are many chances for investment banks and trading service providers to expand their range of products. Anticipated investments in digital transformation and the adoption of new technologies such as artificial intelligence, big data, machine learning, and chatbots are expected to open up opportunities in the investment banking market. Moreover, the economies of these emerging countries are expanding at a faster rate, and there is a rise in business activity. These elements lead to a high demand for investment banking and trading services to keep up with the evolving environment.

- The BFSI segment is expected to hold the largest market share through the forecast period.

Based on industry verticals, the United States investment banking market is segmented into BFSI, energy and utilities, IT and telecom, healthcare, manufacturing, retail and consumer goods, media and entertainment, and others. Among these, the BFSI segment is expected to hold the largest market share through the forecast period. Banks, insurance firms, brokerage firms, and financial advisors often rely on investment banking and trading services. Moreover, insurance, banking, and financial services firms mainly utilize investment banks for various trading services. The BFSI industry covers key product lines such as underwriting and securities sales for risk management and capital raising, executing client trading orders, offering related financing, research, financial advisory, and wealth management services, as well as underwriting and wealth management services. The increasing need for clearing, settlement, custody, and market-making services to accommodate the demands of larger-scale trading is a major trend in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States investment banking market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Morgan Stanley

- J.P Morgan Chase and Co.

- Goldman Sachs

- Credit Suisse

- UBS

- Bank of America

- Evercore

- CITI

- HSBC

- Rothschild & Co.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, Bank of America Corp launched CashPro Supply Chain Solutions to digitize trade finance. CashPro Supply Chain Solutions is an advanced online SCF platform that offers speedy access to funds and information for both buyers and suppliers. These solutions provide valuable advantages to the user, beginning with automated account opening, simplified invoice approval, improved visibility in the supply chain, and quicker processing and decision-making abilities.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Investment Banking Market based on the below-mentioned segments:

United States Investment Banking Market, By Service Type

- Trading and Related Services

- Equity Underwriting/Debt Underwriting

- Financial Advisory

- Others

United States Investment Banking Market, By Industry Vertical

- BFSI

- Energy and Utilities

- IT and Telecom

- Healthcare

- Manufacturing

- Retail and Consumer Goods

- Media and Entertainment

- Others

Need help to buy this report?