United States Irrigation Insurance Market Size, Share, and COVID-19 Impact Analysis, By Component (Motors and Pumps, Center Pivot Structure, Sprinkler Systems, Electrical Systems, and Others), By Type of Coverage (Mechanical Breakdown Coverage, Weather-related Coverage, Comprehensive Coverage, and Others), and U.S. Irrigation Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Information & TechnologyUnited States Irrigation Insurance Market Insights Forecasts to 2033

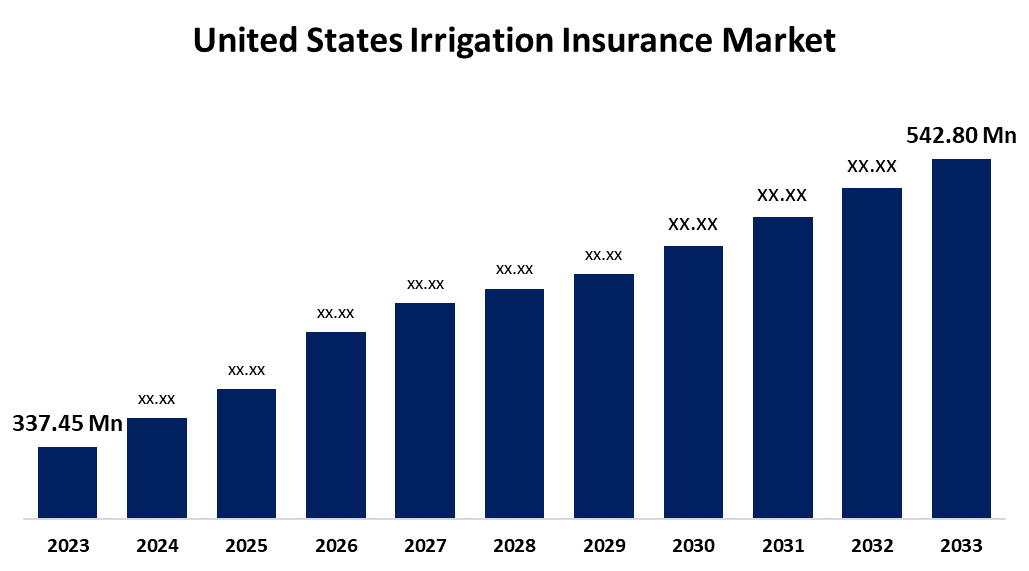

- The United States Irrigation Insurance Market Size Was Estimated at USD 337.45 Million in 2023.

- The Market is Growing at a CAGR of 4.87% from 2023 to 2033

- The USA Irrigation Insurance Market Size is Expected to Reach USD 542.80 Million by 2033

Get more details on this report -

The United States Irrigation Insurance Market Size is expected to reach USD 542.80 Million by 2033, Growing at a CAGR of 4.87% from 2023 to 2033.

Market Overview

The irrigation insurance market in the United States, which is a component of the larger agricultural insurance industry, offers farmers financial security against crop losses brought on by drought, excessive precipitation, and malfunctioning irrigation water supplies, especially in irrigated areas. Farmers look for insurance to guard against operational disruptions, natural catastrophes, and mechanical difficulties. The market's expansion is mostly driven by reasons including the increasing use of sophisticated irrigation systems, growing climatic uncertainty, and farmers' growing awareness of the need for financial insurance against weather-related damages and equipment failures. Furthermore, government initiatives support market expansion such as government incentives and subsidies are promoting the purchase of contemporary irrigation equipment. For instance, in February 2023, the Western Water and Working Lands Framework for Conservation Action was introduced by the U.S. Department of Agriculture (USDA), which allocated $25 million to priority areas to support farmers in developing drought resistance and conserving water.

Report Coverage

This research report categorizes the market for the U.S. irrigation insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US irrigation insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA irrigation insurance market.

United States Irrigation Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 337.45 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.87% |

| 2033 Value Projection: | 542.80 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Type of Coverage and COVID-19 Impact Analysis. |

| Companies covered:: | UNICO Group, Inc., Agri Industries, Chubb Agribusiness, DFS Insurance, Western Shelter Insurance, Inc., Minnesota Valley Irrigation, Plummer Insurance, Scribner Insurance Agency, Gerald Ross Agency, Central Valley Irrigation, and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States irrigation insurance market's demand for insurance coverage against mechanical breakdowns has increased as a result of farmers investing in sophisticated irrigation technologies that raise agricultural yields, water efficiency, and operating expenses. In addition, irrigation insurance increases agricultural resilience and output by providing financial protection against crop damage, soil erosion, and equipment failures during erratic weather occurrences. Additionally, farmers are realizing more and more how important insurance plans are for safeguarding their irrigation system investments from natural disasters and operational delays, ensuring financial recovery.

Restraining Factors

The market for irrigation insurance in the United States is hampered by issues like high rates, a lack of customized coverage alternatives, complicated policy structures, and low awareness among small-scale farmers are some of the issues facing the U.S. irrigation insurance market that may prevent widespread adoption and accessibility for agricultural stakeholders.

Market Segmentation

The U.S. irrigation insurance market share is categorized into component and type of coverage.

- The center pivot structure segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the component, the U.S. irrigation insurance market is classified into motors and pumps, center pivot structure, sprinkler systems, electrical systems, and others. Among these, the center pivot structure segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing because center pivot irrigation systems can effectively cover huge agricultural areas while maximizing water usage, they are frequently used. However, there are risks associated with these systems, including weather-related damages, electrical faults, and mechanical failures. Specialized irrigation insurance is therefore crucial.

- The comprehensive coverage segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the type of coverage, the U.S. irrigation insurance market is divided into mechanical breakdown coverage, weather-related coverage, comprehensive coverage, and others. Among these, the comprehensive coverage segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. The policies that farmers want are comprehensive and cover a variety of risks, such as unexpected system failures, weather-related damages, and mechanical problems. This coverage minimizes possible losses by ensuring irrigation systems continue to function and offering financial stability. The need for complete protection has been fueled in part by the growing unpredictability of weather patterns and equipment malfunctions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. irrigation insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- UNICO Group, Inc.

- Agri Industries

- Chubb Agribusiness

- DFS Insurance

- Western Shelter Insurance, Inc.

- Minnesota Valley Irrigation

- Plummer Insurance

- Scribner Insurance Agency

- Gerald Ross Agency

- Central Valley Irrigation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, Aegis Agribusiness partnered with Accelerant National Insurance Company to launch a new admitted irrigation insurance program. Since 2023, this program has been implemented to supplement its non-admitted program. In addition to providing coverage for actual cash value or replacement cost, it offers protection against total loss, particular dangers, and mechanical breakdowns.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. irrigation insurance market based on the below-mentioned segments:

U.S. Irrigation Insurance Market, By Component

- Motors and Pumps

- Center Pivot Structure

- Sprinkler Systems

- Electrical Systems

- Others

U.S. Irrigation Insurance Market, By Type of Coverage

- Mechanical Breakdown Coverage

- Weather-related Coverage

- Comprehensive Coverage

- Others

Need help to buy this report?