United States Land Drilling Rigs Market Size, Share, and COVID-19 Impact Analysis, By Type (Conventional, Mobile), By Drive Mode (Mechanical, Electrical, Compound), By Application (Oil & Gas industry, Metal & Mining Industry), and United States Land Drilling Rigs Market Insights Forecasts to 2033

Industry: Consumer GoodsUnited States Land Drilling Rigs Market Insights Forecasts to 2033

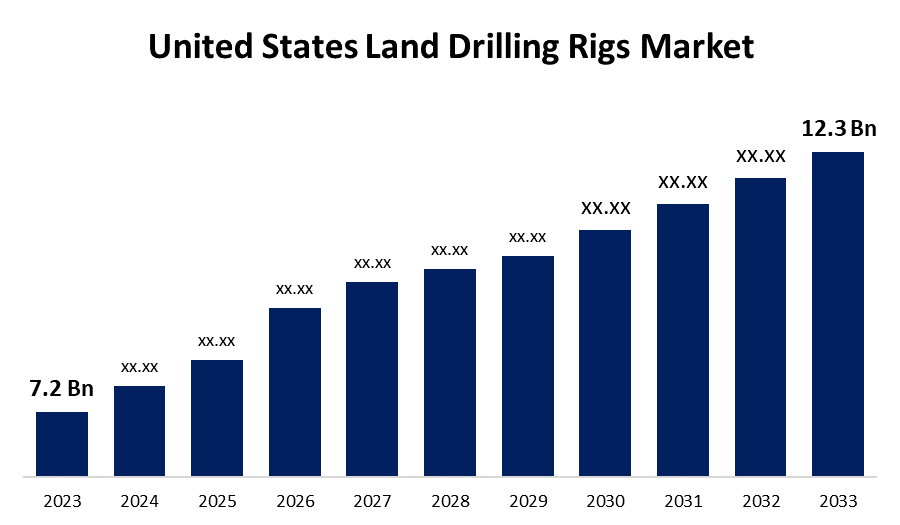

- The United States Land Drilling Rigs Market Size was valued at USD 7.2 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.5% from 2023 to 2033.

- The United States Land Drilling Rigs Market Size is Expected to Reach USD 12.3 Billion by 2033.

Get more details on this report -

The United States Land Drilling Rigs Market Size is Expected to Reach USD 12.3 Billion by 2033, at a CAGR of 5.5% during the forecast period 2023 to 2033.

Market Overview

Land drilling rigs are industrial drills that are used on land to drill deep boreholes in the earth's crust. These drills are stationary on the earth's surface, and their drilling heads penetrate it. Land drilling rigs are used for a variety of purposes, including drilling boreholes for water wells, pile foundations for buildings, blasting in mines, geotechnical surveys, oil exploration, and others. These drills are used in industries such as mining, quarrying, construction, and dimension stone. Land drilling rigs are in high demand as metal and mineral demand rises. Minerals such as iron ore, copper, gold, silver, zinc, nickel, bauxite, and others are in high demand as a result of increased industrialization fueled by economic growth in the United States. The land drilling rigs market in the United States is a dynamic sector of the country's energy landscape. This market has experienced consistent growth in recent years, owing to the pursuit of energy independence and the increasing demand for hydrocarbon resources. The increase in shale oil and gas exploration, particularly in areas such as the Permian Basin, Eagle Ford, and Bakken formations, has fueled demand for land drilling rigs. Technological advances and innovations in drilling techniques have significantly improved operational efficiency and reduced production costs, resulting in increased market activity.

Report Coverage

This research report categorizes the market for United States land drilling rigs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States land drilling rigs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States land drilling rigs market.

United States Land Drilling Rigs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.2 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.5% |

| 2033 Value Projection: | USD 12.3 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Drive Mode, By Application, and COVID-19 Impact Analysis. |

| Companies covered:: | Helmerich & Payne, Inc., Nabors Industries Ltd., Patterson-UTI Energy, Inc., Precision Drilling Corporation, Independence Contract Drilling, Inc., Ensign Energy Services Inc., Unit Corporation, Pioneer Energy Services Corp., Cyclone Drilling, Inc., Trinidad Drilling Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Technological advancement is a key driver propelling the land drilling rigs market in the United States. The incorporation of cutting-edge technologies has transformed the drilling landscape, improving efficiency, safety, and cost-effectiveness. Horizontal drilling and hydraulic fracturing, for instance, have liberated vast reserves of previously inaccessible shale oil and gas formations, fundamentally reshaping the energy industry. These techniques, combined with advanced drilling rigs outfitted with automated systems and sensor technology, have optimized operations, allowing for precise wellbore placement and reservoir targeting. Furthermore, the introduction of data analytics and machine learning has enabled operators to analyze complex geological data in real-time, allowing for more informed decision-making and reducing drilling risks. With ongoing research into robotics, AI-driven solutions, and green drilling practices, the sector anticipates further productivity and sustainability improvements, reinforcing the market's growth trajectory.

Restraining Factors

Factors such as high operation costs and carbon emission norms associated with land drilling rigs are anticipated to restrain the United States land drilling rig market growth. In addition, the lack of skilled labor in United States is negatively affecting the construction sector. Moreover, land drilling rigs are not entirely safe. The drilling and blasting operations often lead to flying debris, dust cloud, and shock waves from a blast. Thus, to ensure workers’ safety, governments have introduced rigorous safety guidelines on drilling and blasting operations, which is discouraging drilling contractors from opting for such drilling operations, especially for quarrying activities.

Market Segment

- In 2023, the mobile segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States land drilling rigs market is segmented into conventional and mobile. Among these, the mobile segment has the largest revenue share over the forecast period. In addition to their operational versatility, mobile drilling rigs have gained significant traction due to their flexibility and adaptability across various terrains and locations. These rigs provide unrivaled mobility, allowing operators to access remote and difficult terrains such as unconventional shale formations. With the resurgence of exploration activities in productive regions such as the Permian Basin and Eagle Ford, the agility and maneuverability of mobile drilling rigs has positioned them as the preferred choice for operators looking to efficiently tap into these resource-rich areas.

- In 2023, the mechanical segment accounted for the largest revenue share over the forecast period.

Based on the drive mode, the United States land drilling rigs market is segmented into mechanical, electrical, and compound. Among these, the mechanical segment has the largest revenue share over the forecast period. Mechanical drive mode rigs, which are distinguished by their robustness, dependability, and long operational history, have remained the bedrock of drilling operations in the United States. These rigs use mechanical power transmission systems, which are often powered by diesel engines, to drive the drilling equipment and efficiently perform drilling operations. Their proven track record in dealing with various drilling challenges, combined with their ability to operate in a variety of terrains and conditions, has cemented their position as an operator's preferred choice.

- In 2023, the oil & gas industry segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States land drilling rigs market is segmented into oil & gas industry and metal & mining industry. Among these, the oil & gas industry segment has the largest revenue share over the forecast period. The oil and gas industry continues to be the primary driver of demand for land drilling rigs in the United States, driven by the ongoing search for domestic energy resources and the exploration of unconventional reserves, particularly in prolific shale formations. The surge in shale oil and gas production, particularly in regions such as the Permian Basin, Eagle Ford, and Bakken formations, has been a major driver of increased drilling activity. Land drilling rigs are critical in allowing operators to access and extract hydrocarbon resources from these difficult geological formations. The recent rise in oil prices has boosted drilling activity even more, with companies increasing their investments in order to capitalize on higher returns.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States land drilling rigs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Helmerich & Payne, Inc.

- Nabors Industries Ltd.

- Patterson-UTI Energy, Inc.

- Precision Drilling Corporation

- Independence Contract Drilling, Inc.

- Ensign Energy Services Inc.

- Unit Corporation

- Pioneer Energy Services Corp.

- Cyclone Drilling, Inc.

- Trinidad Drilling Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In March 2023, DrillTech Solutions, a major player in the land drilling rigs market in the United States, announced the release of its next-generation drilling technology, which represents a significant improvement in drilling efficiency and precision. The cutting-edge technology combines advanced automation and data analytics to optimize drilling parameters and boost overall productivity. DrillTech Solutions' commitment to technological advancement is consistent with the industry's desire for greater efficiency and cost-effectiveness in exploring and extracting hydrocarbon resources.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States land drilling rigs market based on the below-mentioned segments:

United States Land Drilling Rigs Market, By Type

- Conventional

- Mobile

United States Land Drilling Rigs Market, By Drive Mode

- Mechanical

- Electrical

- Compound

United States Land Drilling Rigs Market, By Application

- Oil & Gas industry

- Metal & Mining Industry

- Others

Need help to buy this report?