United States Lime Market Size, Share, and COVID-19 Impact Analysis, By Type (Quick Lime, and Hydrated Lime), By Application (Agriculture, Building Material, Mining & Metallurgy, Water Treatment, and Others), and United States Lime Market Insights, Industry Trend, Forecasts to 2033

Industry: Advanced MaterialsUnited States Lime Market Insights Forecasts to 2033

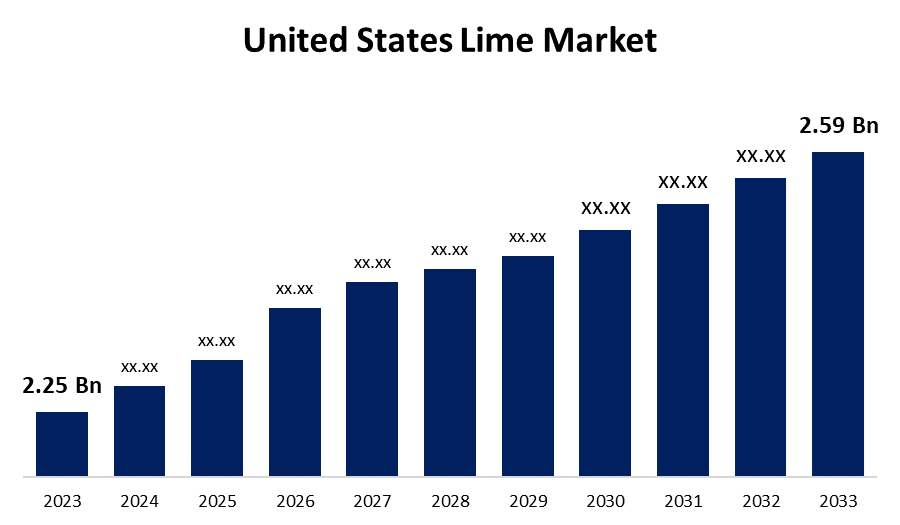

- The United States Lime Market Size was valued at USD 2.25 Billion in 2023.

- The Market Size is Growing at a CAGR of 1.42% from 2023 to 2033

- The U.S Lime Market Size is expected to reach USD 2.59 Billion by 2033

Get more details on this report -

The United States Lime Market is anticipated to exceed USD 2.59 Billion by 2033, Growing at a CAGR of 1.42% from 2023 to 2033.

The growing steel usage in automobiles, higher country economy, and demand for lime for removing dissolved metals and free acids from water are driving the growth of the Lime market in the United States.

Market Overview

Lime, referred to as calcium oxide (CaO) is a versatile chemical that is a vital component in the production of countless materials. It is derived from high-quality natural deposits of limestone, or calcium carbonate (CaCO3) by subjecting to extreme heat that leads to changing calcium carbonate to calcium oxide. The various terms of lime are quicklime, calcium oxide, high calcium lime, and dolomitic lime. The high calcium lime contains pure calcium carbonate while dolomitic lime contains Magnesium oxide (MgO) obtained from limestone containing Magnesium carbonate (MgCO3). It is a widely used chemical compound that is used for glass production, paper manufacturing, agricultural practices, chemical processes, plaster, mortar, and other building materials. The rising demand for calcium hydroxide in various applications such as pulp & paper, sugar, glass, bioplastics, and ferrous and non-ferrous metal mining applications creates a lucrative opportunity for the lime market.

Report Coverage

This research report categorizes the market for the US Lime market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Lime market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Lime market.

United States Lime Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.25 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 1.42% |

| 2033 Value Projection: | USD 2.59 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | United States Lime & Minerals Inc., Valley Mineral LLC, Carmeuse, Mississippi Lime Company, Brookville Manufacturing, Lhoist Group, Graymont Ltd., Linwood Mining & Minerals Inc., Minerals Technologies, Inc., Cheney Lime & Cement Company, Pete Lien & Sons, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for steel in the automotive and construction industry driving the market demand for lime in steel making industry. In architecture development also demand for steel for shaping buildings. Adjusting pH (neutralizing free acid) and removing toxins such as phosphorus and nitrogen from acidic wastewater and removal of dissolved metals. The sewage sludge stabilization and sanitation to enable agricultural recycling ultimately surged the demand for lime.

Restraining Factors

The high carbon emission in the process of calcination for producing lime from limestone. Further carbon emission during steel production using lime further uplifts the carbon emission which ultimately leads to a rise the global warming. These factors are negatively affecting the global environment hampering the market growth. The availability of lime substitutes such as gypsum, limestone, and dolomite further lowers the demand for lime market.

Market Segmentation

- The type segment is expected to hold a significant share of the United States lime market during the forecast period.

The United States Lime market is segmented by type into quick lime and hydrated lime. Among these, the quick lime segment is expected to hold a significant share of the United States lime market during the forecast period. Quick lime is extensively used in metal extraction and concentration plants for maintaining pH and ensuring high yield. Research has shown that more strength development occurs in soil using quicklime mixtures rather than hydrated lime.

- The mining & metallurgy segment is expected to hold the largest share of the United States Lime market during the forecast period.

Based on the application, the United States Lime market is divided into agriculture, building material, mining & metallurgy, water treatment, and others. Among these, the mining & metallurgy segment is expected to hold the largest share of the United States lime market during the forecast period. Lime for mining and metallurgy is used in basic oxygen furnaces, electric arc furnaces, and secondary refining. It is also used in copper ore mining to convert alumina and magnesia into aluminum and magnesium, respectively.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US lime market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- United States Lime & Minerals Inc.

- Valley Mineral LLC

- Carmeuse

- Mississippi Lime Company

- Brookville Manufacturing

- Lhoist Group

- Graymont Ltd.

- Linwood Mining & Minerals Inc.

- Minerals Technologies, Inc.

- Cheney Lime & Cement Company

- Pete Lien & Sons, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent developments

- In November 2020, Carmeuse Overseas started the construction of a greenfield lime plant in Bandia, Senegal that will operate under the name Chaux de la Teranga.

- In September 2020, Mississippi Lime Company, a leading global supplier of high-calcium lime products and technical solutions, completed the acquisition of a transload terminal in Kansas.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Lime Market based on the below-mentioned segments:

United States Lime Market, By Type

- Quick Lime

- Hydrated Lime

United States Lime Market, By Application

- Agriculture

- Building Material

- Mining & Metallurgy

- Water Treatment

- Others

Need help to buy this report?