U.S. Limestone Market Size, Share, and COVID-19 Impact Analysis, By End-use (Building & Construction, Iron & Steel, Agriculture, Paper & Pulp, Chemical, and Others), By Application (Chemical Lime, Construction Lime, Refractory Lime, and Industry Lime), and U.S. Limestone Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsU.S. Limestone Market Insights Forecasts to 2033

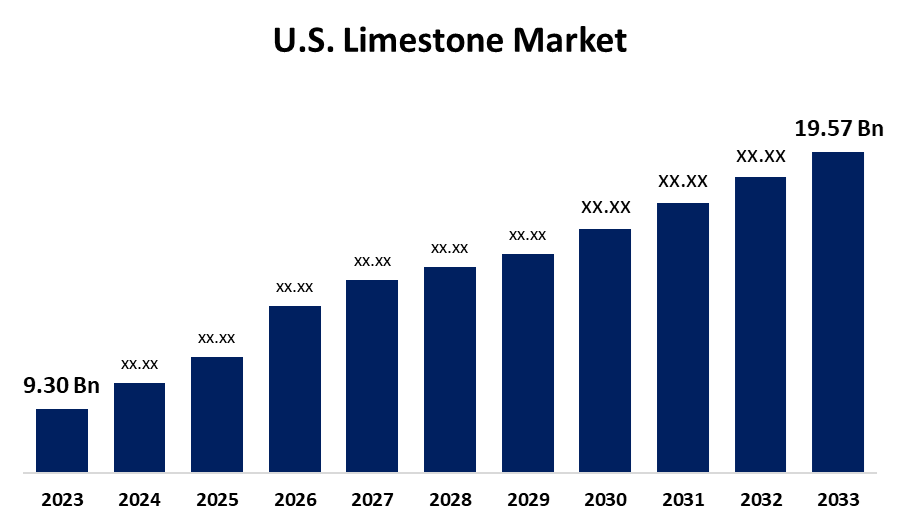

- The U.S. Limestone Market Size was estimated at USD 9.30 billion in 2023.

- The Market Size is Growing at a CAGR of 7.72% from 2023 to 2033

- The U.S. Limestone Market Size is Expected to Reach USD 19.57 billion by 2033

Get more details on this report -

The U.S. Limestone Market Size is Expected to Reach USD 19.57 billion by 2033, growing at a CAGR of 7.72% from 2023 to 2033.

Market Overview

The sector that deals with the extraction, manufacture, and distribution of limestone, a sedimentary rock primarily made up of calcium carbonate (CaCO3), is referred to as the U.S. limestone market. There are several uses for limestone, including building materials in the construction industry, as a raw material for cement manufacture, in agriculture to enhance soil quality, in the chemical industry, and environmental management to purify water and air. The U.S. limestone market is mostly advantageous to the construction industry. In addition to its strength and adaptability, the rock is a popular option for construction materials. Furthermore, the demand for limestone in its various industrial uses has also grown as a result of the country's robust economic expansion, growing population, rising disposable incomes, and high standard of living.

Report Coverage

This research report categorizes the market for the U.S. limestone market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. limestone market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. limestone market.

U.S. Limestone Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 9.30 billion |

| Forecast Period: | 2023 – 2033. |

| Forecast Period CAGR 2023 – 2033. : | 7.72% |

| 023 – 2033. Value Projection: | USD 19.57 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By End-use, By Application and COVID-19 Impact Analysis |

| Companies covered:: | CARMEUSE, GLC Minerals LLC, Graymont Limited, Minerals Technologies Inc., Omya AG, United States Lime & Minerals Inc., Imerys, Iowa Limestone Company, Kerford Limestone, Lafarge Holcim, and Other key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. limestone sector is expanding because of the demand for goods made from limestone, such as cement and concrete, has increased as a result of increased investments in urban development and public infrastructure. In addition, the usage of limestone in water treatment facilities for pH balancing and pollutant removal has expanded as a result of growing awareness about water safety. Additionally, the market is growing due to advancements in processing methods, premium limestone that is long-lasting and environmentally beneficial has been produced.

Restraining Factors

U.S. limestone market faces significant constraints due to the strict environmental laws pertaining to quarrying operations, which are a major barrier influencing the limestone market. In addition, limestone's weight makes transportation expensive, which might restrict its market reach and increase consumers' overall project costs.

Market Segmentation

The U.S. limestone market share is classified into the end-use and application.

- The building & construction segment accounted for the largest share of 78% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the U.S. limestone market is divided into building & construction, iron & steel, agriculture, paper & pulp, chemical, and others. Among these, the building & construction segment accounted for the largest share of 78% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is expanding because limestone is widely used in the building and construction sector. In addition, limestone is a perfect material for construction because of its special qualities, which include weather resistance, durability, and adaptability. It is frequently used to make cement, construction stones, and even glass and pottery.

- The industry lime segment accounted for a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the U.S. limestone market is divided into chemical lime, construction lime, refractory lime, and industry lime. Among these, the industry lime segment accounted for a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to its extensive application in a variety of manufacturing industries, such as the manufacture of steel, paper, and plastics, where it is a vital component in procedures such as purification, pH control, and metallurgical fluxing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. limestone market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CARMEUSE

- GLC Minerals LLC

- Graymont Limited

- Minerals Technologies Inc.

- Omya AG

- United States Lime & Minerals Inc.

- Imerys

- Iowa Limestone Company

- Kerford Limestone

- Lafarge Holcim

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. limestone market based on the below-mentioned segments:

U.S. Limestone Market, By End-use

- Building & Construction

- Iron & Steel

- Agriculture

- Paper & Pulp

- Chemical

- Others

U.S. Limestone Market, By Application

- Chemical Lime

- Construction Lime

- Refractory Lime

- Industry Lime

Need help to buy this report?